Institutional Insights: Goldman Sachs Crypto Insights

Goldman Sachs FICC and Equities

Crypto Insights

GS Crypto: Monthly On-chain & Market Data (July 2025)

A monthly analysis of key market and on-chain metrics across BTC, ETH, and SOL markets.

Highlights:

Ethereum (ETH) Outperformance:

July marked Ethereum’s 10th anniversary, but the spotlight was firmly on ETH’s price movement. The asset surged +48.7% month-over-month (MoM), with the ETH/BTC ratio climbing +37.6% MoM. This breakout was driven by momentum-led demand and several favorable factors:

- Net inflows into US-listed spot ETH ETFs soared by +$5.4 billion (+366.4% MoM), pushing the aggregate assets under management (aUM) to $21.5 billion.

- On-chain activity showed growth, with average daily transaction counts rising +7.7% MoM and daily active addresses increasing +8.7% MoM.

- Positive developments included broader corporate adoption of ETH treasury strategies (led by Sharplink), the passage of digital asset-related legislation in the US, and heightened attention on the stablecoin market, which remains largely Ethereum-centric in terms of total supply.

- Looking ahead, the Fusaka protocol upgrade scheduled for Q4 2025 could serve as the next catalyst for Ethereum's growth.

Solana (SOL) Metrics:

Starting this month, Solana data has been incorporated into the series, reflecting its growing relevance in institutional markets.

- Institutional interest surged, with CME front 3-month futures open interest (OI) and monthly volume increasing by +212.9% and +276.3% MoM, respectively, in dollar terms.

- The average CME front 3-month futures OI in July reached $418.4 million.

- SOL’s price performance closed the month up +11.1% MoM, highlighting its strong market momentum.

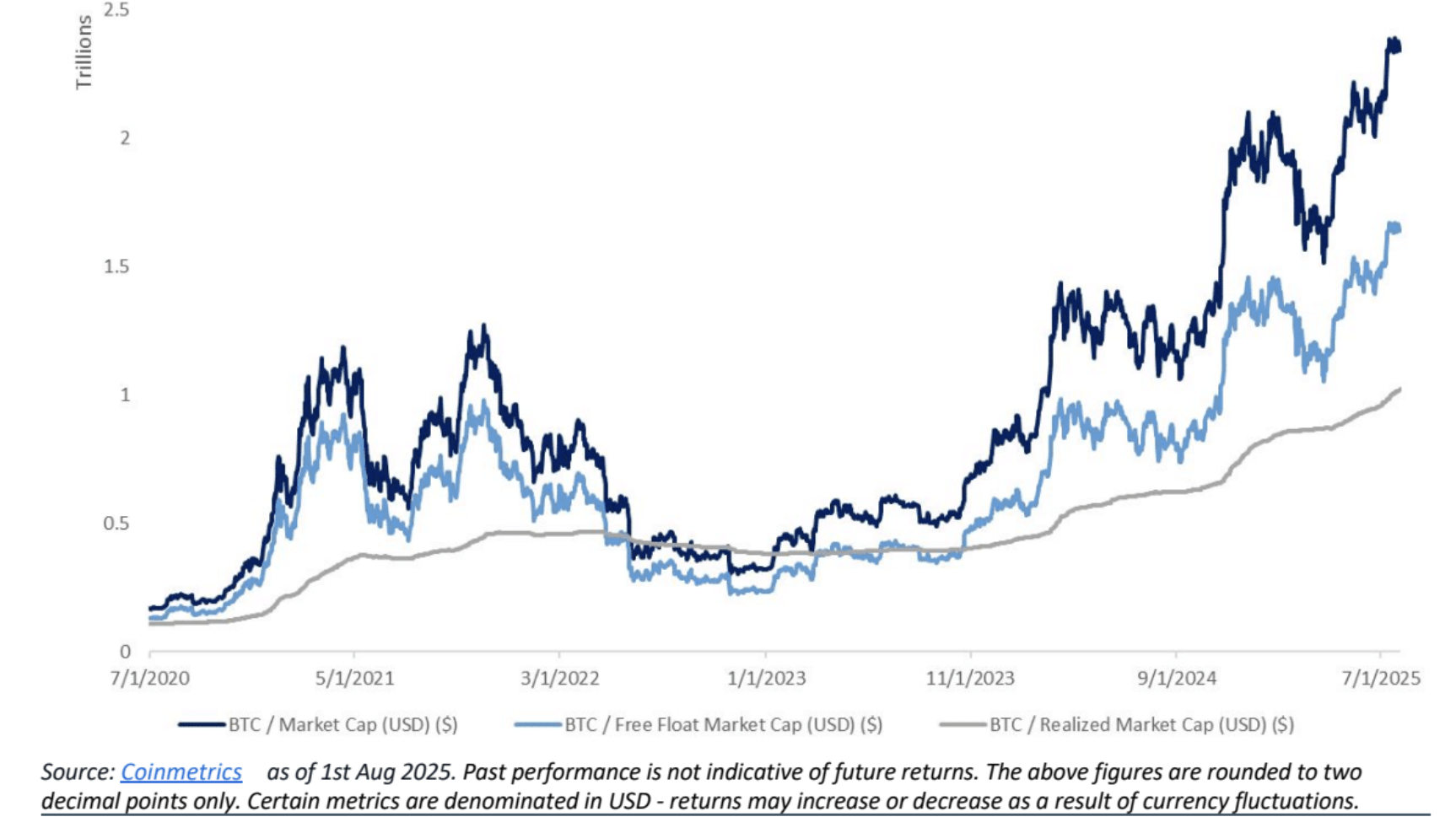

Bitcoin (BTC) Market Data:

Bitcoin demonstrated steady growth in July:

- BTC spot prices rose +8.1% MoM.

- Monthly trusted spot and CME front 3-month futures volumes increased by +22.5% and +28.7% MoM, respectively.

- US-listed spot BTC ETFs recorded aggregate inflows of +$6.0 billion, bringing total aUM to $152.0 billion.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!