Institutional Insights: Deutsche Bank - Investor Flows & Positioning 09/06/25

Institutional Insights: Deutsche Bank - Investor Flows & Positioning 09/06/25

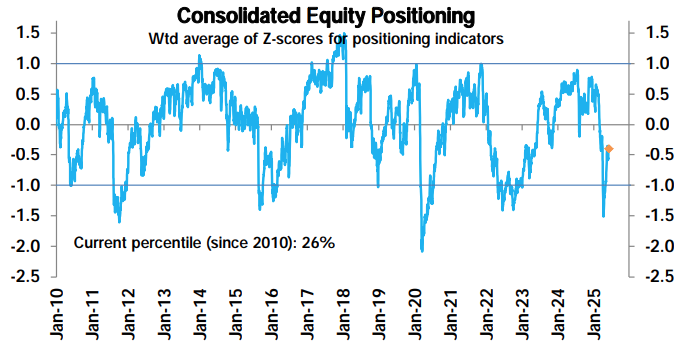

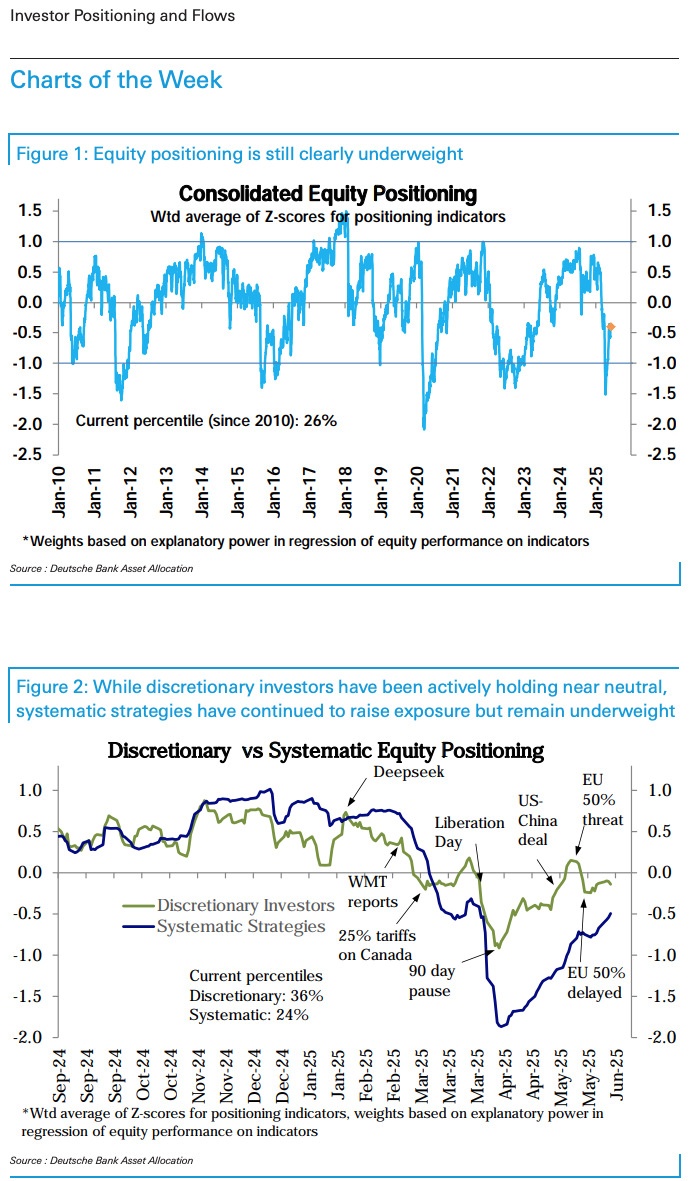

Equity positioning has slightly increased this week but remains underweight (-0.4 standard deviations, 26th percentile). Despite numerous catalysts over the past two weeks, discretionary investors have stayed near neutral (-0.14 standard deviations, 36th percentile), as highlighted in "Stuck In The Middle" (May 30, 2025). This neutrality has led to compressed ranges in the S&P 500 both within and across trading days, accompanied by a gradual decline in volatility.

As volatility continues to drop, systematic strategies have incrementally increased their exposure, with significant room for further expansion given their current underweight status (-0.49 standard deviations, 24th percentile). For Vol Control funds, declining equity volatility directly translates to higher exposure, while CTAs are likely to increase equity longs as trend signals grow increasingly favorable.

This marks the shortest recovery from a volatility shock on record—defined as a volatility spike exceeding 1.5 standard deviations. Historically, such shocks took around two months for equities to bottom and an additional four to five months to recover, resulting in a total roundtrip of six to seven months. However, in this instance, the initial tariff-related shock dissipated rapidly, enabling equities to recover in less than two months and climb 4% higher. At this stage of past volatility shocks, the S&P 500 was typically still down by nearly 10%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!