Institutional Insghts: JPMorgan Trading US CPI

.jpeg)

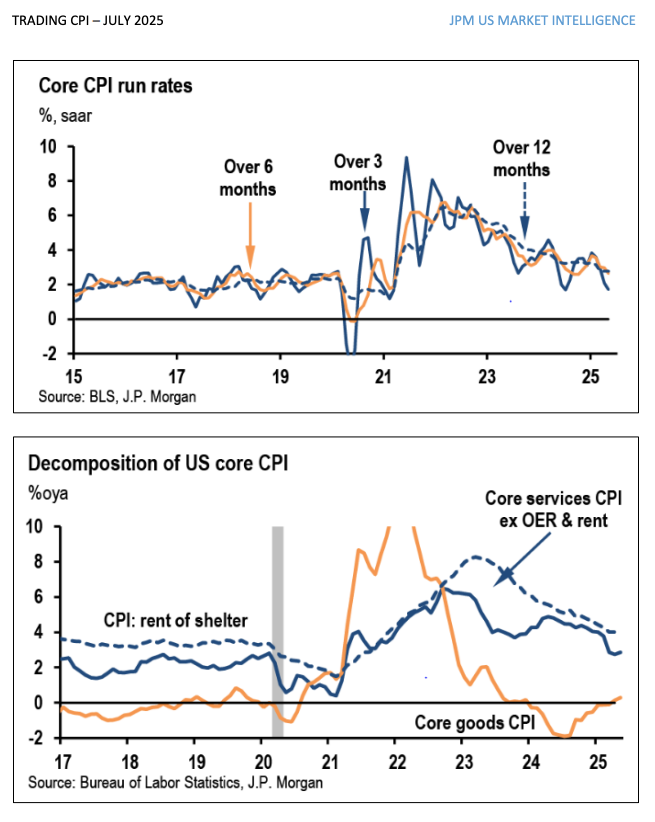

For the CPI, JPMorgan's Feroli anticipates a Headline MoM increase of +0.28% and a Core MoM increase of +0.29%, both aligning with market expectations. This translates to a 2.7% YoY increase for Headline (up from 2.4% last month) and 3.0% YoY for Core, the highest since February 2025. The scenario analysis presented is NOT FROM JPM RESEARCH, but rather a perspective from JPM US Market Intelligence. This month’s focus is on Core MoM outcomes and SPX movements over 1-day.

- If Core MoM exceeds 0.37%, SPX is expected to decline by 1%-2%.

- If Core MoM is between 0.32% - 0.37%, SPX might drop 0.50%-1.25%.

- If Core MoM lies between 0.28% - 0.32%, SPX could see a gain of 0.25%-0.75%.

- If Core MoM is between 0.23% - 0.28%, SPX may experience gains of 0.75%-1.25%.

- If Core MoM falls below 0.23%, SPX could increase by 1.5%-2%.

What are the options pricing? Options expiring on Tuesday are anticipating a move of approximately 85bp based on the closing prices from Friday.

US MARKET INTEL – The risk/reward outlook for this print favors an upward trend as the market braces for the potential peak of tariff-induced inflation. Following recession warnings for 2023 and 2024, there is skepticism in the market towards predictions of an inflation surge. While we concur with our economists about the likelihood of a price increase, it seems we are at least a month away from a data release that could genuinely alarm the market. Assuming the data aligns with expectations, the focus will shift back to August 1 trade deadlines, the August 1 NFP, and the August 12 CPI reports. Additionally, this data is unlikely to significantly alter expectations regarding Fed rate cuts. However, the Fed's Goolsbee suggested that the inflation outlook has become more complex due to new tariffs, potentially delaying any Fed decisions. Since much of the anticipated inflation surge relates to tariffs, it is beneficial to review Abiel Reinhart’s recent analysis on effective tariff rates, which reveals that the effective tariff rate stood at 12.3% with Canada and Mexico’s effective rates surprisingly lower.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!