Institutional Insights: Goldman Sachs NFP Scenario Analysis 6/6/25

.jpeg)

Institutional Insights: Goldman Sachs NFP Scenario Analysis

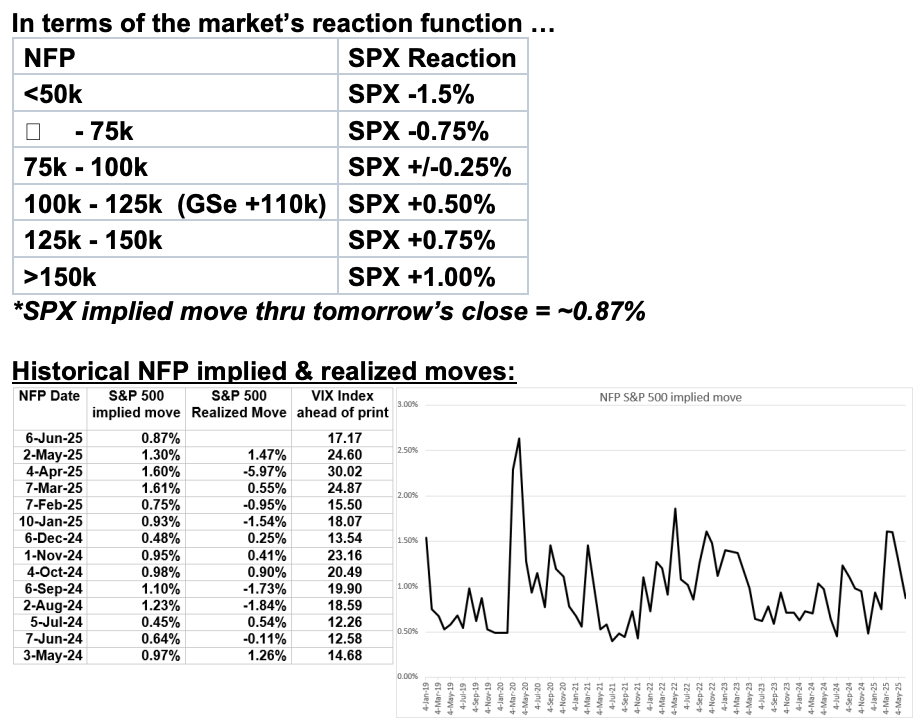

As we began this week, our expectation was for nonfarm payrolls to increase by 125,000 in May. However, after the disappointing ADP report, we revised our projection down by 15,000 to +110,000, which is below the consensus estimate of +125,000. Historically, both the level and the surprise element of ADP figures usually have limited predictive power for nonfarm payrolls, but the extent of the shortfall, alongside a weak ISM Services report, is hard to overlook. We suspect the whisper number is around +80,000.

We believe that the unemployment rate remained stable at 4.2%, when rounded. Our estimate indicates that average hourly earnings increased by 0.3% from the previous month, after seasonal adjustments, which accounts for neutral calendar influences.

Dom Wilson (Seniro Markets Advisor)

The market has grown more comfortable navigating potential economic weakness, assuming bounded tariff outcomes. Data surprises need to be significant to alter the current narrative. A stable unemployment rate and moderate job growth, as forecasted, likely reinforce low volatility and upward market drift. Risks exist from surprises, with greater vulnerability to weak data, especially a notable unemployment rate rise, which could reignite recession fears. A strong report could push rates higher, particularly mid-curve, slowing risk assets but signaling resilience to tariff risks. A weak payroll with steady unemployment is an uncomfortable downside risk, while strong payroll with rising unemployment may be market-friendly but could trigger rotations into cyclical or lower-quality sectors.

Ben Snider (US Portfolio Strategy)

Recent equity market trends indicate "good news is good news," aligning with economists' 2026 growth forecasts despite potential near-term tariff headwinds. Optimism could lead to disappointment and a shift toward defensives, which have high short interest, if weak data challenges this view. Conversely, a strong report might signal hawkish policy, offsetting the positive growth outlook. However, limited expectations for Fed easing and anticipated weakening economic data suggest a high bar for good news to turn negative.

Shawn Tuteja (ETF/Basket Vol Trading)

Economic data this week (ADP, ISM, claims) has eased the bond sell-off, reflecting concerns about near-term economic slowing. Equities remain optimistic, pricing in tariff relief and AI-related positives. Most clients are comfortable with NFP above 85k if unemployment stays under 4.3%. SPX seems range-bound at 5700-6150 but feels overextended short-term. A sub-80k NFP could trigger an equity pullback. With 85-140k NFP, bond yields may stay stable, and rotation into undervalued equity sectors (e.g., RTY > NDX) is possible as tech/AI risk is high.

Joe Clyne (Index Vol Trading)

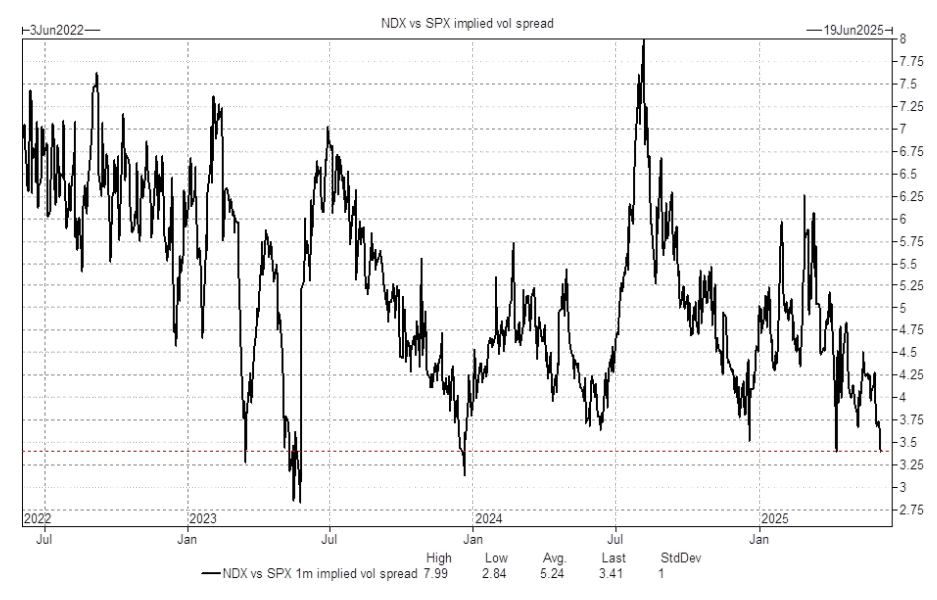

Ahead of NFP, implied/realized vols have eased as tariff concerns subside and markets reach highs. SPX 1m 25 delta call aligns with the 1-year average, and SPX straddle is around 85 bps for tomorrow. The desk prefers long vol via short-dated calls (out to July) over zero-day straddles, given ample downside gamma. Long NDX options are attractive, with SPX-NDX 1m ATM spreads at 3-year lows. These positions are funded by short skew.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!