GBPUSD Rallying Ahead of Fed & BOE

GBP Rallying on Monday

GBPUSD is rallying on Monday as traders look ahead to both the Fed and BOE meetings this week. Given the broad expectation that the Fed will lean on the dovish side while the BOE might strike a more neutral tone, there is room for a fresh rally to develop here with the potential for a breakout to new YTD highs if we see strong divergence between the two central banks.

Fed Expectations

The FOMC on Wednesday will be a pivotal event for market as we approach the start of Q4. Recent weakness in US labour market data has fuelled a strong dovish shift in market expectations with traders now looking for three .25% cuts this year. Should the Fed cut rates on Wednesday while signalling that further easing looks likely, in light of the slump in jobs growth, this should see USD come under fresh selling pressure. In this scenario, GBPUSD should remain bid into Thursday’s BOE meeting.

BOE Expectations

For the BOE, no rate change is expected this week and so focus will purely be on the bank’s guidance. Given that inflation remains well above the bank’s target, and is continuing to rise, the BOE is expected to warn of its readiness to hike rates if needed. This should set a clear contrast into tone between itself and the Fed, creating tradable divergence in GBPUSD, favouring a retest of YTD highs near-term.

Technical Views

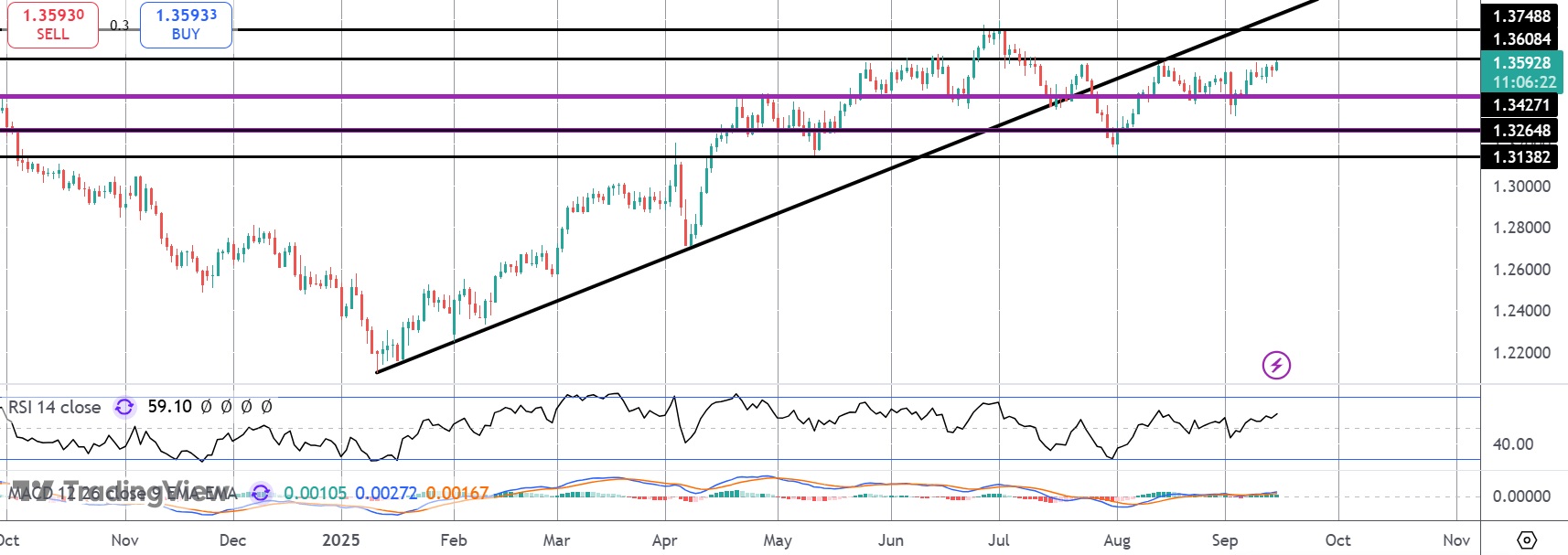

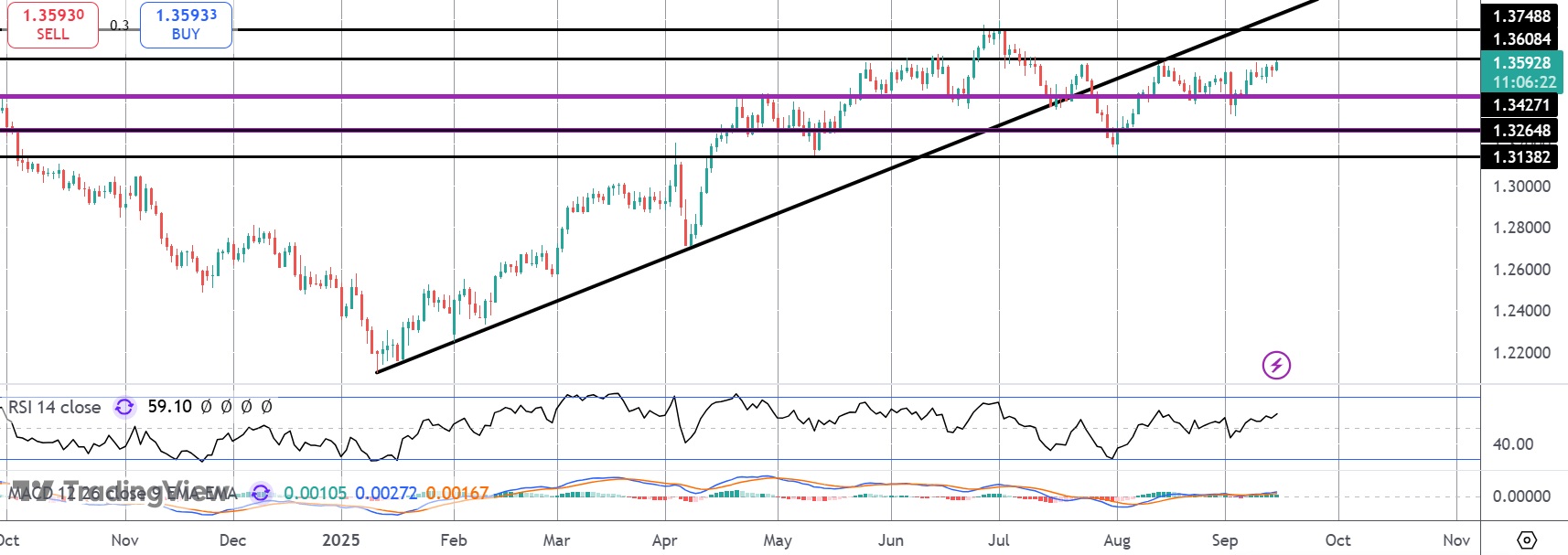

GBPUSD

Following the recovery above the 1.3427 level, price is now testing the 1.3608 highs and with momentum studies bullish, focus is on a continuation higher towards 1.3748 next and a retest of the broken bull trend line. To the downside, 1.3427 is the key pivot to watch with the bull outlook intact while price holds above there.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.