Institutional Insights: Deutsche Bank: Investor Flows & Positioning 19/05/25

.jpeg)

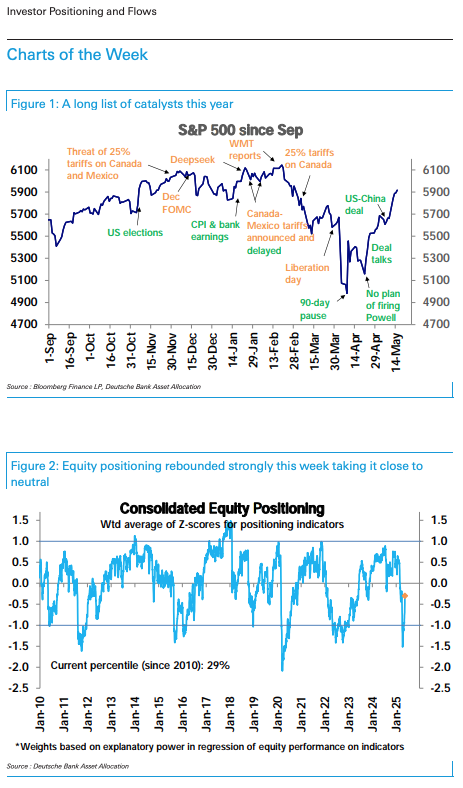

Discretionary Investors Shift to Overweight

Equity positioning surged significantly this week, moving to a modestly underweight stance. Our equity positioning metric experienced one of its largest recorded increases, now standing at a z-score of -0.30 (29th percentile). This rise was primarily driven by a sharp increase in discretionary investor positioning, which has turned overweight for the first time since late March (z-score 0.37, 66th percentile). Meanwhile, systematic strategy positioning continues to climb gradually but still has substantial room for further growth (z-score -0.86, 16th percentile). Recent equity market movements appear to be heavily influenced by discretionary investor activity.

Discretionary investor positioning now reflects expectations of stable earnings and GDP growth. Current positioning suggests no significant slowdown in earnings growth beyond the minor deceleration seen in Q1, nor any signs of GDP growth slowing. This is based on the "final sales to private domestic purchasers" measure, which excludes the effects of changes in net imports, inventories, and government spending. However, the US-China trade deal still leaves a considerable 15 percentage point increase in effective US tariff rates, rising from 2.4% to over 17%, with tariffs on China reaching an elevated 43%. While such tariff increases are expected to weigh on growth, discretionary investors may be anticipating further tariff rollbacks or exemptions as their economic impacts materialize.

US Equity Fund Inflows Rebound

Inflows into US equity funds rebounded sharply this week, reaching $25.2 billion, the highest level in five weeks. US-focused funds saw a strong recovery, with $19.8 billion in inflows following four consecutive weeks of outflows. Inflows into European ($2.7 billion), Japanese ($0.8 billion), and global funds ($5.2 billion) continued, albeit at a slower pace. Conversely, emerging markets (EM) experienced significant outflows of $3.3 billion, largely driven by China (-$3.3 billion).

Bond fund inflows also remained strong at $13.1 billion, with notable rotations into high-yield (HY) bonds ($3.7 billion), investment-grade (IG) bonds ($2.6 billion), and emerging markets bonds ($1.5 billion). However, government bond funds saw outflows of $0.7 billion, primarily from short-term funds (-$4.8 billion).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!