Institutional Insights: Credit Agricole FX Weekly 16/05/25

.png)

90 days to save the world (and the USD)

Since last November, FX investors have shifted from fully endorsing US exceptionalism to cautiously testing an almost universal "sell America" trade, before eventually settling into a conflicted "love-hate" relationship with the USD. At the heart of these volatile swings lies US President Donald Trump, whose unpredictable and often whimsical policies have amplified market uncertainty.

Many clients argue that Trump’s policy unpredictability has inflicted lasting damage on USD sentiment and its long-term outlook. However, we believe recent claims about the USD’s decline as a reserve currency are overstated. Additionally, we anticipate that Trump’s policies over the next 90 days could partially restore confidence in the USD, reversing some of the sentiment damage incurred during the administration’s initial 100 days.

Specifically, we foresee progress in three key areas: (1) agreements with major US trading partners, (2) congressional approval of Trump’s fiscal stimulus package, including tax cuts and other measures, and (3) raising the debt ceiling before the Treasury’s anticipated “X-date” in August. These developments could bolster market confidence in the US economy and encourage investors to recalibrate their long-term Federal Reserve expectations, ultimately benefiting the USD.

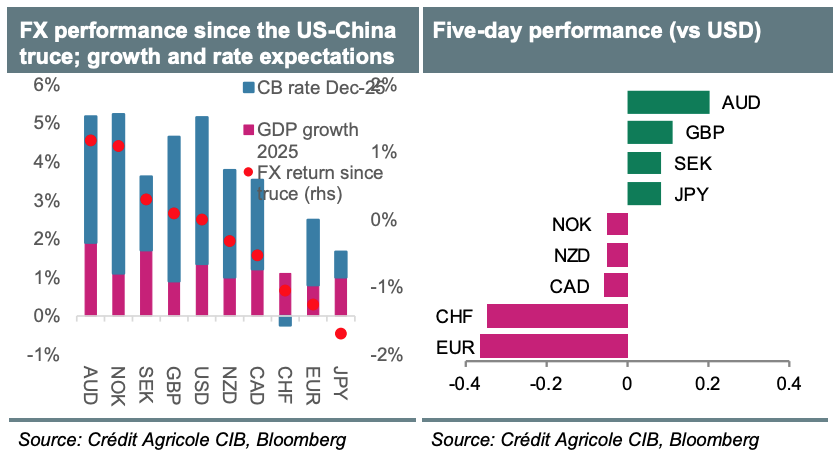

Despite this, FX investors may remain cautious about a near-term USD rally. Instead, they might focus on currencies poised to perform well amid easing trade war concerns, an improving global growth outlook, and stronger risk sentiment. Lower FX volatility could make carry trades more appealing, favoring high-yielding currencies over low-yielders like the JPY and CHF. The GBP, in particular, stands out as a potential beneficiary due to its rate and growth prospects. Upcoming UK data, including CPI, retail sales, PMI figures, and the first post-Brexit UK-EU summit, could draw significant attention.

Looking ahead, global PMIs, Germany’s Ifo survey, and Canadian CPI will take center stage next week. Additionally, the G9 finance and economic ministers’ meeting on May 20-21 will be closely monitored for signs of progress in trade negotiations. Elsewhere, we expect the RBA to deliver another hawkish 25bp rate cut. While softening inflation provides room for rate reductions, a tight labor market, robust wage growth, and the US-China trade truce suggest the central bank will maintain a modestly restrictive stance.

FX and Gold Outlook

EUR Outlook

The Euro (EUR) has recently gained strength, supported by market optimism surrounding aggressive fiscal stimulus, which could enhance the Eurozone’s economic prospects, attract repatriation flows, and potentially shorten the European Central Bank’s (ECB) easing cycle. However, we advise caution as much of this optimism appears already priced into the EUR, suggesting a more neutral near-term outlook. Upside risks to the EUR/USD 6M-12M forecasts remain, driven by an improving Eurozone economic outlook for 2026. If fiscal stimulus successfully revives economic confidence, or if geopolitical tensions in Ukraine ease—potentially lifting sanctions on Russia—this could create a positive commodity terms-of-trade shock for the Eurozone.

