Goldman Warns Of Huge Nvidia Volatility Today

-1724839895.jpg)

Nvidia on Watch

Tech stocks are on watch today as traders brace for the latest earnings from AI chipmaker Nvidia. Fears over the health of the US economy as well as disappointing results from other AI companies put a temporary end to the bumper rally which had been in place across the first half of the year. Ballooning AI optimism over the first half of the year saw Nvidia’s share price soar by almost 200% as traders favoured the stock, given its leading role in supplying the AI industry with software chips. However, that optimism proved over-done into the summer as traders were left underwhelmed by some other big names in the AI space. However, despite the subsequent pull-back as traders mulled the risks around AI investments, the stock has since bounced back and is almost back at highs ahead of today’s results.

Expectations For Today

On the numbers front, the market is looking for EPS of $.645 on revenues of $28.737 billion. If seen, this will mark a firm jump from the prior quarter and should give the rally fresh legs. Indeed, Goldman Sachs is warning today of the potential for a violent upswing in the stock if results come in above expectations. Given the bullish sentiment gripping the stock currently, Goldman points to positioning in the options market as creating ripe conditions for a strong move higher if data surprises today.

Technical Views

Nvidia

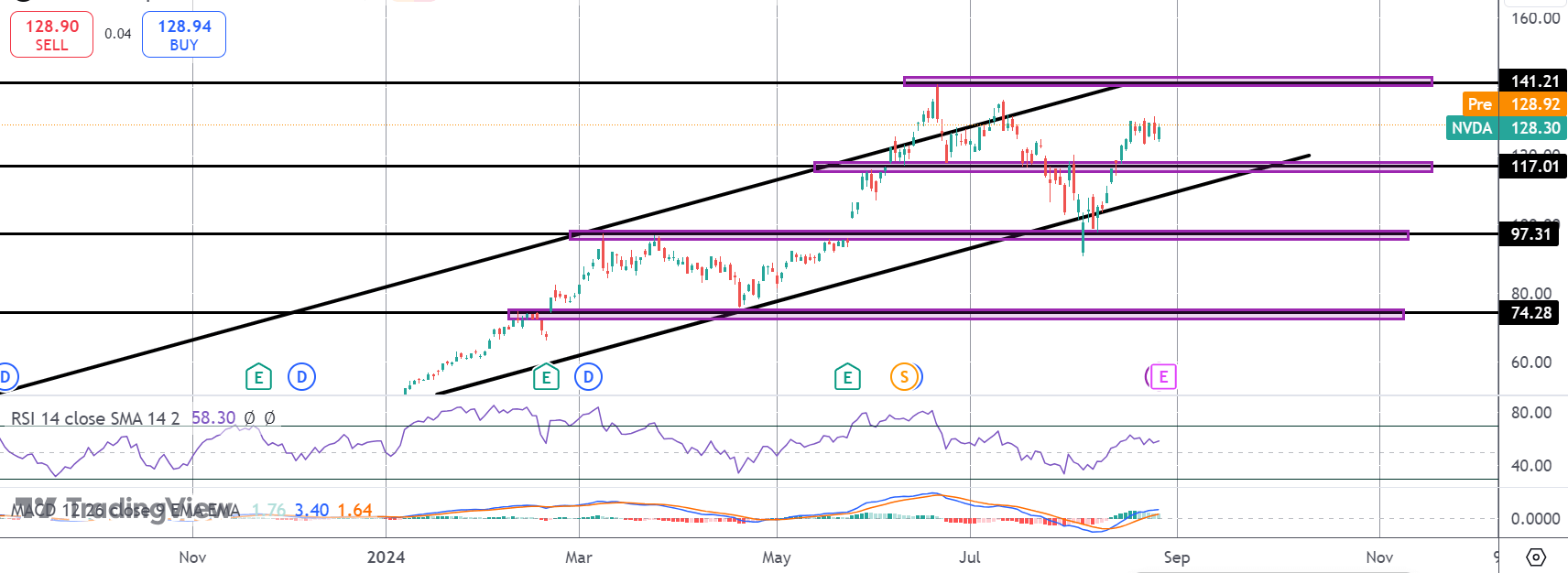

The rally off the 97.31 level has seen the market breaking back above the 117.01 level, trading back up into the middle of the bull channel. While above 117.01 and with momentum studies bullish, the focus is on a continuation higher and a test of the 141.21 highs next, with sights set on a fresh break higher.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.