Institutional Insights: BofA -Global Equity Volatility Insights

Low vol looks unsustainable into Fall risks

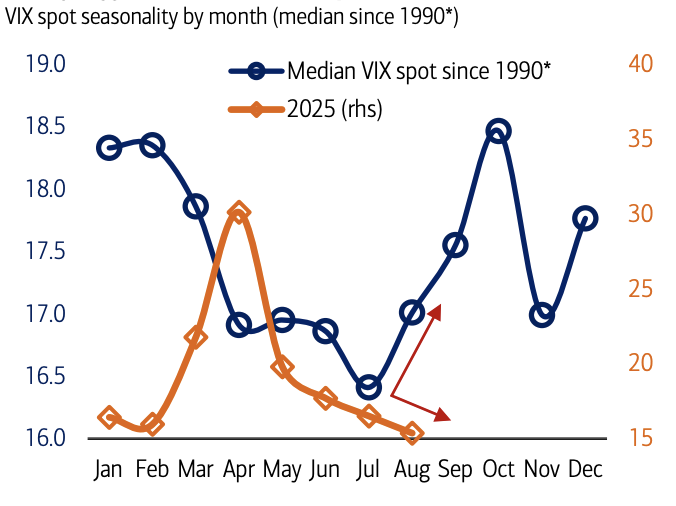

Following Federal Reserve Chair Powell's dovish speech at Jackson Hole, the VIX reached a year-to-date low of 14.22, but this level appears unsustainable as we transition from summer to fall amidst concerns of an artificial intelligence bubble and U.S. policy uncertainties.

The VIX’s decline comes even as realized volatility for the S&P has been increasing since its July low of 6.5%, now at 11.5%. With only a week remaining in summer and historical trends indicating increased volatility during September leading into October's peak, it seems improbable that this low level of volatility will continue, especially considering:

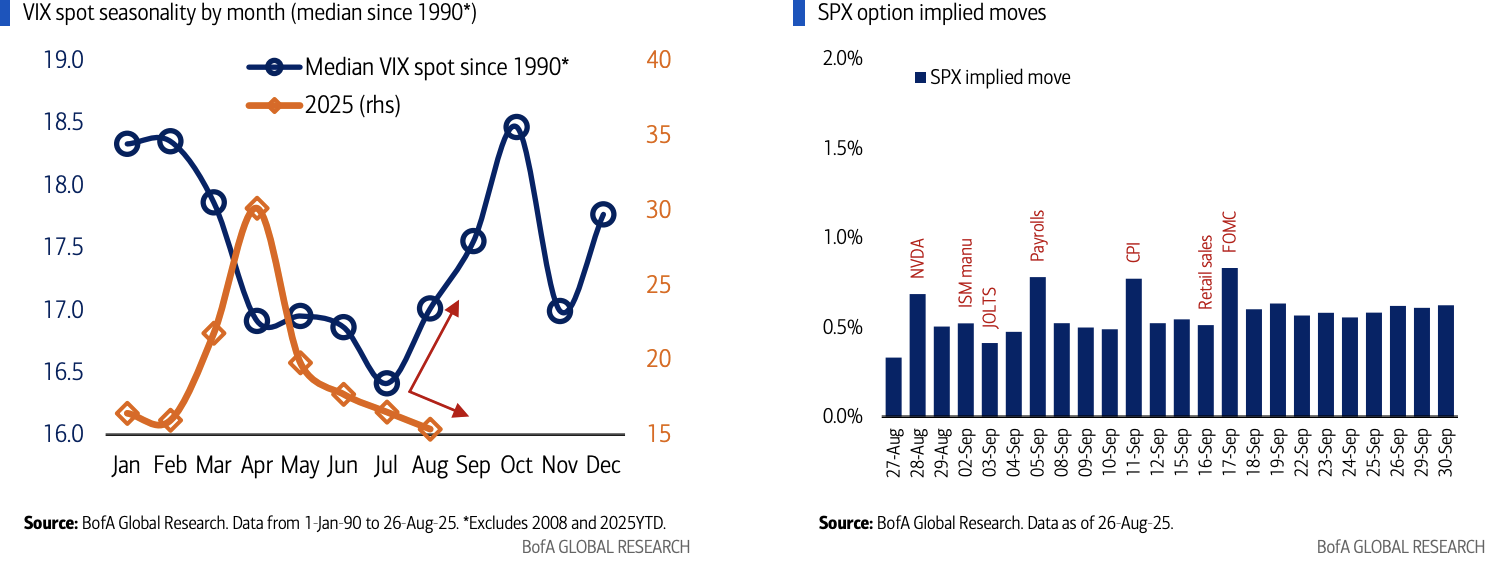

- Concerns about an AI bubble: Following a rapid recovery in the Nasdaq, there are rising worries that the AI sector may be in a precarious bubble. Insights from Sam Altman, OpenAI's CEO, and an MIT study suggest that 95% of companies are not experiencing a return on their heavy investments in AI. NVIDIA's earnings report on August 27 is anticipated as a key market event, with S&P options reflecting expectations of a 0.68% movement the next day. Signs of a slowdown in AI spending could heighten bubble concerns further.

- What if the Fed doesn’t cut rates?: With the market anticipating a Federal Reserve rate cut with an 87% pricing chance for September, there’s a significant risk that this may not materialize. The economics team points to an unemployment rate of 4.2% in August, coupled with job growth over 70,000 and minimal revisions, suggesting that a hold on rates might be possible. Upcoming economic indicators include Payrolls data on September 5, CPI on September 11, and the FOMC decision on September 17. Currently, markets are forecasting minimal movements of under 1% in the S&P during these events.

- Rising policy risk concerns: Policy risk remains prevalent, especially with over a century of tariff policy experimentation by the U.S. government and ongoing concerns about the independence of the Federal Reserve—a pressure not felt in 50 years since Nixon's pressure on Arthur Burns to maintain low rates. Although the market appears to be accepting of policy risk following the April Trump put, genuine tail risks still exist, which the market has been taking into account despite an overarching sense of complacency.

However, elevated volatility is expected to provide substantial buy-the-dip (BTD) opportunities. Despite the risks and the potential for fluctuations to increase volatility this Fall, current indicators suggest that we are far from reaching the "big peak" in the AI sector (refer to "Vol still indicates no bubble yet"). This scenario could lead to further increases in both volatility and valuations over a multi-year timeframe, following historical patterns. It's typical for pullbacks to occur during the formation of asset bubbles, but historical data shows that recoveries are often swift (Exhibit 11). We also find ourselves in one of the most robust BTD environments in nearly a century, surpassing even some measures from the late 90s tech bubble (Exhibit 10). Therefore, we anticipate that pullbacks this Fall are likely to be met with strong buying support, especially with the potential response from both the Federal Reserve and the US government to any significant market stress (such as Fed actions & Trump interventions), coupled with the growing certainty that we are still in the early phases of AI’s profound transformation of the global economy. This combination of high future potential and uncertain timing increases the likelihood of an eventual asset bubble.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!