Institutional Insights: Goldman Sachs – Continued Volatility

GOLDMAN SACHS – CONTINUED VOLATILITY

FICC and Equities | 13 April 2025 |

"Adversity has the effect of eliciting talents which in prosperous circumstances would have lain dormant."

— Horace

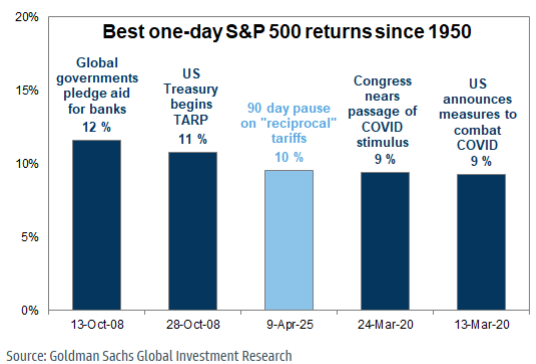

Over the past two weeks, the S&P 500 has seen some of its most dramatic single-day returns in decades. On Friday, April 4, the index plummeted by 6% as the market absorbed the impact of the April 2 tariff announcement. However, on April 9, President Trump's declaration of a 90-day pause on certain tariffs sparked a 10% rally in the S&P 500, marking the third-best daily return since 1950. Expect continued extreme volatility...

Yesterday, the White House announced an exemption for a significant portion of the electronics industry, including smartphones, computers, and semiconductors, from its 125% China tariff and the 10% global reciprocal baseline tariff. This decision is retroactive to April 5. The 20% China fentanyl tariff remains, alongside tariffs from Trump's first term, meaning the electronics sector isn't entirely relieved. For the second time in under a week, the White House has scaled back a major tariff policy. Unlike the 90-day pause announcement on April 9, which President Trump shared on Truth Social, this electronics decision was posted on the US Customs and Border Protection website. Read the WSJ article on this here.

Bottom line: The tech and semiconductor sectors are expected to rally over 5% tomorrow. Our TMT specialist, Peter Callahan, predicts Apple will trade between $210-220, rising 5-10%, returning to its pre-April 2 levels. Notably, Apple has recently become one of the more shorted stocks in the market, being a large, liquid expression of tariff concerns.

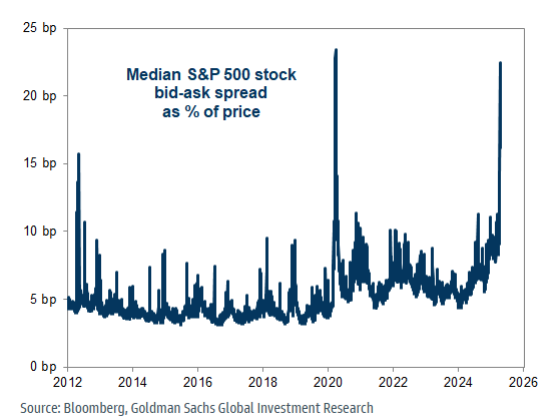

We have been discussing the lack of liquidity and the S&P 500’s top-of-book depth every session. It's also important to examine the S&P 500 bid-ask spread. A sharp widening in bid-ask spreads for the median S&P 500 stock is another sign of today's poor liquidity environment. On April 7, the bid-ask spread for the median S&P 500 stock surged to 22 basis points, the highest since March 2020 (23 basis points). Over the past month, the spread ranks in the 97th percentile over the last decade.

