Gold Higher on Traders' Dovish Fed View

Gold Pushing Up Again

Gold prices are turning higher today but the market remains well within the range which has framed price action over the last four months. Following a strong rally over Q1 gold prices have been stuck within a roughly 10% range down from those YTD highs printed in April. A mixture of uncertainty around Trump’s trade agenda, fluctuating geopolitical tensions and a changeable Fed outlook have combined to keep price hemmed in recently.

US Inflation & The Fed

This week, gold prices are turning higher again on the back of yesterday’s weaker-than-forecast US inflation data. Annualised headline CPI was seen holding at 2.7% last month, below the 2.8% lift the market was looking for. Against this backdrop, expectations of a Fed rate-cut next month have jumped to almost 100% with traders now pricing a more than 60% chance of a follow up cut in October. If this dovish Fed narrative develops further, particularly if fuelled by a decline in inflation form current levels, this could pave the way for a breakout move in gold, helped by a heavy decline in USD.

Russia Peace talks

However, an upside reaction is not necessarily straightforward given the upcoming meetings between Trump and Putin and then Zelensky. If traders get a sense that a peace deal is coming, this should drive risk assets sharply higher, weighing on gold via reduced safe-haven demand. If talks stumble, however. A weaker USD and heightened safe-haven mean for gold could e the perfect storm for a fresh bull run over Q3.

Technical Views

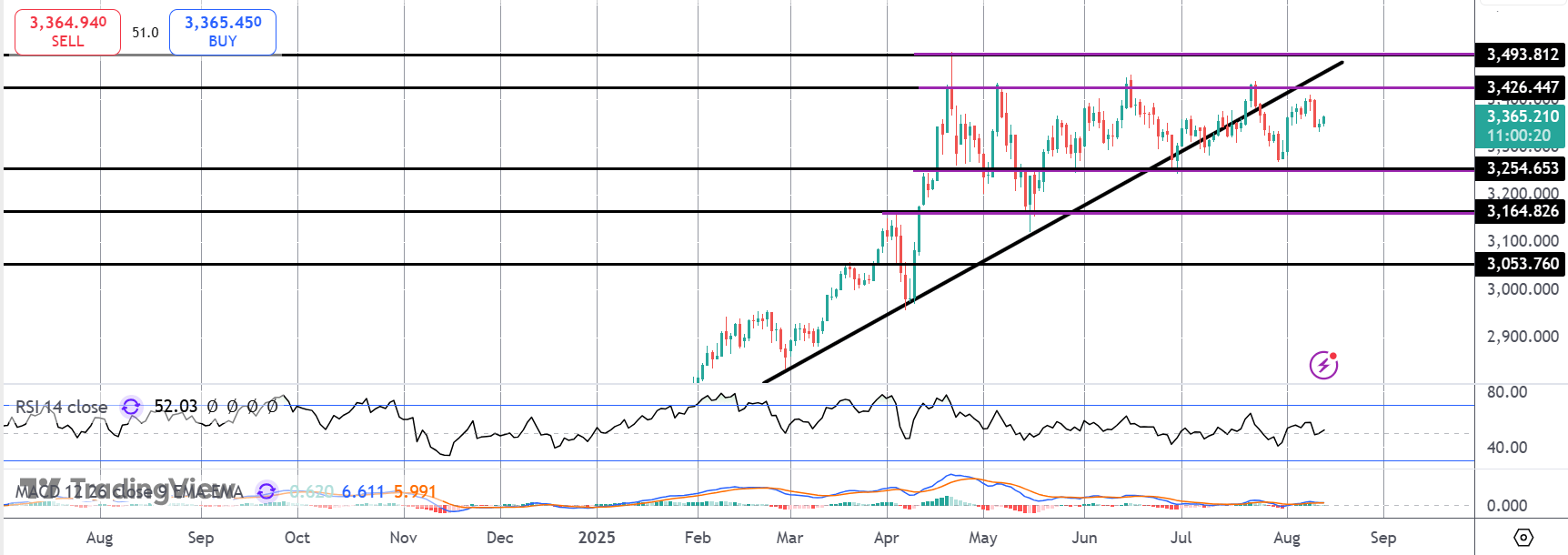

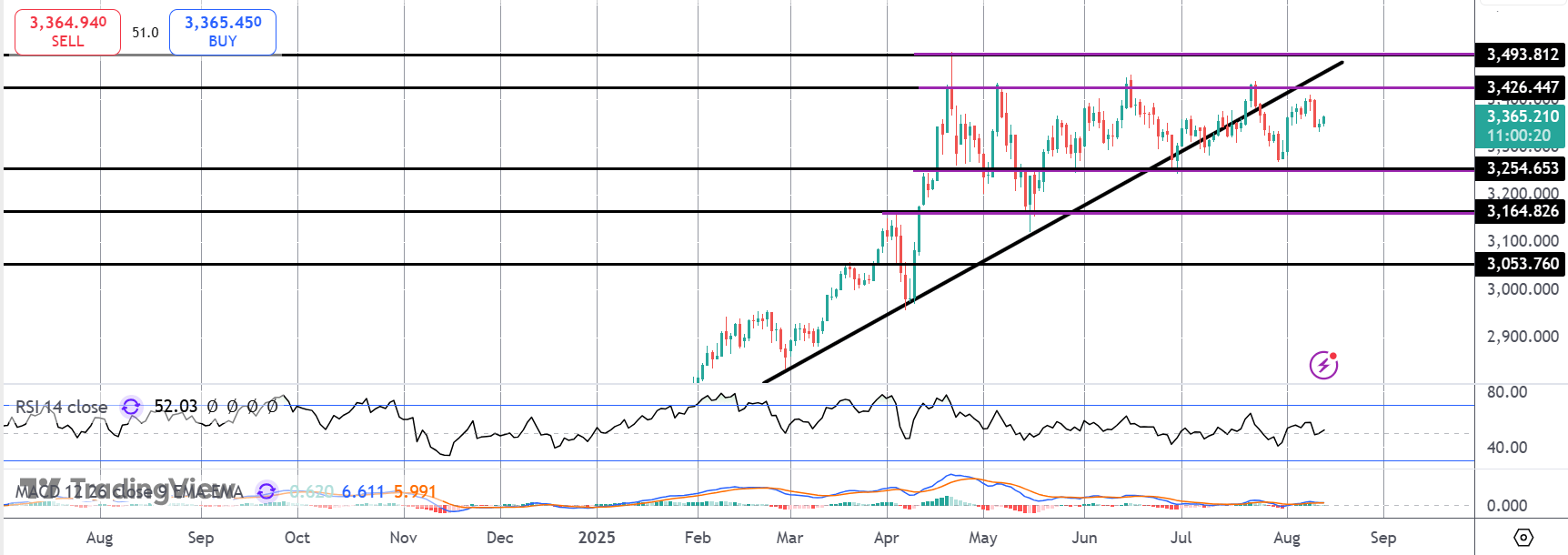

Gold

Price have rebounded firmly off the 3,254.65 level and are now once again putting pressure on the 3,426.44 level. With momentum studies pushing higher, focus is on a fresh upside break with 3,493.81 the next level to target ahead of new highs. To the downside, 3,254.65 remains the key support and pivot level to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.