Institutional Insights: Goldman Sachs Flow of Funds: Pulse Check

.jpeg)

GS Flow of Funds: Pulse Check

FICC and Equities | 14 May 2025 |

Not Zac Efron, but the VIX was 17 Again

April showers bring May volatility collapse—opportunities to roll hedges and add exposure? Maybe you didn’t learn that in school, but it holds true nonetheless.

Let’s keep this pulse check concise:

1. Volatility Decline: Volatility has eased, with systematic investors now leading the charge to add length.

2. Record Flows: Our GS prime book experienced record flows on Monday, driven by short covering. While activity has subsided, it underscores significant directional shifts.

3. Strong Retail Demand: Retail demand remains robust. Historically, May sees outflows in this segment, but a sustained downturn hasn’t materialized yet.

4. Improved Liquidity and Sentiment: Markets are showing signs of recovery, with liquidity and sentiment on the mend.

Trades We Like

As you navigate this trading environment, consider these opportunities:

- The desk continues to favor owning short-dated topside volatility, particularly in SPX and NDX, where it has been carrying positively. One implementation we like: SPY Jun 610 calls, delta neutral. These are priced around $3 (ref 587) at a 13.4v. (h/t Joe Clyne)

- SPX 18Jul25 95.0% Lookback Put (daily lookback until 18Jul25): 1.58% offer (vs 1.16% on vanilla, -10d).

- SPX 19Sep25 95.0% Lookback Put (daily lookback until 19Sep25): 3.06% offer (vs 2.13% on vanilla, -13d). (h/t Riccardo Gasparotto)

Take advantage of these dynamics as markets continue to stabilise.

S&P Top of Book liquidity reached $9.83 million as of yesterday's close. This is more than 8 times higher than the April lows of $1.1 million and now stands 28% above the year-to-date average of $7.66 million. Improved liquidity indicates market recovery, signaling the enhanced ability to transfer risk quickly, which is crucial in the current conditions.

CTA Positioning

If you've been keeping up with our updates, you're familiar with the situation. CTAs have increased their positions in US equities and continue to buy aggressively. With the S&P now over 100 points above the medium-term threshold of 5746, supply from this group has been released. Currently, CTAs are short $4.55 billion in US equities and are expected to purchase approximately $14 billion over the next week, which would shift CTAs to a net long position in US equities.

Over the next week:

- Flat market: Buyers will invest $20.94B ($13.61B into the US)

- Rising market: Buyers will invest $20.88B ($14.74B into the US)

- Falling market: Buyers will invest $5.47B ($7.05B into the US)

Over the next month:

- Flat market: Buyers will invest $31.11B ($24.45B into the US)

- Rising market: Buyers will invest $36.50B ($27.43B into the US)

- Falling market: Sellers will withdraw $82.75B ($11.52B out of the US)

Key pivot levels for SPX:

- Short term: 5610

- Medium term: 5746

- Long term: 5496

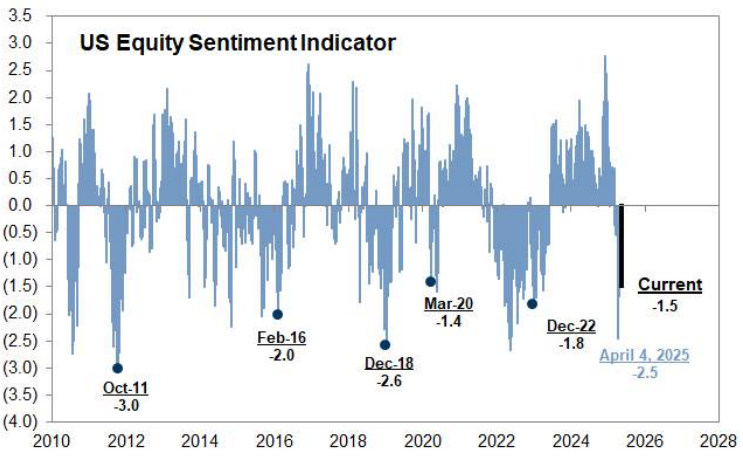

Sentiment has improved, but it remains relatively low compared to our dataset. What does this mean? There’s potential for growth, but don’t be misled by overconfidence. Overall sentiment is still negative, suggesting that investors remain unconvinced.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!