Institutional Insights: Credit Agricole FX Weekly 23/05/25

Stagflation hedges

US President Donald Trump’s inconsistent stance on tariffs heightened FX volatility in Q2, prompting us to further lower our USD forecasts. We have adjusted our EUR/USD projections to 1.12 for Q2 and 1.14 by the end of 2025. Similarly, we revised our USD/JPY forecasts downward to 144 for Q2 and 142 by the end of 2025. While investors are diversifying away from the USD, they are not abandoning it entirely. We maintain that speculation about the USD losing its status as the global reserve currency is highly overstated. A Mar-a-Lago Accord aimed at weakening the USD would be counterproductive for the US, as it would drive up UST yields and raise borrowing costs, exacerbating concerns about fiscal sustainability.

Diversification flows out of the USD are expected to persist, though at a slower pace, as the primary damage to the currency has already occurred. Investors are increasingly skeptical of Trump’s ability to secure fiscal stimulus through Congress, especially following the recent sovereign ratings downgrade. The passing of such a bill could heighten concerns about fiscal sustainability. However, claims that the US is facing a ‘Liz Truss moment’ are exaggerated. The ambitious goal of completing over 100 trade deals within 90 days presents significant risks, with the potential re-emergence of reciprocal tariffs raising the specter of stagflation. Moreover, US economic growth is normalizing, falling back in line with other G10 economies after a period of outperformance.

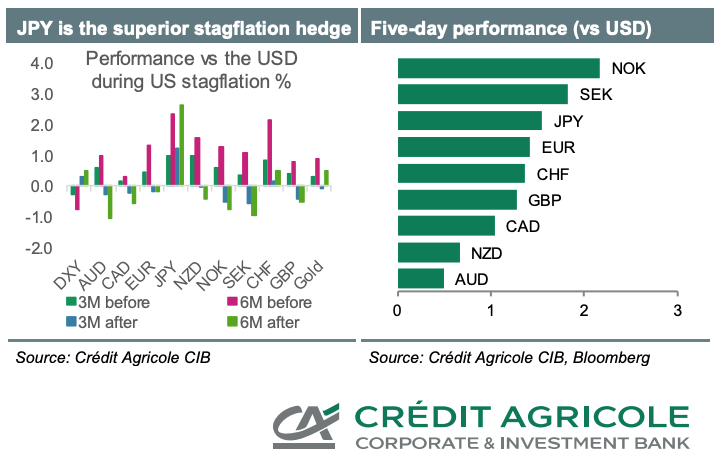

The JPY remains a strong hedge against the risk of trade deals failing and potential stagflation in the US. Historical G10 FX performance since 1983, excluding the pandemic period, shows that US stagflation has consistently led to JPY outperformance. Unlike other G10 currencies, which have shown mixed performance during and after stagflation periods, the JPY has demonstrated persistent strength, even outperforming traditional safe havens like the CHF and gold.

US economic indicators such as the Conference Board and UoM consumer confidence data, along with GDP figures, are unlikely to alleviate investor concerns. It is still too early for PCE data to reflect the full impact of tariffs. Meanwhile, the Fed’s recent cautious rhetoric has failed to provide support for the USD, and similar language in the upcoming FOMC Minutes is unlikely to change this trend.

In the Eurozone, inflation data could reinforce expectations for a ‘dovish ECB cut’ in June, potentially weakening the EUR’s relative rate appeal. However, the EUR may continue to benefit from portfolio and FX reserve diversification flows away from the USD. Additionally, we anticipate the RBNZ to lower its OCR by 25 basis points and revise its OCR forecasts downward.

FX & Gold Outlook

The euro (EUR) has recently strengthened across the board due to market expectations that it could become a key beneficiary of diversification away from the U.S. dollar (USD). Additionally, hopes for aggressive fiscal stimulus supporting the Eurozone’s economic outlook and attracting capital inflows have bolstered the EUR. As a result, EUR/USD may remain supported for the rest of the year and into early 2026. However, many positives appear to be priced into the EUR already, potentially limiting future gains. Upside risks to this forecast include earlier-than-expected revival of economic sentiment from fiscal stimulus and a potential resolution to the war in Ukraine, which could lead to a positive commodity terms-of-trade shock for the Eurozone.

