FTSE 100 FINISH LINE 21/8/25

FTSE 100 FINISH LINE

On Thursday, Britain's primary stock indexes fell, pulled down by losses in consumer-related stocks, as global investors focused on the U.S. Federal Reserve's annual symposium in Jackson Hole. The central bankers' three-day meeting is scheduled to commence later today, with investors paying close attention to Fed Chair Jerome Powell's speech on Friday for indications regarding a possible interest rate reduction in September. The decline follows a day after the FTSE 100 reached an all-time high, gaining from a shift in the market away from technology stocks which had caused a selloff on Wall Street earlier this week. The FTSE has lagged behind in recent years due to its minimal presence of tech stocks, but the recent shift towards value investing has given it a boost. The energy sector increased by 0.5% as oil prices rose, supported by indications of robust demand in the U.S. and uncertainty regarding the resolution of the war in Ukraine. Meanwhile, PMI data for August showed that British businesses are experiencing their best month in a year, driven by a recovery in the key services sector. Furthermore, the public borrowing in Britain for the current financial year has aligned with forecasts, which reinforces the government’s tax and spending strategies.

Shares of Ithaca Energy, a North Sea oil and gas producer, surged 8.2% to 213.5p, marking their highest point since November 2022. The company was the top gainer on the FTSE mid-cap index. Brokerage BofA Global Research increased its price target from 170p to 195p. According to BofA analysts, "2Q25 results and an improved FY25 outlook provide further evidence of ITH's resilience." Out of six analysts covering the stock, two have given a "buy" or higher rating, three have rated it as "hold," and one has a "sell" rating; the median price target stands at 162.5p, according to data compiled by LSEG. With this session's increase, ITH has risen 93.4% year-to-date, while the FTSE mid-cap index has gained 5.9%.

Shares of WH Smith, the British travel retailer, have fallen by as much as 40.9% to 656p, marking their lowest point since March 2020. The stock has become the biggest loser on the FTSE mid-cap index and has experienced its largest one-day percentage decrease. The company anticipates a pre-tax profit of approximately £110 million ($147.84 million) for the year ending August 31. In April, WH Smith had predicted that annual profits would align with market expectations, which were around £182.6 million, according to LSEG data. A financial review has revealed an overstatement of about £30 million in expected headline trading profit, primarily due to premature recognition of supplier income from North America. Brokerage Peel Hunt has downgraded WH Smith to 'hold' from 'add' and has reduced the price target to 755p, down from 1400p. As of the last closing, the stock has decreased 6.6% year-to-date.

Shares of Lancashire Holdings, a British insurer, fell approximately 2% to 616p. Peel Hunt has downgraded the stock from "add" to "hold," considering a softening market cycle and a gradual decline in premiums over the next four years. They have increased the price target to 645p from 630p. On average, 15 analysts rate the stock as a "buy," with a median price target of 710p according to LSEG data. The stock has declined about 3.2% year-to-date.

Hays drops by as much as 7.8% to 59p, ranking among the worst performers on the FTSE mid-cap index. The British recruitment company's annual pre-tax profit has plunged by 90% year-on-year. It aims to achieve additional cost reductions of approximately £45 million annually by FY29. Jefferies comments, "We think the weaker exit rate in the fourth quarter and the lack of any signs of recovery so far indicate downward pressure on the FY26 consensus operating profit projection of £53 million ($71.29 million)." As of the last closing, Hays has lost 20% of its value this year.

Technical & Trade View

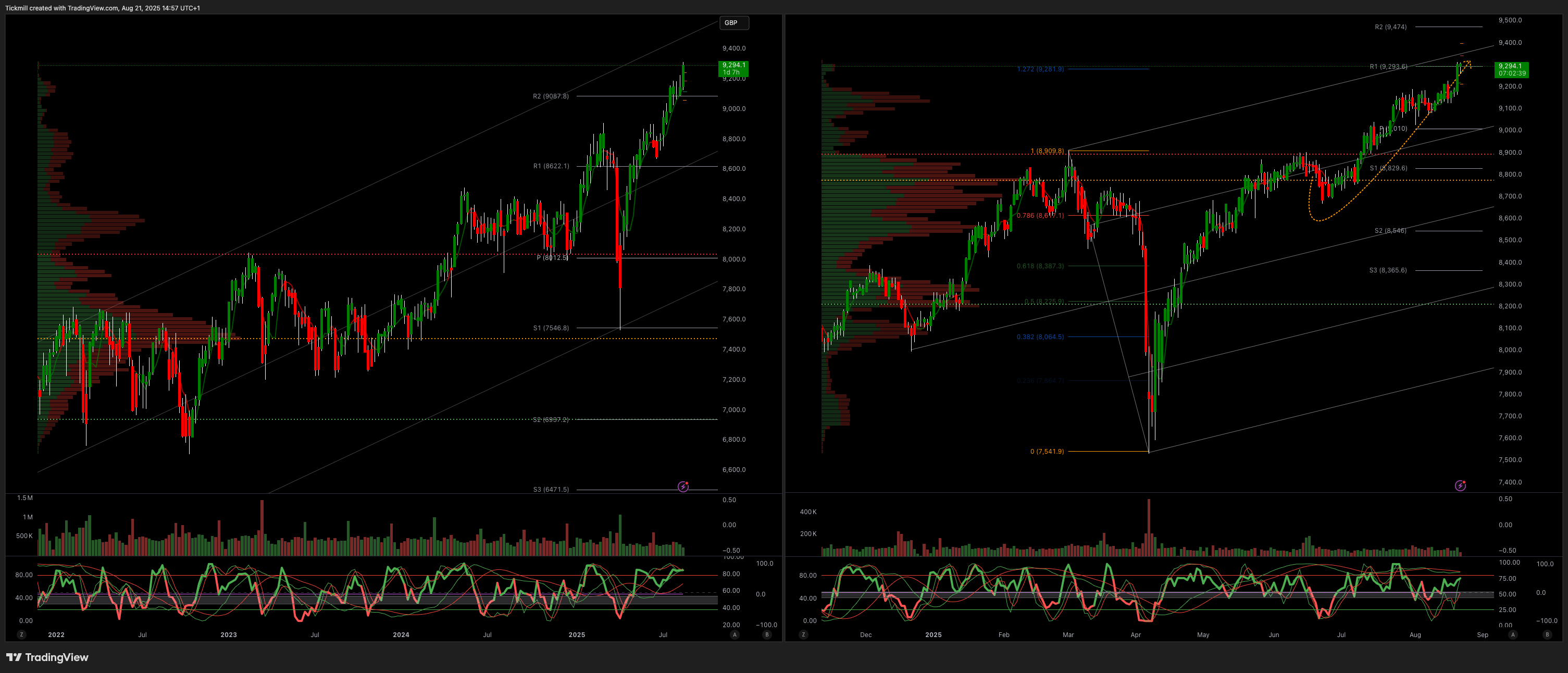

FTSE Bias: Bullish Above Bearish below 9000

Primary support 8900

Below 8900 opens 8600

Primary objective 9280

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!