FTSE 100 FINISH LINE 28/8/25

FTSE 100 FINISH LINE

The UK's leading blue-chip and midcap stocks declined for the third straight day on Thursday, primarily due to the pullback from utilities and technology sectors, as investors evaluated the results from chipmaker Nvidia.

Apple criticized Britain's competition regulator's plans to increase competition in the mobile operating system market, claiming they could harm users and developers and force the company to share its technology for free. The CMA's potential designation of Apple and Google as having strategic market status would impose rules to promote fair competition, including measures requiring interoperability and allowing developers to direct users to external purchases. Apple argued these changes could expose users to scams and hinder innovation, while a CMA spokesperson stated that their approach differs from the EU model and aims to balance competition with privacy and security. The final decision is expected in October.

The Confederation of British Industry reported a decline in confidence and activity among services businesses this month, urging finance minister Rachel Reeves to postpone any increase in corporate taxes. Last week, the UK's blue-chip index reached a record high as global markets were buoyed by U.S. Federal Reserve Chair Jerome Powell's indication of a potential interest rate cut at the central bank's September meeting.

Shares of Drax Group, a British power producer, have fallen 7% to 653p. The Financial Conduct Authority (FCA) is examining Drax's biomass sourcing claims from January 2022 to March 2024. Additionally, the FCA is investigating whether Drax's annual reports from 2021 to 2023 comply with financial disclosure regulations. Drax has stated that it will work with the FCA during the investigation. As of the last closing, the stock has risen approximately 8.6% year-to-date, compared to a 5.73% increase in the FTSE mid-cap index for the same period.

Shares of consultancy firm Next 15 have risen 4.4% to 273.5p. The company intends to permanently shut down its U.S.-based venture-building subsidiary, Mach49, just a few months after revealing "potential serious misconduct." NFGN, which acquired Mach49 in 2020, is currently in arbitration with former firm members regarding earnout payments from the acquisition. The company anticipates that its adjusted operating profit for FY26 will align with market forecasts of £67.5 million ($91.19 million), based on a company consensus. Additionally, following the recent changes, the stock has decreased by 31.51% in 2025.

Shares of Softcat, a provider of IT services and infrastructure, have risen by 2.5% to 1,604p. The stock is currently the leading gainer on the FTSE mid-caps index, which has increased by 0.1%. The company anticipates mid-teens growth in its operating profit for the fiscal year, an improvement from the previously announced low-teens growth. Furthermore, Softcat projects high single-digit growth in operating profit for FY26, excluding large project contributions in FY25. Year-to-date, taking into account today's movements, SCTS has increased by nearly 5%, while FTMC has risen by approximately 6%.

Shares of Gulf Keystone Petroleum, a Kurdish oil producer, have risen by 4.1% to 188.4p. The company's interim gross average production grew by 12% to 44,100 barrels of oil per day (bopd). Production has restarted and is being ramped up towards full capacity at the Shaikan Field following a temporary shutdown due to security concerns. The commissioning of water handling facilities at Production Facility-2 in Shaikan Field is anticipated in early 2027. PF-2 is expected to contribute additional production beyond the expected field baseline once it becomes operational. An interim dividend of $25 million has been declared. However, Gulf Keystone has revised its 2025 gross average production outlook to between 40,000 and 42,000 bopd, down from the previous guidance of 40,000 to 45,000 bopd, mainly due to disruptions at the Shaikan Field. Including session movements, the stock has increased by 30.5% year-to-date.

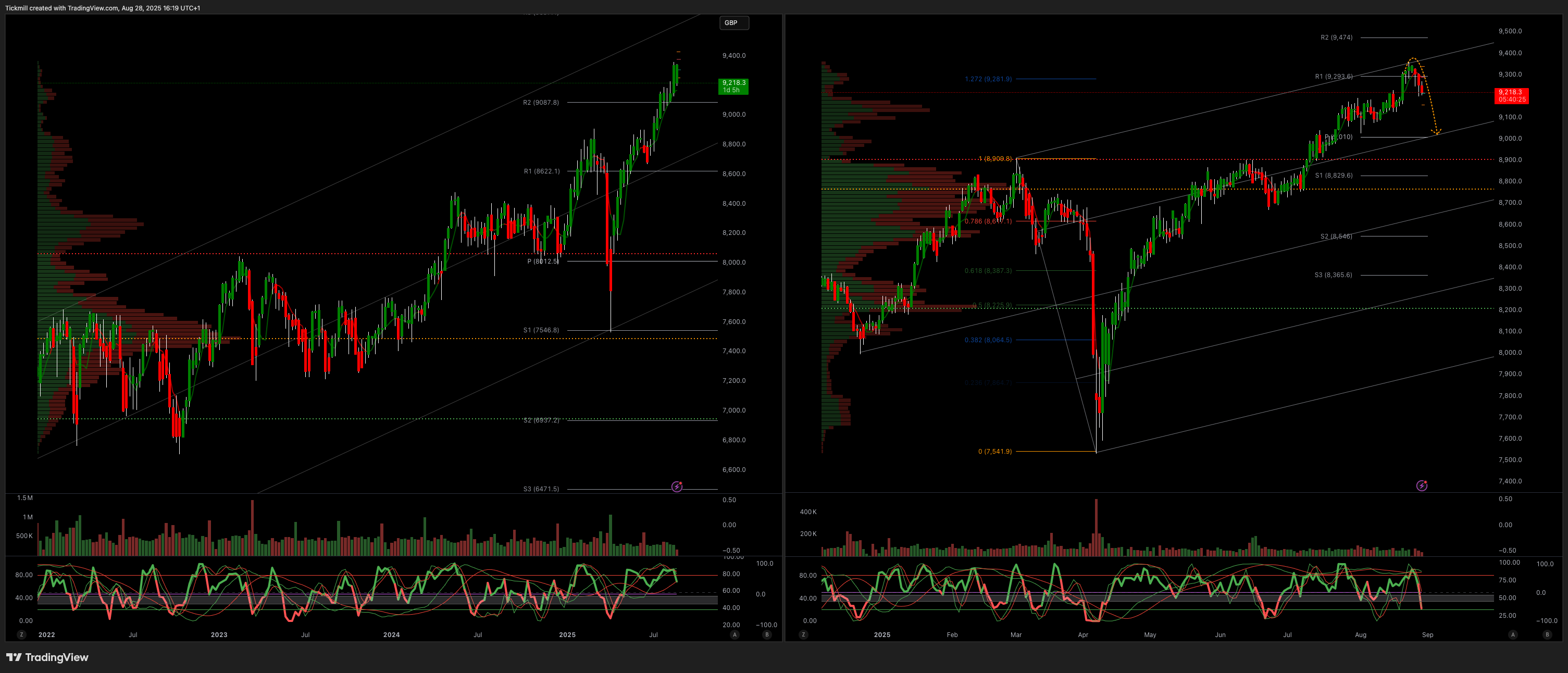

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9000

Primary support 9000

Below 8900 opens 8600

Primary objective 9600

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!