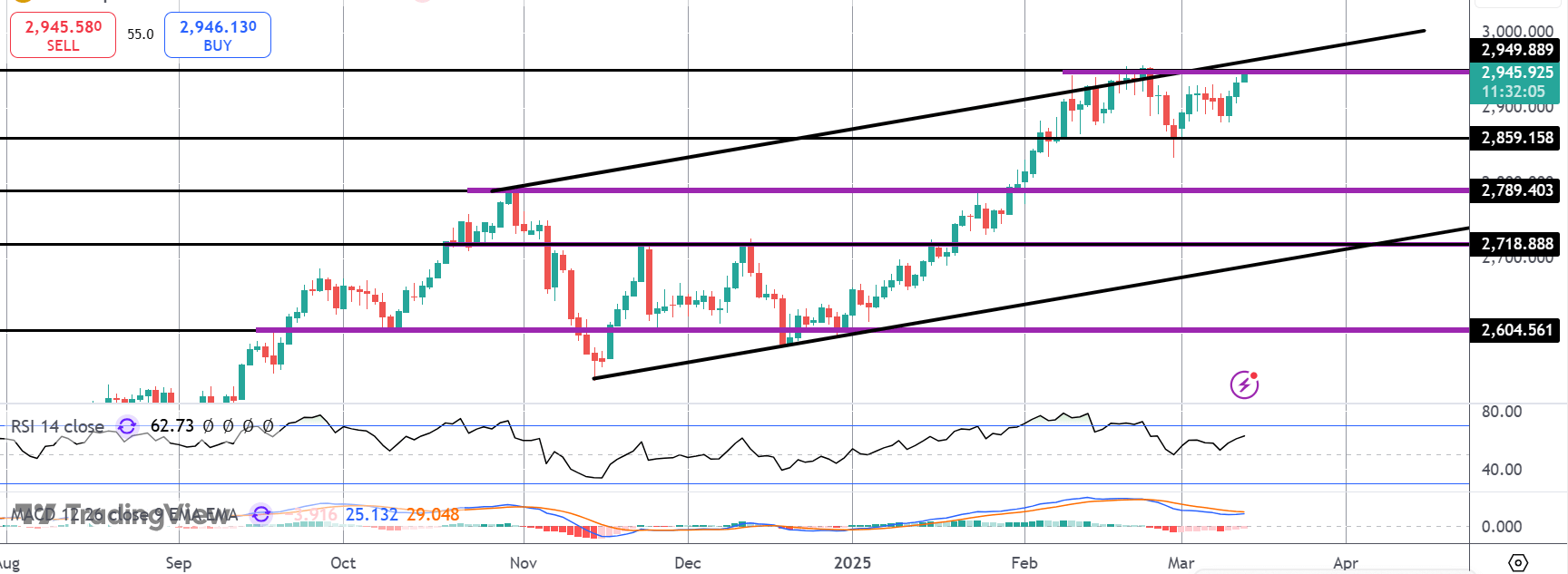

Gold Testing YTD Highs

Gold Testing Highs

Gold prices remain well bid through the back end of the week with the futures market once again testing the 2,949.88 level. The push higher comes despite the USD sell-off stalling in recent days. Yesterday, a weaker set of US inflation figures should have fuelled a fresh push lower in the Dollar. Headline annualised CPI was seen falling to 2.8% from 3% prior, below the 2.9% the market was looking for. Both headline and core monthly readings were also seen falling back, printing 0.2% from 0.5% and 0.4% respectively.

Tariff Fears

However, concerns over the impact of Trump’s tariff actions stole the limelight yesterday and thwarted any fresh USD selling. Indeed, despite the downturn in inflation, near-term Fed easing expectations were seen weakening with pricing for a cut in May falling lower, putting the focus now on a June cut. The reasoning here is that inflationary pressures are expected to return as the impact of current tariffs starts to materialise in coming months. Additionally, the risk of further tariffs presents a greater risk over the remainder of the year meaning that traders are reluctant to buy into the deflationary story immediately. Nevertheless, concerns over the impact of tariffs is fuelling fresh safe-haven demand for gold, with this dynamic expected to continue near-term at least.

PPI & Jobless Claims Next

Looking ahead, focus today will be on the latest set of PPI figures, also expected to cool, alongside weekly jobless claims. A soft showing in PPI today along with an uptick in jobless claims could swing the focus back to recessionary fears, curtailing the upside in USD. On the back of heavy selling over recent weeks, sentiment remains skewed towards further losses in USD which should keep gold prices supported.

Technical Views

Gold

The correction lower in gold has found strong support into the 2,859.15 level with price since turning higher and now once again testing the 2,948.88 level and bull channel highs. With momentum studies pushing higher, focus is on a fresh breakout here towards the $3k level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.