FTSE 100 FINISH LINE 18/8/25

FTSE 100 FINISH LINE

Property prices in the UK saw a modest decline in August after significant decreases in June and July, according to property website Rightmove, which reported on Monday. The average price for properties entering the market fell by 1.3 percent month-over-month in August, aligning with the ten-year average. Rightmove noted that reduced asking prices, coupled with a positive selection for buyers, are sustaining sales activity, leading to the most successful July for sales agreed since the post-lockdown market in 2020. The Bank of England's third interest rate reduction has further boosted buyer confidence and affordability, according to Rightmove. However, the unexpectedly close vote within the monetary policy committee in August has created some uncertainty regarding a potential fourth rate cut later this year. During the August session, the committee voted 5-4 to lower the bank rate by 25 basis points to 4.00 percent.

Bootmaker Dr Martens rises 11.1% to 83p, becoming the top gainer on the FTSE mid-cap index, which sees a 0.2% increase. Peel Hunt has upgraded its rating to "buy" from "add" and has increased the price target from 80p to 112p. The firm notes that progress is being achieved under the new management's more customer-focused strategy while still maintaining attractive margin structures and strengthening the balance sheet. DOCS is up 3.5% this year, based on the last close.

Shares of Babcock, a British engineering company, have increased by almost 5% to 1,042p. RBC Capital Markets has begun coverage with an "outperform" rating and a price target of 1,200p. They highlight Babcock as a much-improved enterprise after years of restructuring, though its valuation is still significantly lower than that of its competitors in the European defence sector. The brokerage emphasizes the company's strong relationships with the UK Ministry of Defence, extensive engineering expertise, and ownership of crucial infrastructure as key factors contributing to business stability and visibility. RBC states, "Together with a capable management team and effective execution, this creates strong prospects for success across a promising array of opportunities in the UK and internationally." The average rating from nine analysts is "buy," with a median price target of 1,180p, according to data from LSEG. As of the last closing, Babcock's stock has risen nearly 107% year-to-date.

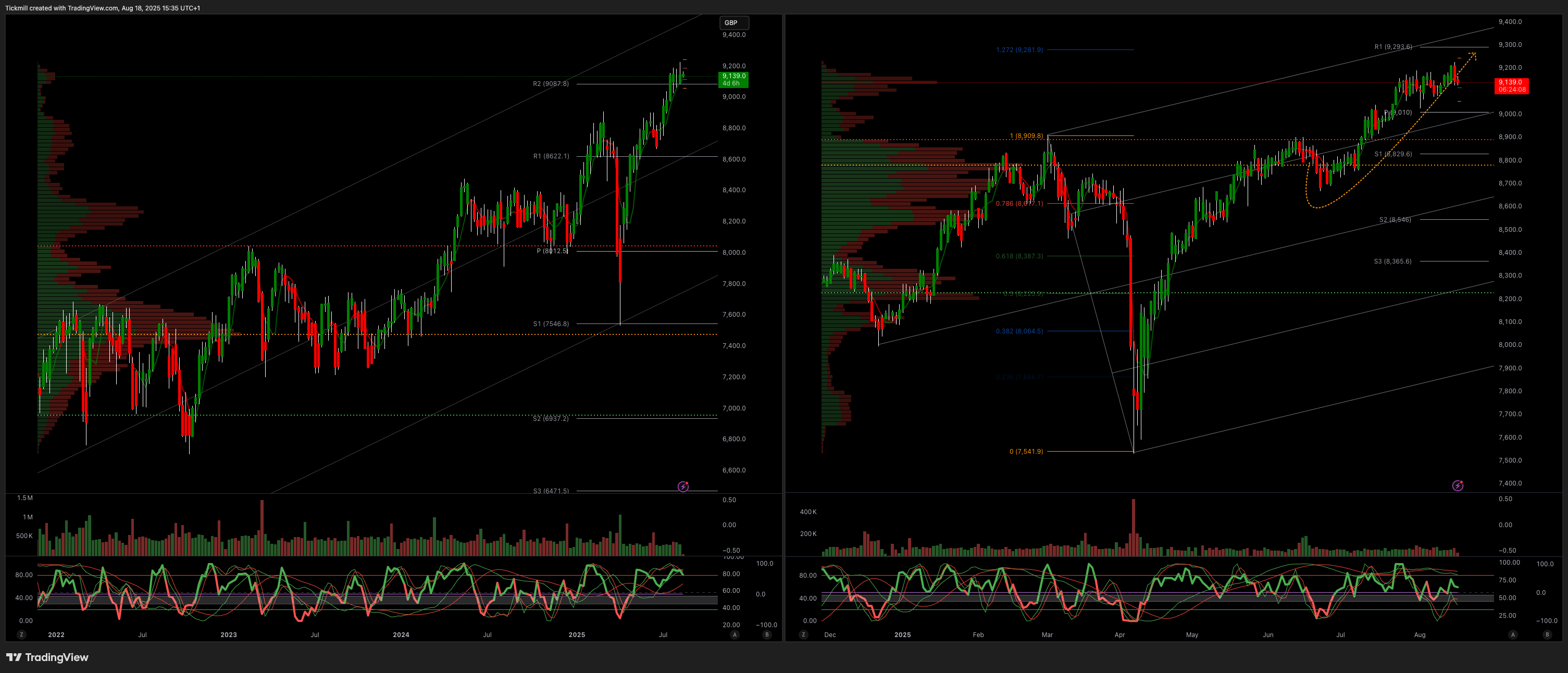

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9000

Primary support 8900

Below 8900 opens 8600

Primary objective 9280

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!