Institutional Insights: BCA Research - GBPUSD To 1.60 & BTCUSD 200k+

Pound to Reach $1.60

Regardless of how the Israel-Iran conflict unfolds, a tactically oversold dollar may experience a bounce in the near term. However, we expect the diminishing sense of 'exceptionalism' for both US bonds and stocks to exert downward pressure on the greenback in the longer term. This raises the question of which currency is likely to emerge as a significant winner. If it must be another fiat currency, the pound sterling stands out as a strong candidate.

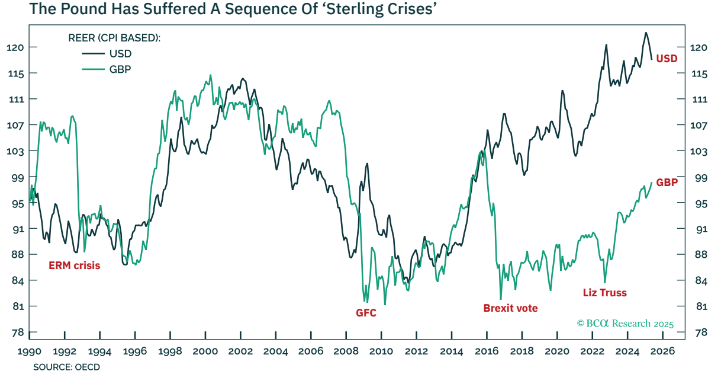

Remarkably, over the past 40 years, the real effective exchange rates (REERs) of the pound sterling and the US dollar have followed the same cycle. Given this shared overarching cycle for both currencies, the pound/dollar real exchange rate is largely influenced by multiple ‘sterling crises’ that have occurred during those four decades.

The most significant of these crises was the global financial crisis (GFC). Although the GFC originated in America, it severely impacted the pound due to the UK economy's heavy reliance on financial services and foreign financial inflows. However, aside from the GFC, the other sterling crises were largely self-inflicted: the European Exchange Rate Mechanism (ERM) crisis of 1992, the Brexit vote of 2016, and the Liz Truss mini-budget debacle of 2022.

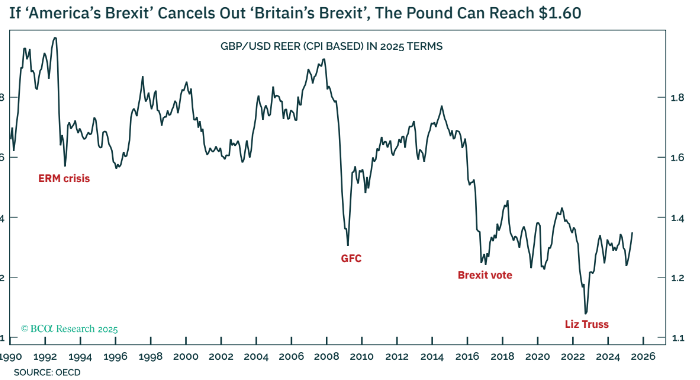

Our analysis indicates that the damage to the pound from the Liz Truss situation has been reversed, but the effects of Brexit continue to persist. Without Brexit, the pound would likely be trading in the $1.50 to $1.70 range. The Brexit vote in 2016 and the subsequent rise in protectionism led to a surge in UK inflation—both actual and expected—compared to other major economies, and this inflationary pressure has remained persistent. Additionally, Brexit's economic disengagement caused UK assets to lose their privileged status as a safe haven, resulting in a structural dislocation of the pound.

Now, however, the situation has shifted. Trump's trade war and the disengagement from global trade can be seen as "America's Brexit." This shift suggests that the US may soon experience higher inflation rates, similar to what the UK faced post-Brexit, while US assets may also lose their privileged haven status. Consequently, this could lead to a structural dislocation, or "flattion," in the dollar. Given that an exchange rate is a relative price, "America's Brexit" will effectively counterbalance "Britain's Brexit," bringing the pound/dollar exchange rate back to its pre-Brexit range. Therefore, we are establishing a new structural position: we are going long on pound/dollar, fully anticipating that the pound will reach $1.60 within the next couple of years.

Bitcoin to Reach $200,000+

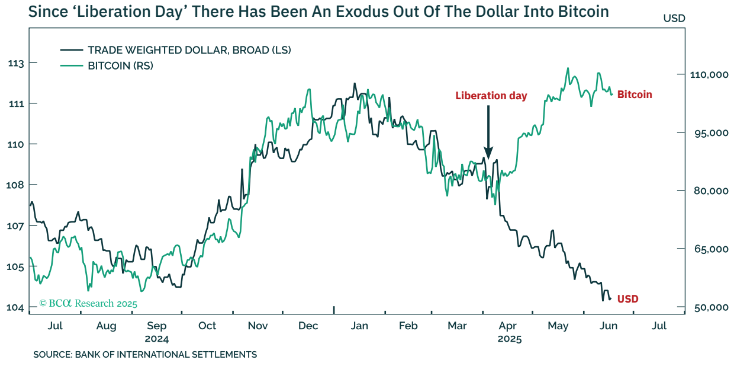

If investors switching out of US dollars do not need to transition into another fiat currency, then the strongest candidate for a multi-year horizon is bitcoin. Since "Liberation Day," the most significant beneficiary of the dollar exodus has been the world’s leading cryptocurrency.