USD Outlook

Our below-consensus USD outlook has performed well in 2025, as concerns over the U.S. economic outlook prompted FX investors to unwind the “Trump trade,” leading to a broad-based USD decline. While the pace of the USD sell-off was sharper than anticipated, we foresee a period of consolidation in the near term. Nonetheless, the USD is expected to remain under pressure over the next 12 months, as the Federal Reserve resumes its easing cycle and ends quantitative tightening (QT). Concerns over fiscal dominance and a potential "Mar-a-Lago Accord" also weigh on the greenback. Further into 2026, a renewed U.S. economic recovery and rising Treasury yields could provide some relief for the USD.

CHF Outlook

Uncertainty surrounding tariffs has bolstered demand for safe-haven currencies like the Swiss Franc (CHF), which has strengthened even against the recovering EUR. While EUR/CHF could edge higher in 2025 due to the return of zero interest rate policy (ZIRP) in Switzerland, making the CHF an attractive funding currency, lower inflation differentials may temper CHF valuations. Stable growth in Switzerland could also mitigate significant nominal losses.

JPY Outlook

The narrowing U.S.-Japan rate spread continues to drive USD/JPY on a volatile downward trajectory. Tariffs negatively impact USD/JPY by weighing on global equities and raising U.S. stagflation risks, which in turn boosts demand for the Japanese Yen (JPY) as an alternative safe-haven. However, the Bank of Japan’s (BoJ) hesitance to raise rates further due to these uncertainties offers some support to the exchange rate. Near-term upside risks to USD/JPY exist, particularly if a U.S.-Japan trade deal is finalized, as this could boost the Nikkei, reduce U.S. stagflation concerns, and support USD/JPY appreciation.

GBP Outlook

While GBP/USD has benefited from recent USD weakness, caution is advised over the next 3M-6M due to persistent concerns about the UK’s economic and fiscal prospects, geopolitical risks, and potential fallout from a U.S.-led trade war. However, the GBP/USD rally could regain momentum in 6M-12M, supported by ongoing USD weakness and signs of an improving UK growth outlook. We remain bearish on EUR/GBP, expecting the GBP to outperform the EUR in 2026 as a higher-yielding proxy.

CAD Outlook

USD/CAD has recently dropped below the 1.44 pivot, driven by broad-based USD weakness. Despite a subsequent decline in oil prices, the Canadian Dollar (CAD) has shown resilience. However, heightened global uncertainties may delay a sustained CAD recovery, as the domestic economic impact of trade tensions remains unclear.

AUD Outlook

We anticipate a gradual rise in AUD/USD, supported by a shallower-than-expected rate-cutting cycle by the Reserve Bank of Australia (RBA) and continued USD weakness. A tight labor market and low productivity growth are contributing to inflationary pressures. However, weaker Chinese growth due to U.S. tariffs and the RBA’s ongoing rate cuts could weigh on the Australian Dollar (AUD). The failure of bilateral U.S. trade deals could further hinder the AUD’s rally.

NZD Outlook

Similarly, NZD/USD is expected to grind higher, buoyed by USD weakness and potential upside surprises in New Zealand’s economic recovery. The New Zealand Dollar (NZD) may also benefit from investor diversification away from U.S. assets toward Asian markets. Nevertheless, weaker Chinese growth and the absence of U.S. trade agreements could challenge the NZD’s upward trajectory.

NOK Outlook

The Norwegian Krone (NOK) has struggled to sustain its recovery amid global market volatility triggered by U.S. tariff announcements. Its high-beta nature and declining energy prices have undermined its rebound. While Norway’s fundamentals remain solid, a return to risk-on sentiment is necessary for the NOK to regain lost ground.

SEK Outlook

The Swedish Krona (SEK) has emerged as a surprising outperformer among G10 currencies this year, benefiting from its status as a high-beta

Gold Outlook

The recent sharp gains in gold may discourage buyers in the short term, but its momentum could strengthen later in 2025, supported by central bank purchases and the anticipated resumption of the Federal Reserve's easing cycle, which may drive US real rates and the USD lower. However, a significant rebound in the US economic outlook, along with higher US interest rates and Treasury yields, would be required to weaken gold's performance in 2026.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!