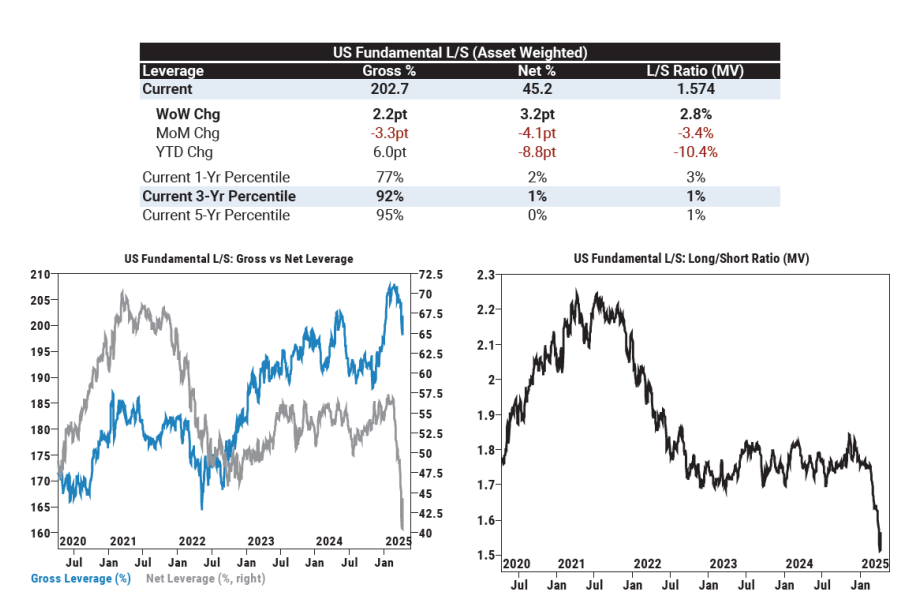

Last week, US equities experienced the largest notional net buying since last November, according to GSPB, with a significant increase of +1.4 standard deviations over the past year. Hedge funds repurchased approximately one-third of what they sold on April 3rd and 4th following reciprocal tariff announcements, primarily driven by short covering across Macro Products (Index and ETF combined). US-listed ETF shorts decreased by 3.1%, although they remained up 7.5% month-over-month, led by covering in Large Cap Equity and, to a lesser extent, Small Cap Equity ETFs. This was partially offset by increased shorting in Sector and Corporate Bond ETFs.

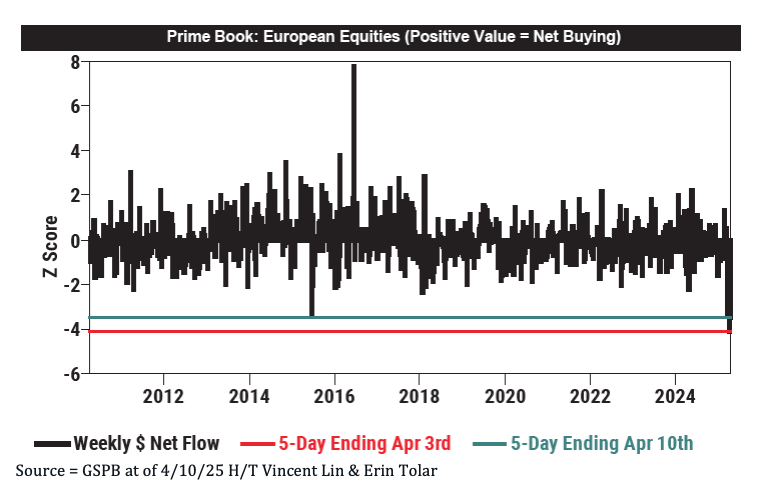

While hedge funds net purchased US equities on our Prime book last week, they continued to reduce their net positions in European equities. To provide perspective, last week's notional net selling in Europe was the second largest on record over the past 15+ years, with a -3.5 Z score. Two weeks ago marked the largest at -4.1, driven primarily by short sales and, to a lesser extent, long sales at a ratio of approximately 3 to 1. Macro Products (Index + ETF) and Single Stocks accounted for roughly 80% and 20% of last week's net selling, respectively. Eight out of eleven sectors were net sold, led by Staples, Energy, Materials, and Utilities, while Consumer Discretionary, Information Technology, and Health Care were the only sectors with net purchases. The Prime book is now overweight in Europe by 3.7% compared to the MSCI ACWI, down from 4.9% at the start of the year. This is near the lowest overweight level in the past year (4th percentile), yet still significantly above the 5-year average in the 75th percentile.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!