Institutional Insights: BofA - Investor Sentiment: Risk-Love

.jpeg)

Investor Sentiment: Risk-Love

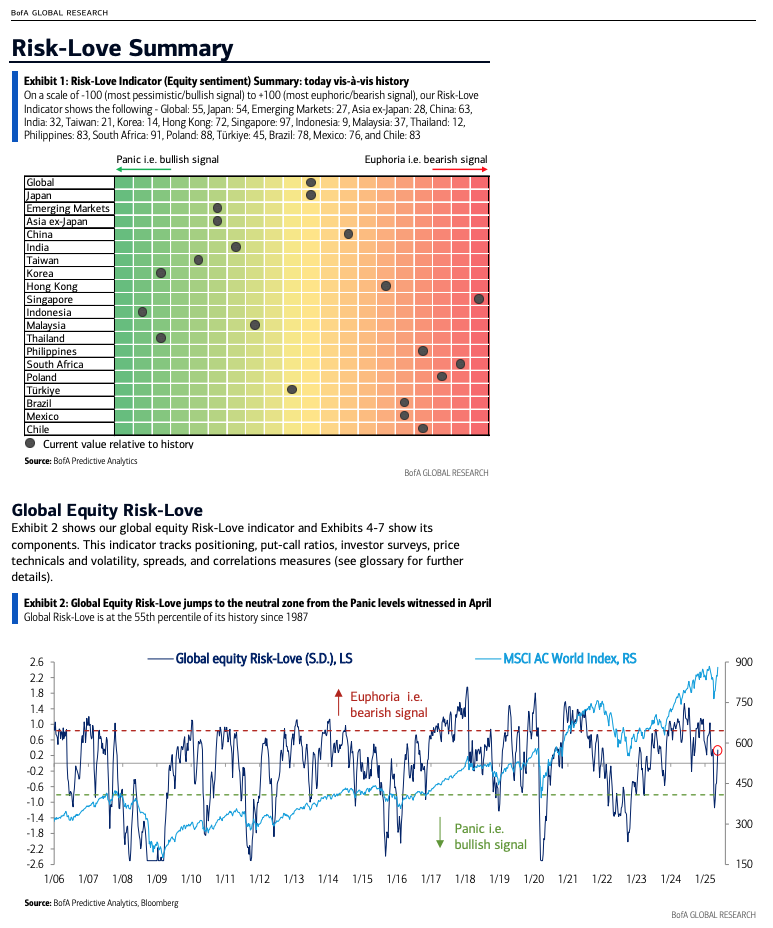

As is often the case, the Global Equity Risk-Love Indicator has rebounded sharply from its deep panic levels (9th percentile) observed in early April. This recovery was driven by renewed investor confidence following President Trump's announcement of a 90-day suspension on tariffs and the proactive trade discussions initiated by the US administration with key trading partners. The left-tail risk of a recession, which had driven Risk-Love into panic territory, has now subsided. Supporting this, Polymarket’s US recession risk dropped significantly to 38% from a recent peak of 66%.

Looking Ahead:

What lies ahead? Weak corporate earnings, subdued economic data, and renewed debates about secular stagnation. We anticipate that global central banks (excluding the US and Japan) are likely to lean towards monetary easing. David Hauner, our Head of Global Emerging Markets Fixed Income Strategy, highlights that the Emerging Monetary Mood Indicator (EMMI) shows EM central banks are now at their most dovish stance since the onset of COVID. With inflation not posing a significant threat outside the US, there is room for rate cuts without triggering currency depreciation.

Historically, the Global Risk-Love Indicator has shifted from panic to neutral levels 32 times over the past 38 years. Of these instances, it only fell back into panic during 1988, 1998-99, 2012, and 2015. In all other cases, it continued to rise to euphoric levels, surpassing the red line. Washed-out sentiment, coupled with improving market breadth and monetary easing, has typically been associated with the continuation or emergence of a new bull market. While history is not a definitive predictor, the evidence suggests markets may have further room to climb.

The Two Extremes:

Contrarian Bullish Signals:

- India: Risk-Love is steadily recovering from the panic levels seen in early March.

- Korea: Risk-Love has been hovering near the panic threshold since the start of the year.

- Indonesia: Risk-Love has marginally risen above the panic zone threshold.

- Thailand: Risk-Love has slipped back into the panic zone.

Contrarian Bearish Signals:

- Singapore: Risk-Love has remained at euphoric levels for the past six months.

- Philippines: Risk-Love indicates mild euphoria.

- South Africa: Risk-Love has stayed at euphoric levels for the third consecutive month.

- Poland: While slightly below its peak, Risk-Love remains buoyant.

- Mexico: Risk-Love is hovering near the threshold of euphoria.

In summary, while risks remain, the broader sentiment and historical patterns suggest potential for further market gains, particularly in regions showing contrarian bullish signals.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!