The Flow Show

Scores on the Doors:

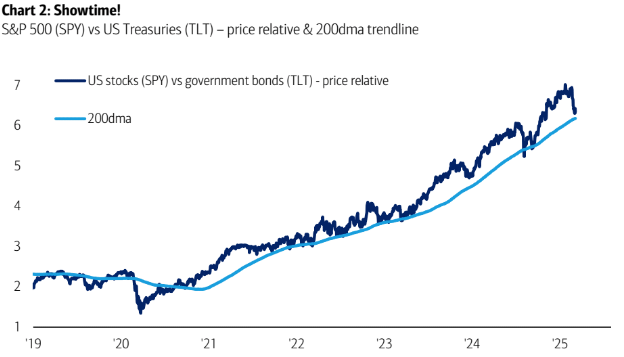

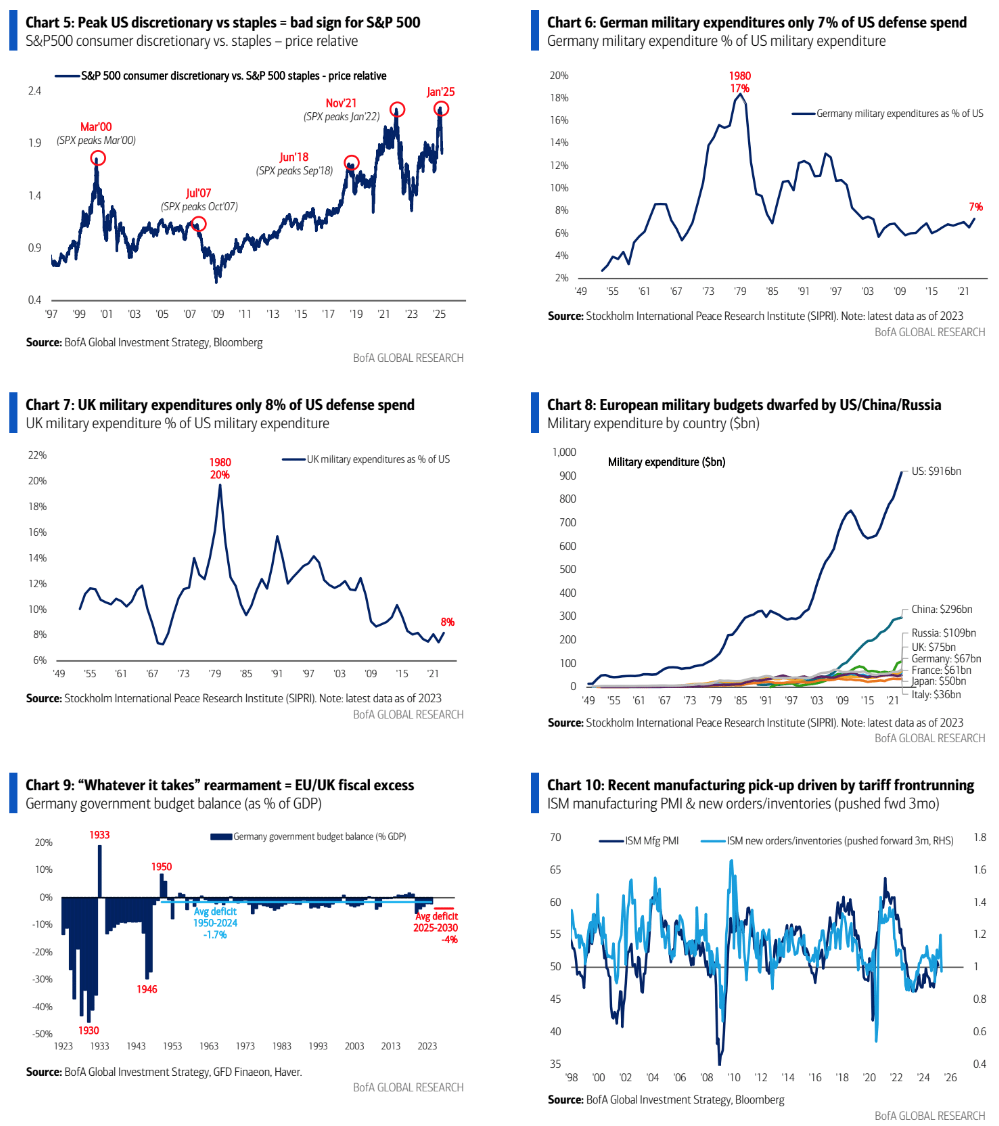

gold at 10.8%, IG bonds at 2.7%, HY bonds at 2.6%, government bonds at 2.5%, stocks at 1.3%, cash at 0.7%, commodities at -0.2%, US dollar at -4.1%, oil at -7.5%, and crypto at -21.8% year-to-date. The Biggest Picture: The S&P 500 versus Treasuries is once again at a critical 200dma trendline (which has been held since December 2020 - see Chart 2). "Showtime" as they like to say in the industry; strong February payrolls exceed 200k... US stocks maintain their position, but weak February payrolls are below 125k... it’s a bull market for bonds and a bear market for equities. Tale of the Tape: Active and reserve military personnel in 2024... Russia has 2.6 million, China has 2.5 million, the US has 2.1 million (with 84k in Europe), while France has 230k, Germany 213k, and the UK 211k... "whatever it takes" European rearmament equates to EU/UK fiscal excess; meanwhile, DOGE represents new fiscal austerity in the US; the conditions appear favorable for German bund yields to outpace US Treasury yields by the end of the year (see Chart 3). The Price is Right: "DeepSeek" leads to a $3 trillion market cap loss for the "Magnificent 7" (now referred to as the "Lagnificent 7") while the market cap for China's "Fab Four" (Baidu, Alibaba, Tencent, Xiaomi) doubles to $1.6 trillion; European equities are not far behind China's projected gains in 2025; this will be the Year of International - focusing on China and the EU; the next equity strategy is the "weak US dollar" trade... consider investing in the oversold US semiconductor sector, and look to buy into underperforming small-cap stocks in India, down 20% since the peak in September 2024 (see Chart 4).

Weekly Flows:

- $53.1bn to cash, $22.9bn to stocks, $12.0bn to bonds, $1.0bn to gold, $0.8bn out of crypto.

Key Highlights:

