Institutional Insights: Goldman Sachs FX Focus

.jpeg)

FX in Focus Loss of US Exceptionalism Strengthens Case for FX-Hedging US Equities

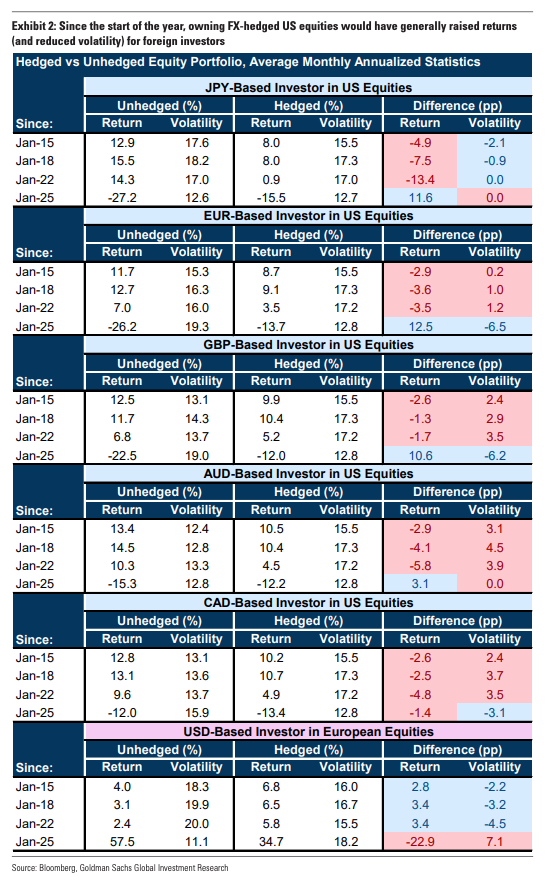

The erosion of US exceptionalism and increased recession risk suggest a shift in hedging strategy. Recently, international investors have been less likely to hedge US equities, while US investors have been more likely to hedge non-US equities, particularly those in Japan. In just a few months, those conclusions have changed.

Foreign investors may consider increasing their hedge ratios, notably in Japan and Europe. We recommend that US investors reduce their hedge ratios or buy non-US shares unhedged.

When there is a higher risk of a US downturn, US investors should boost their FX-hedging of non-US shares. Reducing foreign currency exposure has traditionally increased returns during equity bear markets. However, the current situation warrants additional vigilance.

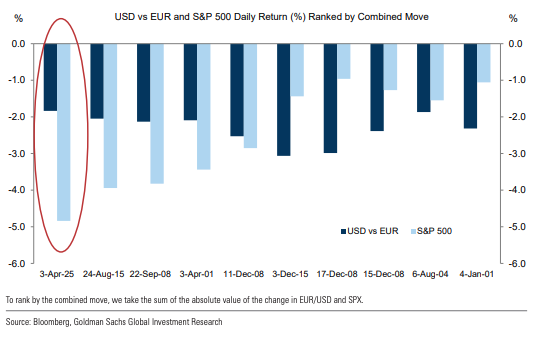

A more balanced global economy and stronger return prospects abroad can lead to more frequent and long-lasting bouts of dollar and equity sell-offs. Foreign investors' rise to unhedged US equities exposure in recent years may lead to larger events if tactics are adjusted. On April 3, the S&P 500 and EUR/USD had their greatest one-day joint change since 2000, primarily due to equities. As tariffs rise and the economy approaches recession, investors may get concerned about US stagflation if the Fed is reticent to lower rates as growth slows. This scenario may have a stronger impact on the dollar, especially against the yen.

Tariffs may have a greater impact on global economic growth than on the US, potentially leading to a rise in the US dollar due to changes in relative rates. However, a broader set of tariffs (compared to China in 2018-2019) reduces the incentive for foreign producers to drop prices, making the US more likely to adjust. In the coming year, policy uncertainty and FX volatility are expected to persist. Tariffs may not have a significant impact on growth outside of the US, notwithstanding recent optimism about international returns. We recommend that US investors add JPY, CHF, and EUR exposure as protection, rather than increasing hedging ratios on non-US shares. The Dollar is expected to depreciate more in the following year.

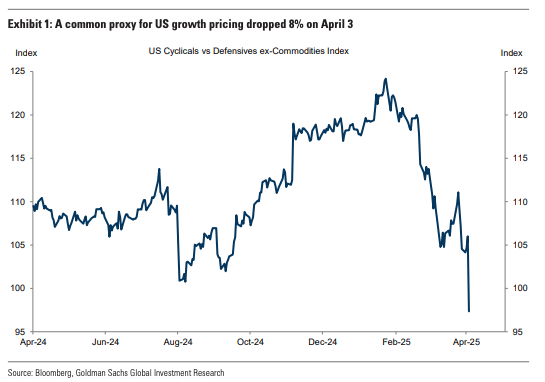

A change in hedging strategy is warranted by the increased recession risk and the loss of US exceptionalism. On April 3, a prevalent proxy for US growth pricing—US cyclicals versus defensives—declined by 8%, exacerbating the equity market correction that was already underway (Exhibit 1). In recent years, the backdrop of US exceptionalism has been against FX-hedging US equities from a foreign investor perspective and in favour of FX-hedging foreign equities (particularly in Japan) from a US investor perspective. Those conclusions have been reversed in a matter of months.

In fact, more frequent (and longer-lasting) times when the dollar and stocks drop off together are made possible by a world with more balanced global growth, stronger return possibilities overseas, and overweight USD posture. This was amply demonstrated by the price action on April 3, when the EUR/USD and S&P 500 saw the biggest one-day joint rise since 2000 (Exhibit 4).

The next two most significant events were the August 24, 2015, "flash crash," which was partly caused by worries about China's economic development, and September 22, 2008, which occurred in the days after the US bank rescue plan was announced. When economic momentum slows, investors may worry more about US stagflation due to tariffs and an economy that is getting closer to a recession. This would put greater pressure on the dollar, especially when compared to the yen. In the coming year, policy uncertainty and FX volatility are expected to persist. We recommend that US investors add JPY, CHF, and even EUR exposure for protection, rather than increasing hedging ratios on non-US shares.

Foreign investors may consider increasing their hedge ratios, particularly in Japan and Europe. The Dollar is expected to depreciate more in the following year.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!