Institutional Insights: Goldman Sachs - August Flow of Funds Preview

Lessons for Markets Inspired by the NY Jets:

1. Prepare for the Worst During the Best Times

When everything seems to be going smoothly, it’s crucial to anticipate potential challenges ahead and start preparing accordingly.

2. Defense Alone Isn’t Enough – Play Offense Too

A strong defense is important, but sometimes you need proactive strategies to seize opportunities and stay ahead.

Bottom Line: Our thesis remains largely unchanged – we are bullish on equities in the near term but anticipate potential cracks later this summer. A closer look at underlying dynamics reveals shifts in technical composition, making this an opportune time to consider adding hedges.

### 1. Systematics

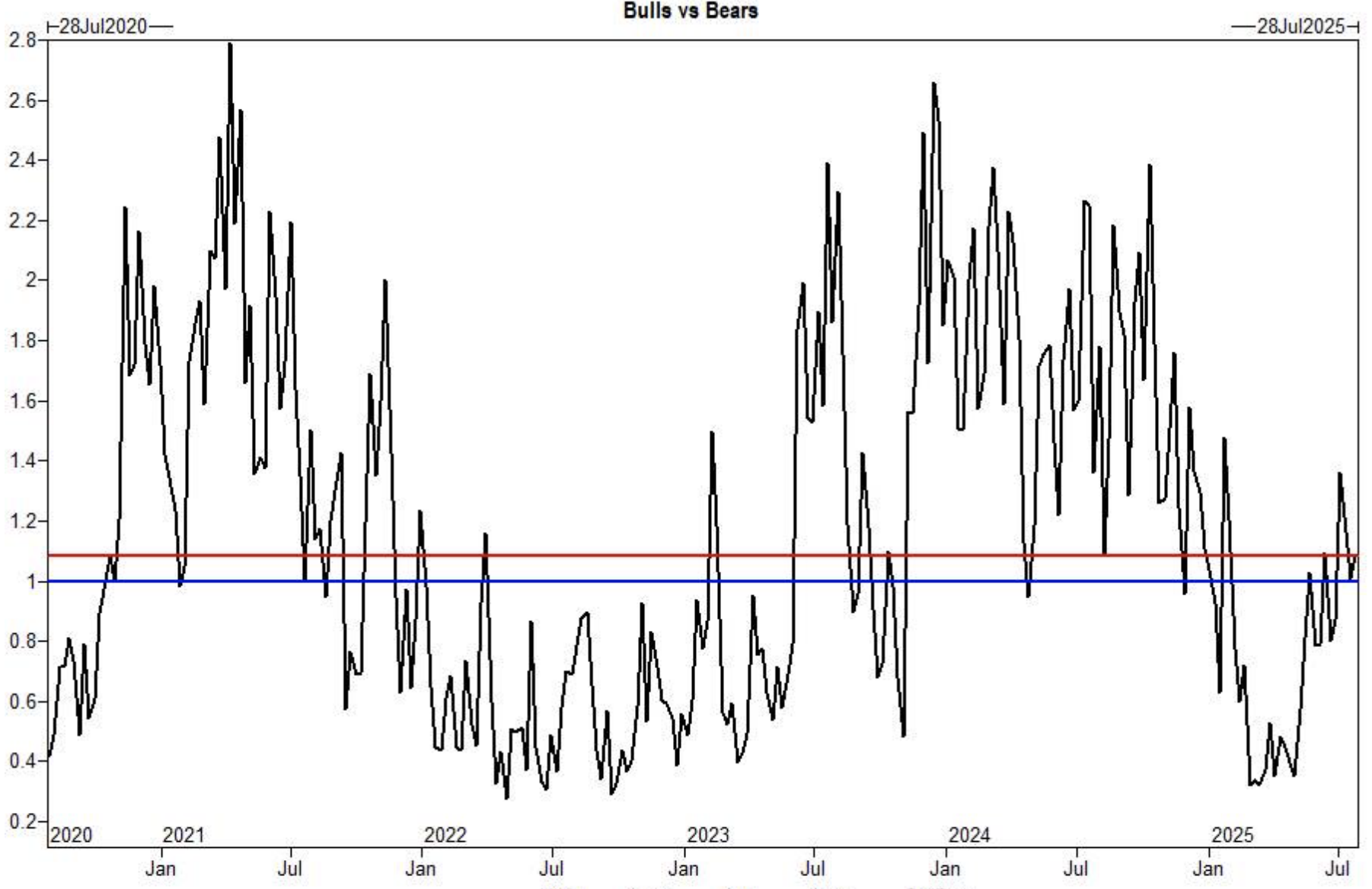

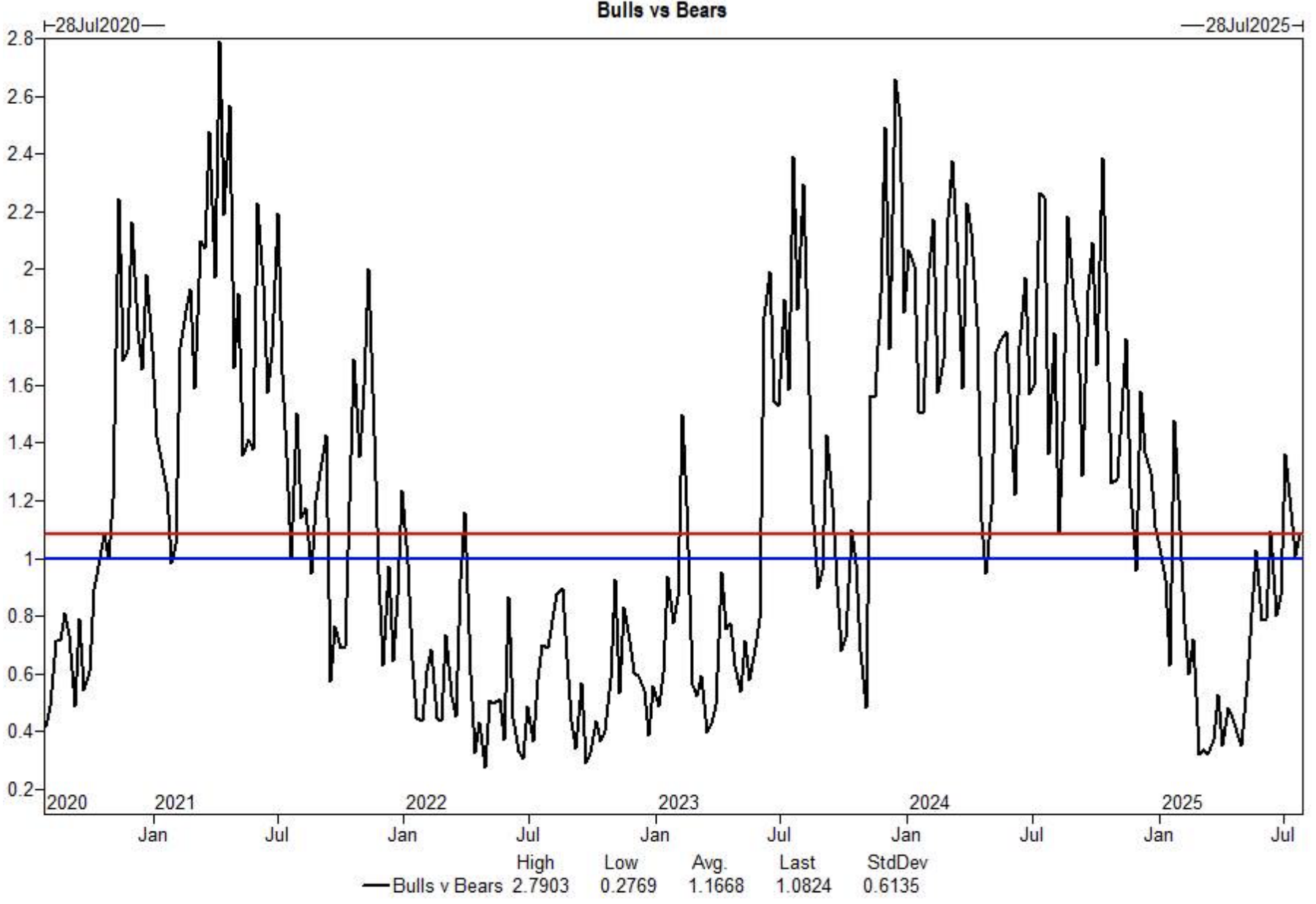

The next phase will see systematic strategies, such as CTA and volatility-based cohorts, continuing to buy U.S. equities over the next month. However, most of this demand is expected to peak after this week. While this activity supports a near-term equities rally, we are monitoring technical factors that could accelerate deterioration.

According to GS futures sales strategies, global equity positioning reached an estimated 6.5 out of 10 this week and is projected to climb to 8 in the next month under baseline conditions. In a 1-week scenario, this could push the cohort to $186 billion (83% of maximum positioning).

#### Over the Next Week:

- Flat Market: Buyers expected at $23.99B ($9.71B into the U.S.)

- Rising Market: Buyers expected at $23.35B ($8.37B into the U.S.)

- Declining Market: Sellers expected at $5.01B ($5.70B out of the U.S.)

#### Over the Next Month:

- Flat Market: Buyers expected at $48.69B ($24.55B into the U.S.)

- Rising Market: Buyers expected at $50.67B ($21.72B into the U.S.)

