USD: just tarrific

In recent weeks, the return of President Donald Trump to the global stage has taken center stage and influenced market dynamics significantly. Foreign exchange investors, in particular, are closely watching the developments around trade tariffs, as they have emerged as a primary tool in US foreign policy.

President Trump's recent threats of imposing substantial tariffs, such as 25% on Canada and Mexico and 10% on China, have escalated concerns among investors. While there is a possibility of a last-minute agreement to avert tariffs, the looming prospect of a tariff confrontation or even a full-blown trade war remains a concern for FX traders.

Amidst these uncertainties, the US dollar, noted for its high yields and safe-haven status, continues to assert dominance in FX markets. However, there are indications that the economic impact of potential US tariffs may be limited and short-lived, which could diminish the USD's strength and revive risk appetite in the market.

Analysts point out that the current strength of the USD may be overstretched and possibly overvalued, suggesting a potential correction in the near future. Despite expectations of President Trump's inclination towards gradual and less disruptive tariff measures to address the trade deficit and enhance fiscal revenues, factors such as persistent inflation, high fiscal deficit, and borrowing costs in the US could constrain any significant USD appreciation.

The upcoming focus for FX market participants includes key economic data releases like the US core PCE data, Non-farm payrolls, and ISM reports for January. Investors will closely analyze these figures along with any remarks from the Federal Reserve for insights into future monetary policy decisions, considering the influence of President Trump's trade policies on the broader economic landscape.

Additionally, attention will turn towards the February BoE policy meeting, with expectations leaning towards a potential rate cut by the Bank of England. The soft UK inflation and growth numbers have led to increased speculations of easing measures, which have already been factored into the GBP's valuation. This could imply a higher threshold for any unexpected dovish signals from the MPC in the upcoming meeting.

We have revised our outlook for the EUR/USD following the US election, but we believe that many negative factors are already reflected in the price, and the pair appears to be oversold and undervalued. Our economists do not foresee a recession in the Eurozone and anticipate a terminal ECB rate of 2.25%, which is significantly higher than current market expectations for European rates. Additionally, while recent political events in France and Germany have unsettled EUR investors, our rate strategists are not positioned for a repeat of the sovereign debt crisis from a decade ago and believe that many negatives are already accounted for. Moreover, we think that a potential reduction or withdrawal of US support for Ukraine under President Donald Trump could ultimately lead to the end of the war by 2025. This development could ease geopolitical risks in Europe, potentially enhancing domestic demand in the Eurozone. Furthermore, the conclusion of the Ukraine conflict could trigger a reconstruction boom in the country, serving as a tailwind for recovery in the Eurozone.

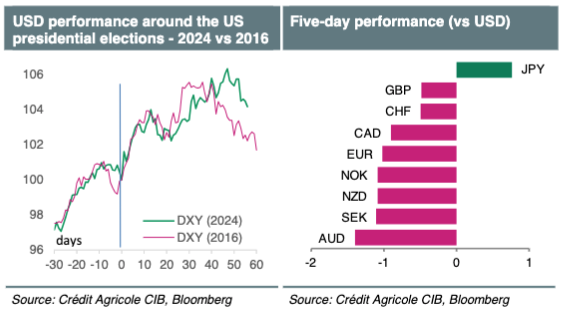

The USD strengthened following Donald Trump’s victory in the US presidential elections and the ‘red wave’ in Congress. The second Trump administration is expected to introduce additional fiscal stimulus and more aggressive trade policies, which could improve the US growth outlook compared to its trading partners and make US inflation more persistent. We also anticipate that the Trump policy mix could shorten the Fed's easing cycle, but we believe this has already been factored into the rates markets, enhancing the USD's appeal across the board. More generally, we think that many positive factors are already priced into the USD, and we expect it to remain near recent highs without surpassing them on a sustained basis through 2025. While we cannot rule out further USD gains due to US tariffs, the timing and intensity of these measures remain uncertain. In the long run, we also believe that a return to President Trump’s ‘Weak USD Doctrine’ and concerns about the Fed’s independence could put downward pressure on the USD as we approach 2026.

Increasing struggles in the Eurozone have driven safe-haven demand for the CHF, which may remain sought after until uncertainties are largely resolved. Assuming no lingering shocks, the CHF could revert to being a preferred funding currency due to the potential return of near-zero interest rates and its high valuation, while the SNB will closely monitor FX developments and Swiss disinflation.

Among the G10 currencies, the JPY was one of the least affected by tariffs during Trump’s first term. We expect the US-Japan rate spread to continue to narrow as the Fed cuts rates and the BoJ raises them further. This compression of the US-Japan spread will diminish the carry appeal of holding long positions in USD/JPY, while the exchange rate’s volatility is likely to remain high due to uncertainties surrounding the Fed and BoJ rate paths, as well as Trump’s policy agenda, particularly regarding trade. Japan’s Ministry of Finance will also be prepared to intervene to support the JPY.

The recent decline of the GBP appears to reflect renewed concerns about the UK’s economic outlook, which, combined with rising government borrowing costs, could lead the Labour government to exceed its current fiscal deficit target, necessitating new austerity measures as early as March. However, we would not go so far as to say that FX investors no longer see the GBP as a higher-yielding, safe-haven alternative to the EUR. We continue to expect that the UK’s political stability and relative economic performance compared to the Eurozone will sustain market expectations that the BoE will require a less aggressive easing cycle than the ECB to support growth. This outlook continues to make us optimistic about the GBP versus the EUR for 2025 and 2026. GBP/USD may continue to trade near its lows following the US election, but we anticipate a stronger recovery for this pair compared to EUR/USD in 2026.

Trump’s tariff threats have pushed USD/CAD to new highs above 1.45, but regardless of the new US administration's policy stance, risks to the CAD appear to be skewed to the downside in early 2025 due to a potentially widening gap between the BoC and the Fed. However, the prospects of Canada outperforming the US in terms of growth could facilitate a gradual recovery for the CAD.

AUD/USD was weaker during Trump’s first term due to his tariffs on China and a declining Australian-US rate differential. We expect Trump to be open to negotiations regarding his China tariffs, which are likely to be less than the 60% he promised during his campaign, thereby supporting AUD/USD. Additionally, the RBA is expected to remain less dovish than many other G10 central banks, further supporting AUD/USD.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.png)