Institutional Insights - Goldman Sachs FOMC Preview

.jpeg)

Institutional Insights - Goldman Sachs FOMC Preview

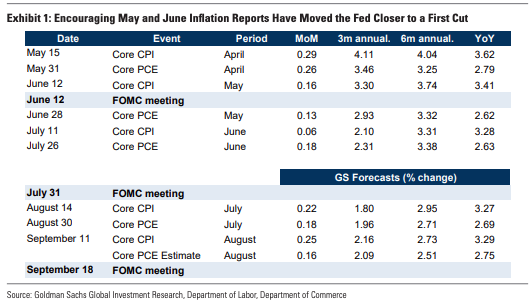

According to Goldman Sachs 'Encouraging inflation news and a further rise in the unemployment rate have pushed Fed officials closer to cutting. The FOMC is set to hold steady today but is likely to revise its statement to hint that a cut at the following meeting in September has become more likely.

Specifically, we expect the FOMC to revise its statement to say that the unemployment rate has “risen slightly but remains low,” that there has been “further progress” (dropping “modest”) toward the 2% inflation goal, that the risks to the two sides of the mandate “are in” (not “have moved toward”) better balance, and—most importantly—that it now needs only “somewhat” greater confidence in the inflation outlook in order to start lowering interest rates.

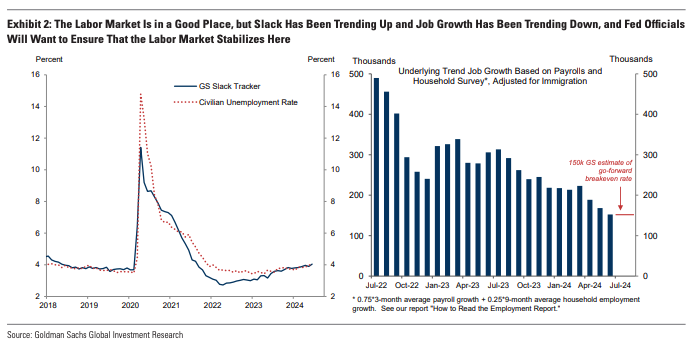

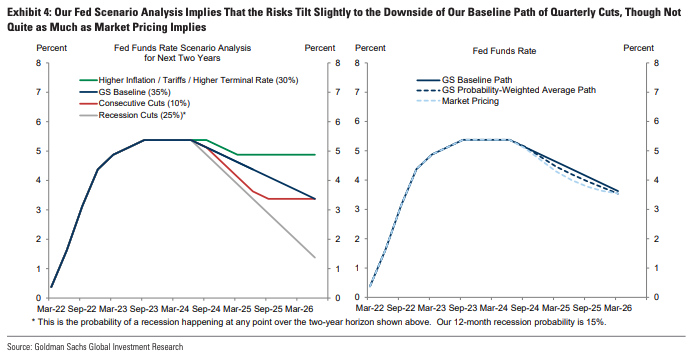

We suspect that an acceptable July CPI report would likely be enough to clinch a September cut. Whether the FOMC deviates from the broader plan implied by the June dot plot to normalize the funds rate at a gradual pace of 25bp per quarter as inflation returns to target will likely depend mainly on the labor market, which has sent mixed signals lately, and on fiscal policy after the election. We now see the risks to the Fed path as tilted slightly to the downside of our baseline of quarterly cuts, though not quite as much as market pricing implies

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!