Institutional Insights: Goldman Sachs January Flow OF Funds Update

.jpeg)

Goldman Sachs Tactical Flow-of-Funds: January 2025

a. The US equity market has absorbed a ton of supply in late December between hedge funds (new shorting), pension funds (rebalancing into bonds), volatility control and systematic strategies (vol spike), and retail year-end.

b. Liquidity was also challenged, and the gamma dynamic in the market quickly changed.

c. As we walk in today, the SPX futures scoreboard is up ~2%, and exposure remains short and underexposed locally to a rally from here. I would not call it FOMO but more FOMU (fear of materially underperforming benchmarks) out of the 2025 gates.

d. This is a short-term bullish tactical trading call as we move above key threshold levels and retail/PWM/401k/529 start to do their thing.

e. I will go bearish in February and look to re-establish hedges given any resets in volatility. f. GS January Flow-of-Funds Checklist below

Hedge Fund Selling - 98th percentile: Last week’s notional net selling in US Macro Products was the largest in the past year and ranks in the 98th percentile on a five-year lookback. US-listed ETF shorts increased +7.1% (+17.5% month over month) led by shorting in Large Cap Equity, Corporate Bond, Tech, and, Healthcare ETFs. I do not think that shorts will stick around for very long. Hedge Funds typically re-lever gross exposure: this starts now. GS prime brokerage gross leverage has increased in 13 out of the past 14 Januarys. We are starting the year with a large local short base.

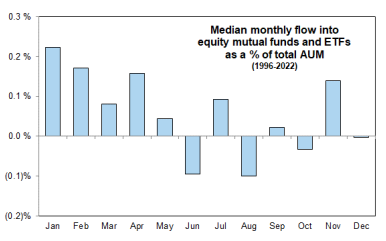

CTA and Vol Control Projected supply may not materialize, as we are now above CTA trigger level. We are now opening above the CTA S&P short term threshold of 5972, as potential supply may not materialize. "January Effect" starts today The PWM are making the calls today after back from holidays. "what should we buy?" January is the single largest month of the year for inflows

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!