- Declining Market: Sellers expected at $185.73B ($55.00B out of the U.S.)

Liquidity

S&P Top of Book liquidity has been above the YTD average of $8.98mm for the last 23 trading days and above the 2y average of $12.63mm for 7 straight trading days – liquidity has remained robust throughout the recent monster rally. We expect this to taper off in August (as it also has historically) so now is the time to embrace the ability to transfer risk quickly

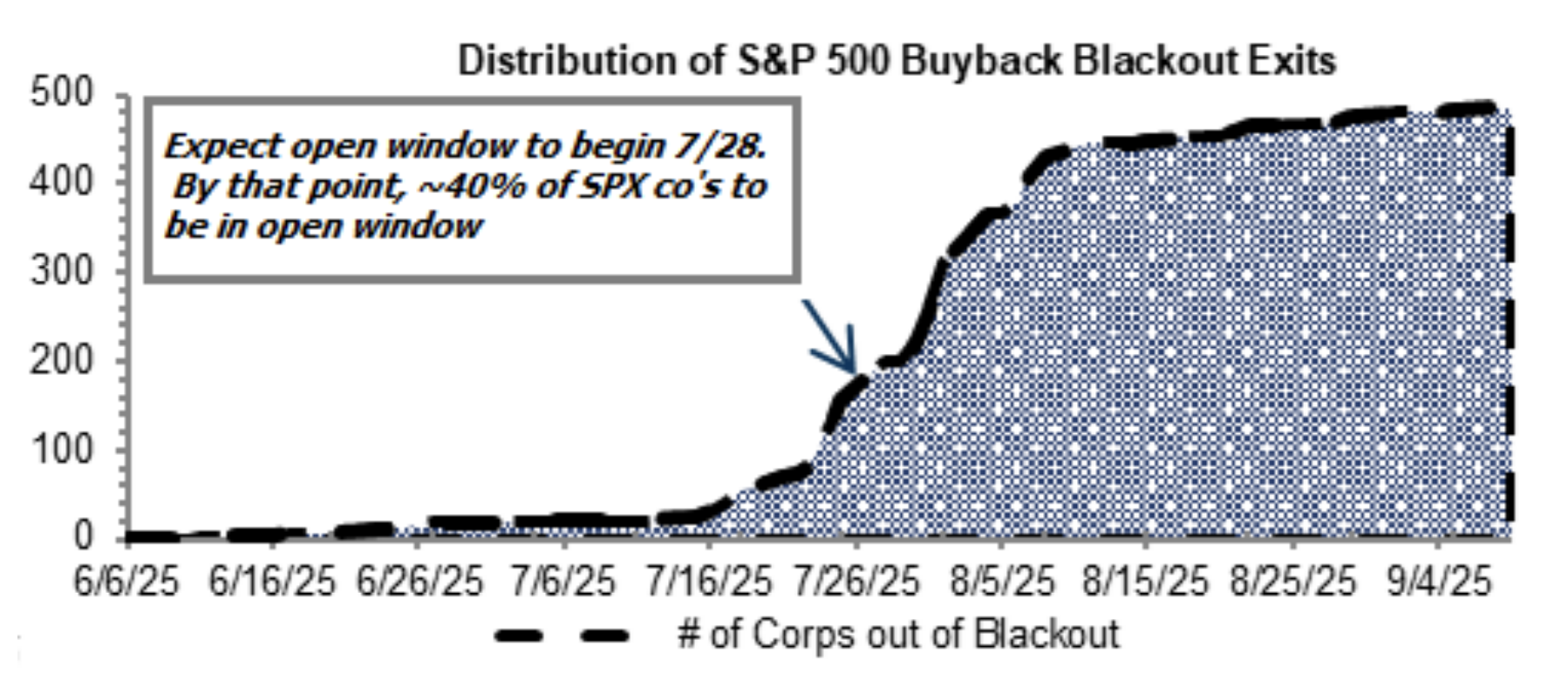

Buybacks

We estimate the next open window begins today 7/28. At this point, ~40% of S&P 500 companies ar expected to be in open window. This number will increase by Friday's close. We estimate companies enter open window ~1-2 days post earnings release so we will continue to see companies enter their discretionary period as we move through this earnings season.

Retail

THE COHORT THAT JUST WON’T QUIT Arguably the MVP segment of late, retail’s bid to the market has been sustained and sizable. As we’ve previously stated, we do not expect a notable decline in this demand until we see a fundamental change in the economic/labour data

Pensions

GS US Pension rebal update: US Pensions are modeled to SELL $10bn of US equities for month-end. $10bn to sell ranks in the 65th percentile amongst all buy and sell estimates in absolute dollar value terms over the past three years and in the 69th percentile going back to Jan 2000. Enough to do…nothing but will note this removes a layer of market support into month end

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!