FTSE Rallying As Risk Mood Recovers

Stock Sentiment Improves

Global stock markets are continuing to recover ahead of the weekend as traders breathe a sigh of relief following better-than-forecast US jobless claims yesterday. Weekly claims fell to 233k from 250k prior, below the 241k the market was looking for. On the back of significantly weaker jobs data on Friday, global markets had tumbled as US recession fears spiked. However, with those fears having since weakened slightly, we are seeing a better tone to stock trading. Indeed, with the Fed expected to push ahead with easing from as early as next month, conditions look favourable for stocks provided we don’t see any fresh drop off in US data.

BOE Easing

In the UK, the recent rate cut from the BOE should offer support for the FTSE moving forward. If traders get a sense that the bank is likely to pursue further rate cuts sooner, this should help keep the index supported. For now, expectations are split over the expected path of UK rates with some warning that robust UK economic activity will force the BOE to pursue a more gradual path. If we do see economic readings continuing to improve the focus will then be on BOE guidance with any hawkish ( hawkish in this case meaning not in favour of pursuing a faster pace of easing) likely to cause some headwinds for the FTSE near-term.

Technical Views

FTSE

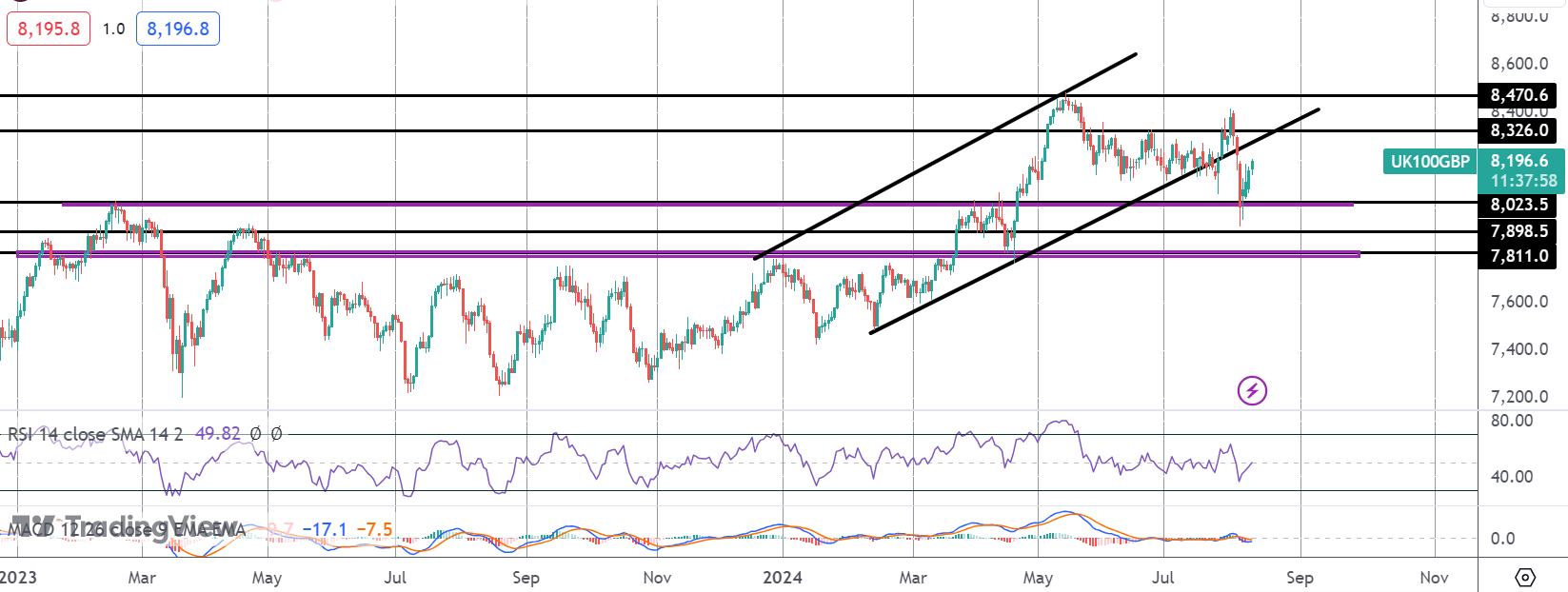

The breakdown in the FTSE found strong support into the 8,023.5 level, with price since reversing higher again. With the bull trend still intact, focus is on a continuation higher near-term with 8,326 the next test for bulls, along with the retest of the broken bull channel.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.