Institutional Insights: Citadel Global Market Insights Update 4/9/25

.jpeg)

September is historically the weakest month for equities, with volatility rising into option expiration and retail participation fading. With systematic strategies (CTAs, Vol-Control, Risk Parity) already near peak allocations and corporate demand set to slow, risk/reward skews to the downside. That makes hedges particularly attractive. Or, to borrow from Drake: “S&P” started from the bottom (in April), now we’re here…30% later.

The longer-term equity trend remains intact and supportive of a Q4 rally.

Q4 Equity Snapshot: Equity Rally Themes

• Equal-weight breadth improving (S&P ‘493’ > ‘Top 7’)

• Value > Growth

• Small/Mid > Large caps

• “The rest” > “The best”

These are the key dynamics we’re tracking.

I. On-the-Ground Sentiment (Citadel Securities)

Client activity remains robust even at all-time equity market highs.

• Retail Equities: Net buyers in 17 of the last 20 weeks

• Retail Options: 18-week net buying streak

• Institutional Options: Bullish in 5 of the last 7 weeks

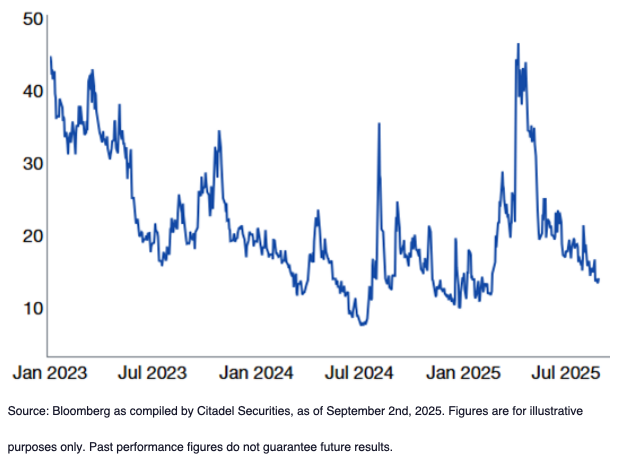

II. Low Implied Correlation: A Stock Picker’s Market

� Low implied correlation signals a market where fundamentals matter more than macro—supportive for alpha from security selection.

• Typical of late-cycle markets with refocus on earnings

differentiation

• “Alpha > Beta; Single-name > Index; 493 > 7”

• Active > Passive

SPX 3-month Implied Correlation

Jan 2023 – Today

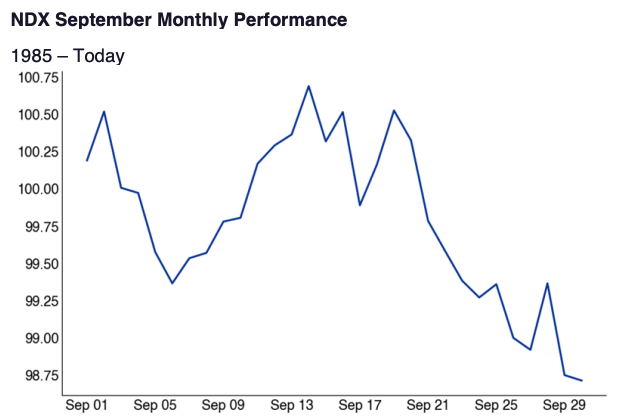

Seasonality Watch: September Setup

� September Setup

• Historically, Sep 3rd marks the monthly S&P 500 high

(since 1928)

• Post–Labor Day FOMO tends to fade

• Quarter-end rebalancing intensifies

• 2025 has closely mirrored historical patterns

SPX September Monthly Performance

1928 – Today

.png)

.png)

Citadel Securities’ Bullish Retail Options Streak Update

• The bullish streak has now reached 18 consecutive weeks of demand, marking it as one of the longest since 2020, tied for third place.

• The average duration of the top five streaks is also 18 weeks, which typically signals a slowdown in option activity.

September Decline Ahead of Q4 Surge:

Retail options volume at Citadel Securities usually decreases in September, followed by a resurgence as the year approaches its final quarter. Q4 generally sees an uptick in activity, with November being the peak month of the year.

Volatility: Significant Decline in Realized, Implied Now Lower

Three-month realized volatility has drastically decreased, dropping 10 percentage points in just two weeks as prior high-volatility periods phase out. This situation has created a considerable long dealer-gamma environment, which tends to dampen intraday fluctuations. Our estimates suggest that long dealer gamma positioning is quite notable.

• SPX 3M realized vol is approximately 12 (a significant drop from previous highs)

• SPX 2M realized vol is around 9

• SPX 1M realized vol is about 10

• Systematic re-leveraging has been driven by the drop in realized vol and strategies that involve selling volatility.

Implied Volatility: Has reset to lower levels, making hedges more appealing again.

.png)

Takeaway: After a period characterized by a relentless upward trend throughout the summer months, accompanied by heavy positioning in various market sectors, the arrival of September typically signals a notable change in market dynamics. Historically, this month exhibits a tendency to shift market sentiment, leading to a decrease in momentum.

One key factor contributing to this shift is the saturation of systematic trading strategies, which have likely reached their peak effectiveness during the preceding months. As these strategies become maxed out, they leave less room for continuous bullish trends. Additionally, corporate demand may begin to dwindle as companies enter a blackout period, during which they refrain from buying back their own stocks, further exacerbating a potential downturn.

Seasonality also plays a crucial role, with historical data indicating that the fall months can present negative market trends. As September unfolds, traders may observe that market volatility is on the rise, prompting an increase in fear and uncertainty among investors. Given these conditions, implementing downside hedges becomes particularly wise, serving as a protective measure against potential losses and providing a buffer for investment portfolios during this transition period.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!