The USD outlook for 2025 remains subdued as foreign exchange investors express concerns over: (1) long-term damage to the U.S. economy and USD-denominated assets from Trump-era policies, which could drive portfolio rebalancing away from the U.S. and increase short-USD positions; and (2) uncertainties surrounding fiscal stimulus approval in Congress following the recent U.S. sovereign downgrade and the need to raise the debt ceiling in the summer. While a USD collapse is unlikely, the economic impact of Trump’s policies is expected to be significant but temporary. The U.S. economy could begin recovering in the second half of 2025 and rebound in 2026 as fiscal stimulus gains traction. This recovery could allow the Federal Reserve to avoid aggressive policy easing, especially if inflation remains persistent, supporting a USD recovery within 6-12 months.

Safe-haven demand amid tariff uncertainties has strengthened the Swiss franc (CHF), even against the resurgent EUR. EUR/CHF may edge higher throughout the year as Switzerland’s return to zero interest rate policy (ZIRP) makes CHF an attractive funding currency. However, lower inflation differentials and balanced growth could temper real CHF valuations and limit large nominal losses.

The Japanese yen (JPY) remains a reliable hedge against potential stagflation in the U.S., as asset managers diversify away from U.S. and Japanese assets. While the Federal Reserve’s rate cuts and the Bank of Japan’s anticipated rate hikes (not expected until 2026) exert downward pressure on USD/JPY, the JPY stands to benefit from these dynamics.

The British pound (GBP) is likely to outperform both the EUR and USD in 2025 and beyond, partly due to improving trade relations with the U.S. and EU. Persistently high UK inflation could delay aggressive Bank of England rate cuts, maintaining the GBP’s rate advantage over the EUR. Additionally, the UK government’s reputation for fiscal conservatism could shield the GBP amid global bond market volatility. The GBP’s recent underperformance has pushed it into undervalued territory versus the EUR, according to short-term FX fair value models.

USD/CAD has recently dipped below the 1.44 pivot due to broad USD weakness. Despite a decline in oil prices, the Canadian dollar (CAD) has remained resilient. However, heightened global uncertainties may delay a sustained recovery, as domestic economic activity continues to grapple with trade turmoil.

Investor concerns over U.S. tariffs and a global trade war appear to have peaked, with the conflict narrowing to primarily U.S.-China tensions. While this scenario is less detrimental to the Australian dollar (AUD) compared to a broader trade war, China’s ongoing economic stimulus efforts to counteract U.S. tariffs could support the AUD. The AUD remains strongly correlated with the Chinese yuan (CNY). Australia’s labor market remains tight, contributing to underlying inflation, which is further bolstered by increased government spending post-election. This suggests that rate cuts in Australia may be overestimated by the market.

New Zealand’s economy is recovering well from a deep recession, supported by strong agricultural export prices and production. While the absence of major U.S. trade deals could negatively impact the New Zealand dollar (NZD), diversification away from U.S. assets will likely benefit NZD/USD, which is positively correlated with Asia-U.S. equity market performance.

The Norwegian krone (NOK) has seen its rebound cut short by global market turmoil following U.S. tariff announcements. Its high-beta nature and the decline in energy prices have raised concerns about Norway’s otherwise-solid fundamentals. A return to risk-on sentiment is needed for the NOK to regain ground.

The Swedish krona (SEK) has been the surprising year-to-date outperformer among G10 currencies, benefiting from its role as a high-beta proxy for the EUR. However, near-term challenges such as dividend season and the Riksbank’s decision to absorb large selling flows could limit further gains. More evidence of sustainable economic recovery in Sweden will be required for the SEK to achieve long-term appreciation.

Gold’s recent aggressive gains may deter buyers in the short term, but its strength could resume in the next 3-6 months due to central bank purchases and a potential Fed easing cycle, which could lower U.S

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!