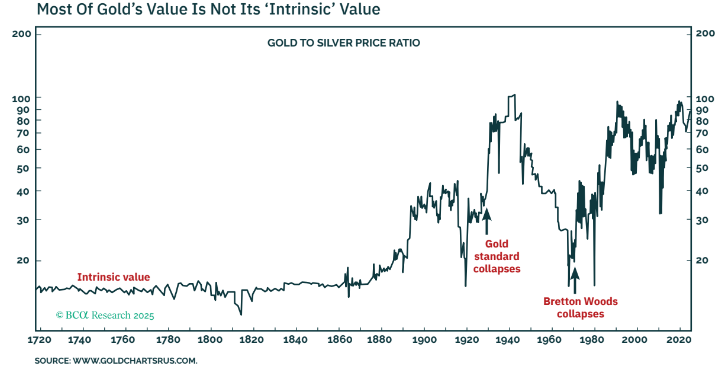

Many investors I speak with remain uneasy about owning bitcoin, expressing concerns that it lacks "intrinsic" value. However, these same investors often have no reservations about holding gold, which is illogical considering that gold also has very little intrinsic value. If gold were valued solely based on its intrinsic worth as a precious metal, it would be trading closer to $340 per ounce rather than its current price of around $3,400 per ounce.

The value of both gold and bitcoin derives from their so-called "network effects." As I previously explained in "Bitcoin Closes In On $100,000, But The Ultimate Destination Is $200,000+ | BCA Research," the network effect stems from the collective belief that gold and bitcoin are the non-confiscatable assets to own in a fiat monetary system. A certain proportion of total wealth must be held in these non-confiscatable assets as a safeguard against hyperinflation, banking system failures, or government default and expropriation.

The Value Dynamics of Gold and Bitcoin

The nominal dollar value of the gold and bitcoin networks is determined by three key factors:

1. Global wealth in nominal dollars.

2. The proportion of this global wealth held in the non-confiscatable asset class.

3. The distribution of this non-confiscatable asset class between gold and bitcoin.

Since "Liberation Day," evidence suggests that investors have lost faith in the dollar as a safe haven asset. They are moving towards gold and the Swiss franc, but the shift towards bitcoin has been even more pronounced. Consequently, all three components contributing to bitcoin’s value are expected to trend significantly higher in the coming months and years.

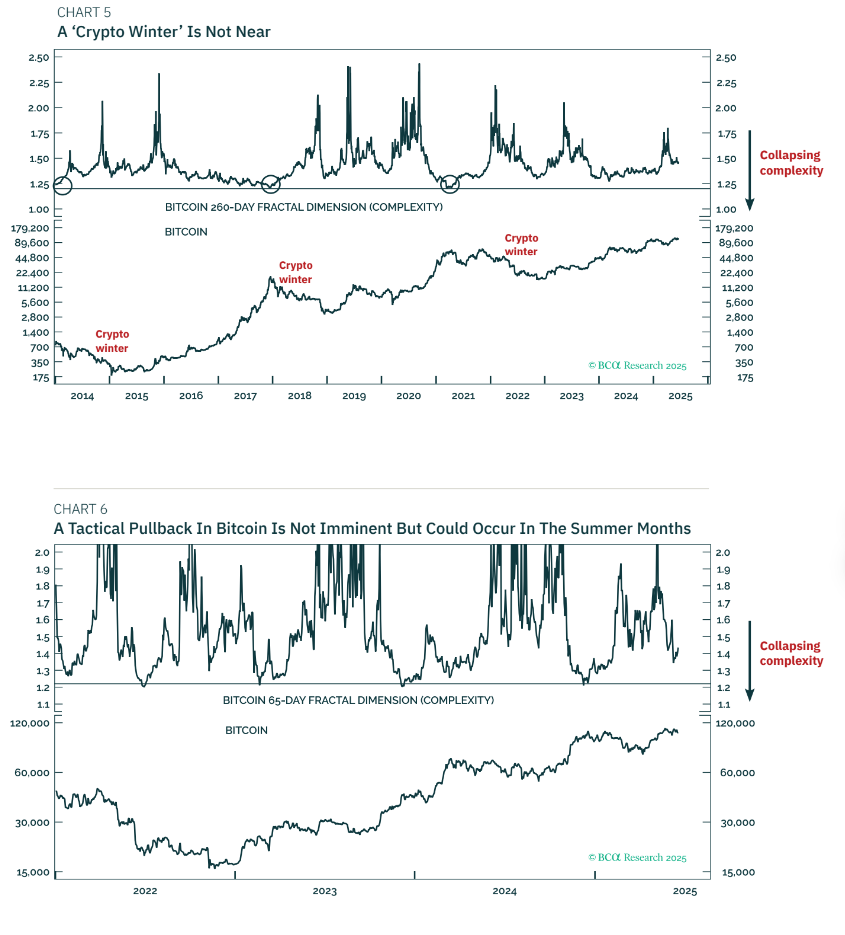

However, bitcoin is notorious for experiencing painful structural drawdowns, commonly referred to as "crypto winters." Our proprietary analysis of long-term price trend complexity, which has accurately identified these crypto winters, indicates that the next one is still some time away.

For those seeking a good entry point, the question arises: is a meaningful pullback on the horizon? Our analysis of short-term price complexity suggests that a pullback is not imminent. However, if the rally's short-term complexity continues to decline, there could be a pullback to around $80,000 during the summer months.

Bitcoin's Future Outlook

Regardless of whether a pullback occurs or not, I fully expect bitcoin to reach $200,000+ within the next couple of years. It continues to be one of our high-conviction structural long positions. The underlying fundamentals and the increasing shift of investors towards non-confiscatable assets like bitcoin support this optimistic outlook.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!