USDJPY Rally Continues

USDJPY broke out to new highs for the year yesterday as the rally in the pair off the July lows continues to gather pace. USD has seen strong demand over recent weeks against a backdrop of shifting Fed expectations. While the market had initially scaled back tightening expectations for the remainder of the year, expectations have become more divided recently in light of the resilience of the US economy (as shown by continued data strength) and hawkish Fed commentary.

Hawkish FOMC Minutes

This week, the release of the FOMC meeting minutes further endorsed those remaining hawkish risks. The minute showed that most members felt that inflationary risks were still skewed to the upside, meaning that further tightening would likely be necessary. Currently market pricing shows around a 40% chance of a hike at the November/December meetings. However, if there is any stickiness or fresh uptick in inflation in coming months, this pricing could easily spike, leading USD higher near-term.

JPY Under Pressure

JPY remains weak here, despite the broader risk off tone to markets. Traders appear to be caught in a game of cat and mouse with the BOJ given that the bank continues to stick to its easing stance, despite ongoing weakening of JPY. Notably, the pair is now sitting above levels at which we saw intervention last year, raising near-term risks of a reversal lower.

Technical Views

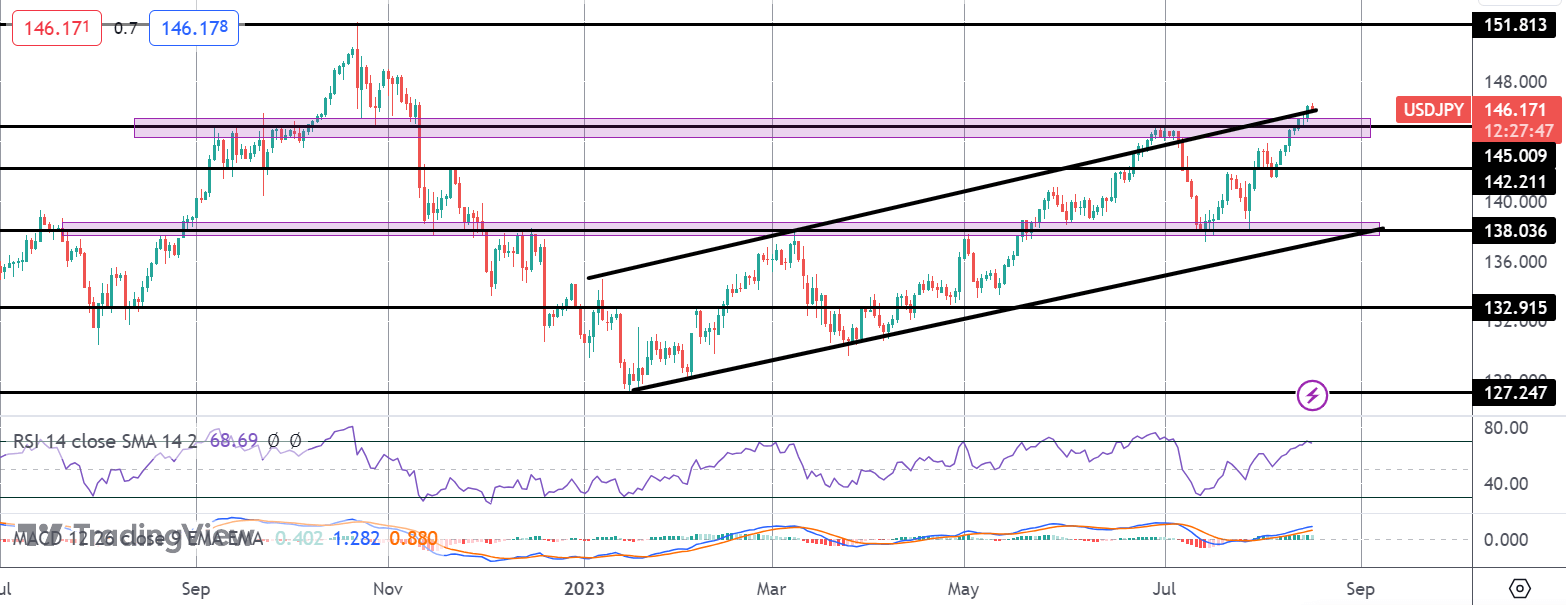

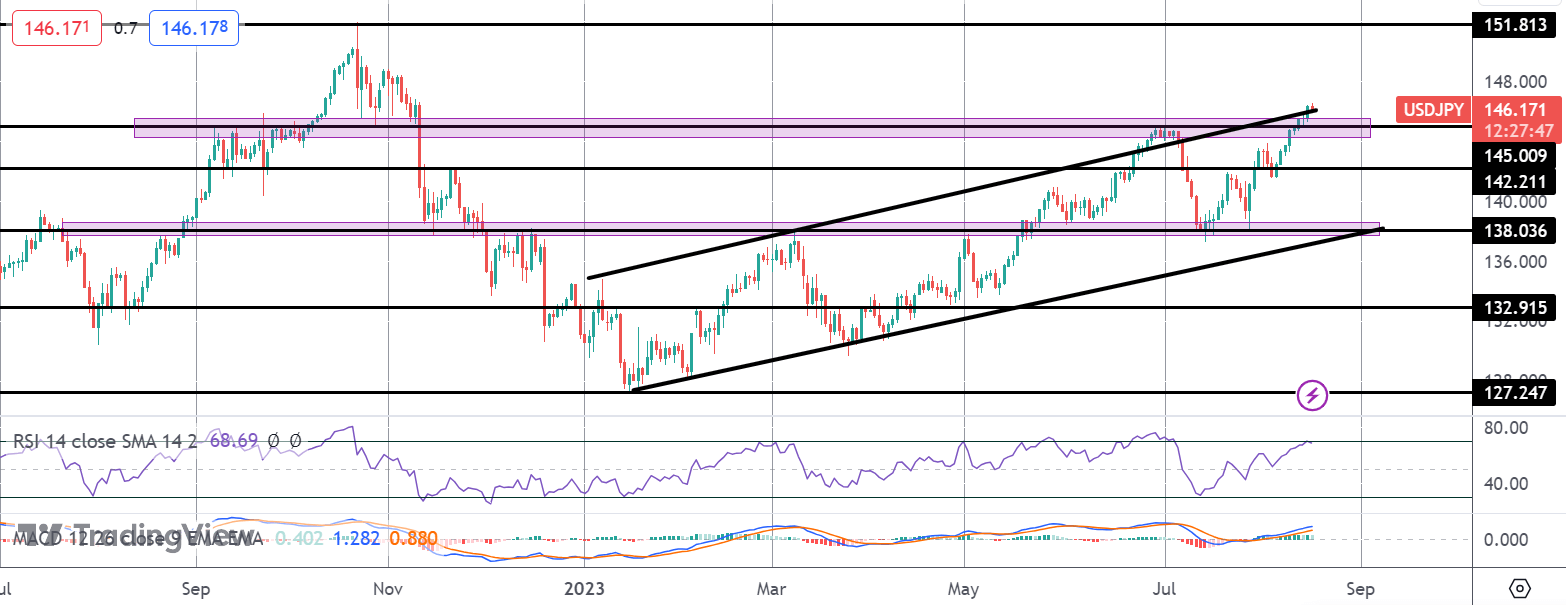

USDJPY

The rally in USDJPY has seen the pair breaking out to fresh highs for the year, moving above the 145 level. Price is currently stalled into a test of the bull channel top though, with momentum studies bullish, focus is on a continued push higher while price holds above the 142.21 support. Below there, 138 and the bull channel lows are the next support area to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.