Institutional Insights: Credit Agricole FX Weekly 20/06/25

USD: A Crude Impact

Escalating geopolitical tensions in the Middle East have recently driven oil prices higher, significantly dampening market risk sentiment. In this context, the Federal Reserve chose to maintain its stance during the June policy meeting, signaling that stagflationary conditions are likely to persist in the US. Concerns over potential US involvement in the Israel-Iran conflict continue to loom, keeping markets on edge in the short term. The USD has emerged as a key beneficiary of heightened geopolitical risks. A crucial question for FX investors is whether these developments could prompt a reassessment of the USD's dominance as the high-yielding, safe-haven leader in the FX market. While a full resurgence of "King USD" appears unlikely at this stage, we believe the currency could gain further ground across the board in the near term.

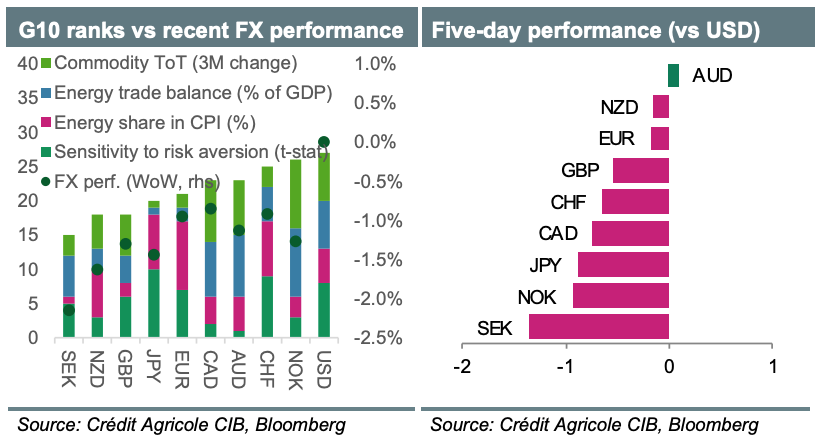

To explore this, we constructed a ranking of G10 currencies based on several factors: (1) sensitivity to market risk aversion; (2) the share of energy exports in GDP; (3) the weight of energy prices in CPI; and (4) changes in overall commodity terms of trade. These factors capture both the market's reaction to rising risk aversion and the economic impact of higher oil prices, as well as fluctuations in other commodity prices. Our analysis places the USD at the top of the ranking, followed by the NOK, while the SEK and GBP rank at the bottom. This ranking aligns with some of the FX price movements observed since the onset of the Middle East crisis.

In the short term, risk sentiment will remain a critical driver of market dynamics, with FX investors closely monitoring geopolitical developments and any progress toward a diplomatic resolution in the Middle East. Additionally, next week’s key data releases will likely influence FX markets. In the US, investors will focus on the May Core PCE, June PMIs, and the Conference Board Index, along with Fed Chair Jerome Powell’s semi-annual testimony. In the Eurozone, the June PMIs, the German ifo index, the German federal budget, and the EU leaders’ summit will draw significant attention, particularly for insights into defense and infrastructure spending in Europe. Despite these developments, we believe much of the optimism is already priced into the EUR, leaving it vulnerable to potential profit-taking if disappointments arise. Meanwhile, BoE speakers, UK June PMIs, and Canada’s May CPI data will also garner attention in the coming week.

FX and Gold Outlook

EUR Outlook

The EUR has recently gained strength across the board, supported by market expectations that it could emerge as a key beneficiary of diversification away from the USD. Additionally, optimism surrounding aggressive fiscal stimulus potentially bolstering the Eurozone’s economic outlook and attracting capital inflows continues to provide a boost. As a result, EUR/USD is likely to remain supported through the remainder of the year and into early 2026. However, much of the positive sentiment appears to be priced into the EUR already, which could limit further gains. Upside risks to the EUR forecast include earlier-than-expected economic revival driven by fiscal stimulus and a potential resolution to the Ukraine conflict, which could lift sanctions on Russia and deliver a positive commodity terms-of-trade shock for the Eurozone.

USD Outlook

The USD may face subdued performance in 2025 as FX investors remain concerned about:

1. The lingering economic impact of prior US administration policies, which could lead to further portfolio rebalancing away from USD assets and an increase in short-USD hedges.

2. Fiscal stimulus approval challenges in Congress, compounded by the recent US sovereign credit downgrade and the need to address the debt ceiling during the summer.

However, a USD collapse is unlikely. The negative economic effects of past policies are expected to be significant but temporary. The US economy could begin recovering in the second half of 2025, with a more robust rebound anticipated in 2026 as the focus shifts to fiscal stimulus. This recovery could allow the Federal Reserve to avoid aggressive policy easing, especially if inflation remains sticky. Consequently, the USD could stage a recovery within 6 to 12 months.

CHF Outlook

Safe-haven demand has strengthened the CHF, even against the resurgent EUR, partly due to tariff uncertainties. EUR/CHF may edge higher throughout the year as Switzerland’s return to a zero interest rate policy (ZIRP) makes the CHF an attractive funding currency. However, lower inflation differentials and stable growth should help prevent significant nominal losses, tempering CHF real valuations.

JPY Outlook

The JPY remains a reliable hedge against potential stagflation in the US. Asset managers are expected to continue diversifying away from US and Japanese assets, which will benefit the JPY. However, USD/JPY could face downward pressure due to the Federal Reserve’s rate cuts and the Bank of Japan’s anticipated rate hikes, though the latter is not expected until 2026.

GBP Outlook

The GBP is likely to outperform both the EUR and USD in 2025 and beyond. This is partly due to the UK economy benefiting from easing trade tensions with the US and EU. Persistent UK inflation could delay aggressive rate cuts by the Bank of England, helping the GBP maintain its rate advantage over the EUR. Additionally, the UK government’s reputation for fiscal conservatism should shield the GBP in the event of a global bond market sell-off. The GBP’s relative underperformance has pushed it into undervalued territory against the EUR, according to short-term FX fair value models.

CAD Outlook

USD/CAD has returned to levels seen a year ago near 1.36, primarily due to broad USD selling. This retracement has exceeded what relative interest rates would have suggested. A potential trade agreement between the US and Canada could act as a catalyst for a spot pullback.

AUD Outlook

Concerns about US tariffs and a global trade war have peaked, with a narrowing focus on US-China tensions. While this is less negative for the AUD than a broader trade war, Australia’s economy will benefit from continued Chinese government stimulus aimed at offsetting tariff-related growth drags. Investors diversifying away from US assets will also support the AUD, given its strong correlation with the CNY. The Australian labor market remains tight, which, combined with higher post-election government spending, is expected to sustain inflationary pressures and limit the scope for aggressive rate cuts.

NZD Outlook

New Zealand’s economy is recovering strongly from a deep recession, supported by robust agricultural export prices and production. Although the lack of major US trade deals could weigh on the NZD, diversification away from US assets will benefit NZD/USD, which is positively correlated with Asia-US equity market performance.

NOK Outlook

Despite some setbacks, Norway’s robust economic fundamentals and the NOK’s regained rate appeal suggest further long-term appreciation, assuming no significant global disruptions. However, April’s correction highlights potential obstacles on the NOK’s recovery path.

SEK Outlook

The SEK has been the standout G10 FX performer year-to-date, leveraging its high-beta EUR proxy status. However, a softer economic phase and potential monetary easing have tempered gains. For sustained long-term appreciation, more compelling evidence of Sweden’s macroeconomic outperformance relative to the Eurozone is needed.

Gold Outlook

While recent aggressive gains in gold prices may deter short-term buyers, its

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!