FTSE Sinking Following Hawkish BOE Inflation Outlook

Hawkish BOE Forecasts

The FTSE is moving sharply lower through early European trading on Friday, despite the Bank of England cutting rates by a further .25% yesterday. While the BOE cut rates from 5% to 4.75%, as expected, a hawkish revision to its inflation and growth forecasts saw GBP rallying on the back of the meeting, leaning on UK asset prices. Going into the meeting, traders were wary of the impact the recent UK budget would have on the bank’s outlook. The BOE noted that it expects the budget to add 0.5% to peak inflation and delay a return to target by one year. Additionally, growth is expected to rise by 0.75% this year due to the budget. With these revisions in mind, traders have scaled back expectations of a further BOE rate cut in December, pushing stocks lower for now.

UK Earnings Shocker

News on the UK earnings front today is also having a negative impact on the FTSE. A sharp drop in UK housebuilder Vistry is fuelling a wave of bearish sentiment in UK assets today. The group’s share price has dropped more than 15%, wiping around half a billion pounds off its value after the developer issued a fresh profit warning. The group declared that it now expects profits over the next three years to be £50 million lower than signalled in last month’s profit warning. Since that initial warning in October, shares are down 42% for Vistry.

Technical Views

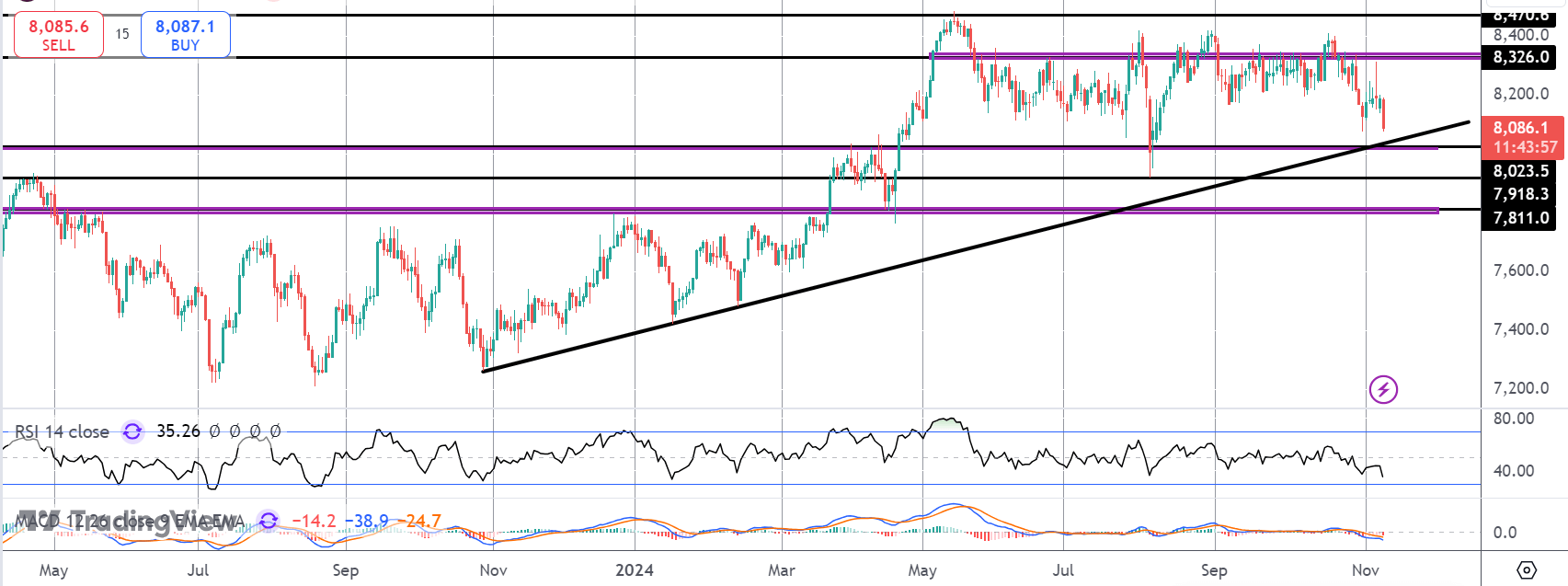

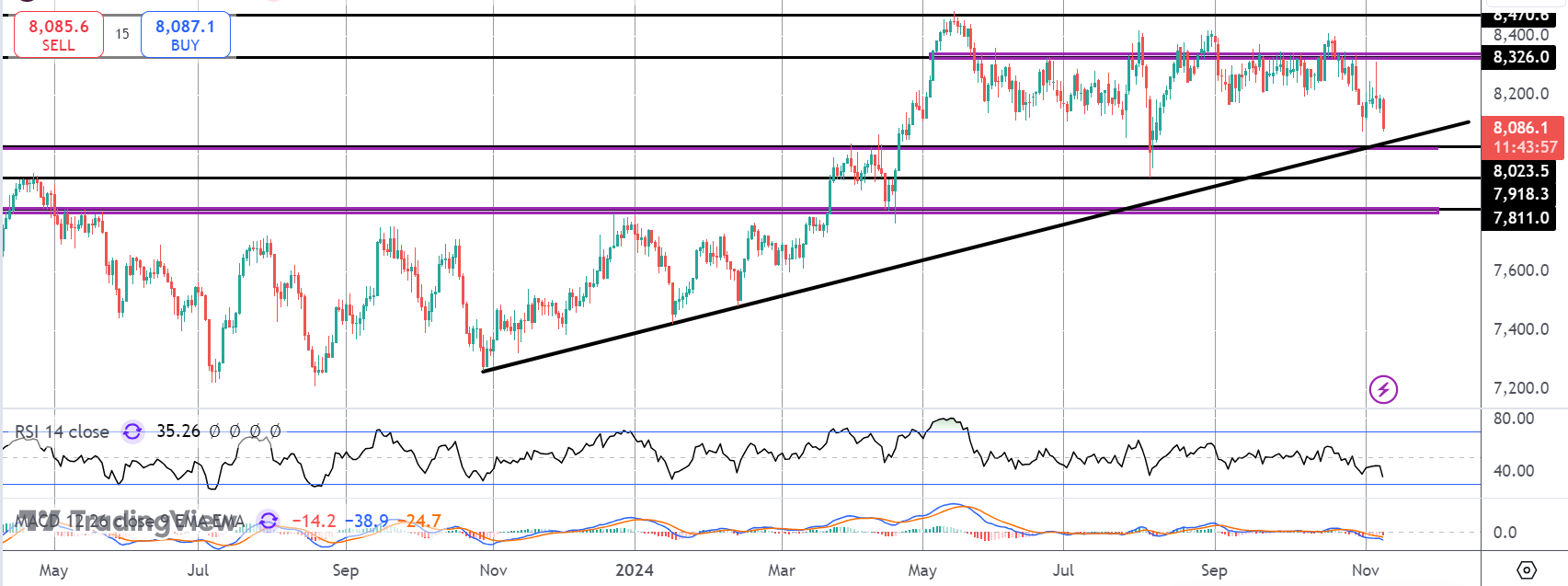

FTSE

The failure at the 8,326 level has seen the FTSE turning sharply lower. Price is now fast approaching a test of the bull trend line off YTD lows and the 8.023 level support. This is a key support area for the market with a break lower opening the way for a test of 7,918 and 7,811 thereafter.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.