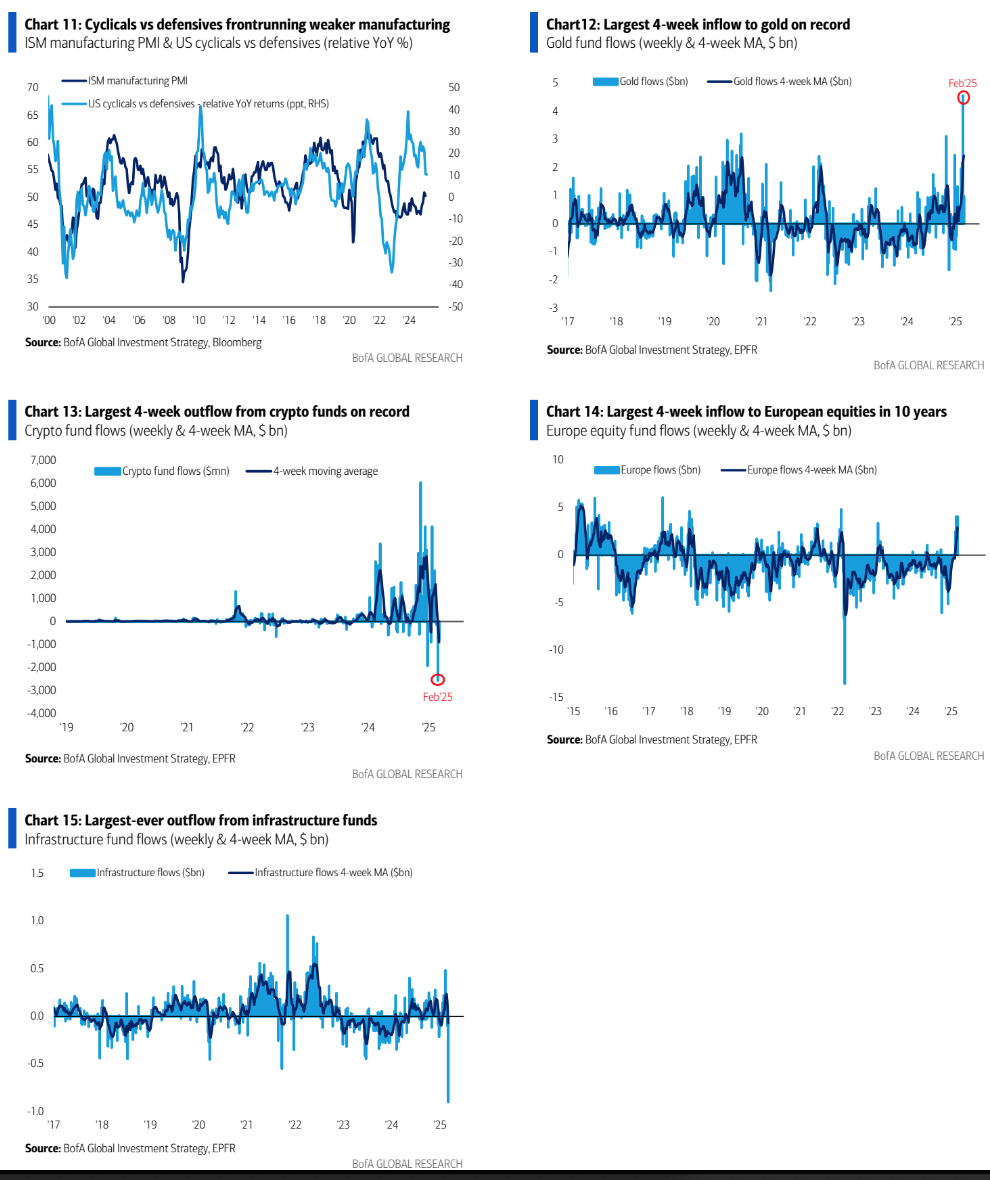

- Gold: $1.0bn inflow, largest 4-week inflow on record ($9.9bn).

- Crypto: $2.1bn outflow, largest 4-week outflow on record ($3.6bn).

- Treasuries: Biggest outflow in 11 weeks ($1.2bn).

- TIPS: 8-week inflow streak, longest since Dec '21 ($0.4bn last week).

- Europe: $4.1bn inflow, largest since Feb '22; 4-week inflow at $12.0bn, highest since Aug '15.

- EM: $2.4bn inflow, largest in 3 months.

- Tech: First inflow in 5 weeks ($2.6bn).

- Infrastructure: Record outflow ($0.9bn).

BofA Private Clients:

- $3.9tn AUM: 62.7% stocks, 19.2% bonds, 11.2% cash.

- Largest 3-week stock selling since Nov '22; strong T-bill inflows since Mar '23.

- Buying IG bonds, bank loans, TIPS ETFs; selling energy, materials, staples ETFs.

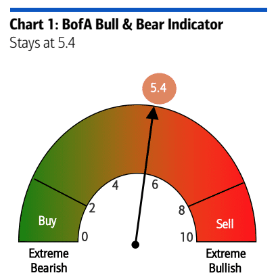

BofA Bull & Bear Indicator: Unchanged at 5.4. Improved global stock breadth and EM/HY inflows offset by hedge fund downside protection for S&P 500.

Year of Bonds:

- US Treasuries: Buyers of 30-year Treasuries. Recession risks rise amid weak payrolls, higher savings rates, and fading fiscal bailouts. S&P 500 outlook cautious; <4% Treasury yields possible.

- UK/EU Bonds: Sell. German yields >3% and UK yields >5.5% on rearmament spending; German bunds may surpass US Treasuries by year-end. UK gilt crisis likely due to deficits.

- Japan Bonds: Sell. JGB 30-year yield at 17-year high (2.5%), BoJ lagging behind tightening needs. Nikkei underperformance expected until BoJ policy shifts.

Year of International:

- Long International vs. US stocks amid "US exceptionalism" fading. Geopolitical, policy, and economic catalysts favor Chinese & European equities (e.g., China H-shares +23%, German DAX +18%, Euro Stoxx +13% YTD).

- Despite this, investors remain underweight Europe vs. US tech. For every $100 outflow from European equities since Feb '22 ($255bn total), only $4 inflows in the past 4 weeks. Meanwhile, tech funds saw $99bn inflows since Nov '22, with just $6 outflows in the past 5 weeks.

- Recommendation: a) Buy oversold US semis (equal-weighted ESOX down 73% since May '23), b) Focus on US equities benefiting from a weak USD in 2025, c) Explore lagging International markets, particularly India (small caps -21% from Sep '24 peak).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!