When to Expect a Major Pullback in Gold? A Closer Look to the Recent XAUUSD Rally

Gold has been rising recently supported by extremely benign fundamental background. Pullbacks were short in magnitude and duration, so it was truly a gold mine for market players of any kind and even “dumb money” made good money. We’ve flipped the week, but the rally has continued with new force as the price has risen by 2.5 percent today. Of course, the further we are in the trend, the riskier looks the bet on continuation of the trend, especially when the price curve becomes almost vertical and the likelihood of major pullback increases, at least because some early trend hunters need to take profit. To understand if and when we can expect correction, the following points should be taken into account:

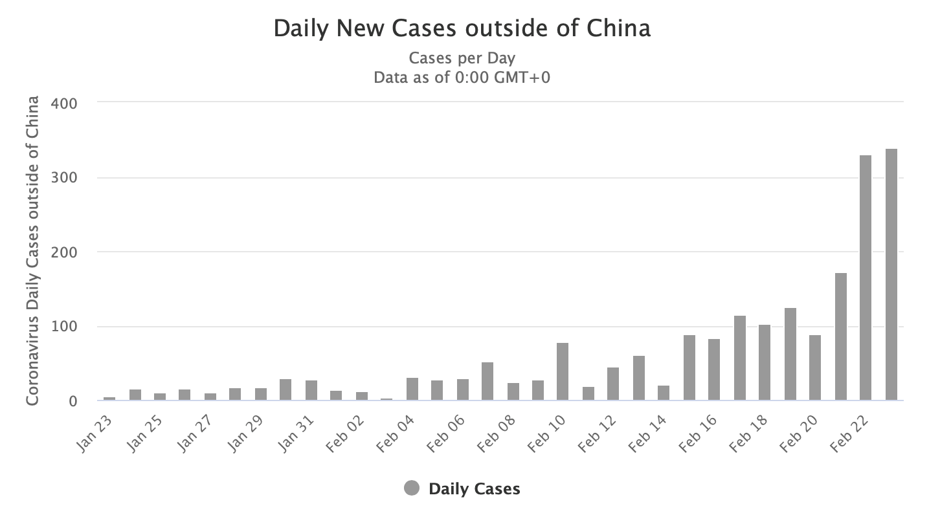

Two big waves of Gold rally (starting at $ 1,560) roughly coincide with the two stages of development of the coronavirus epidemic: mainly inside China and outside it. For example, gold went on the offensive on approximately January 24, when Hubei authorities announced lockdown and its further dynamics resembled the trend of clinically confirmed cases in China: XAUUSD reached a local peak of $ 1,590 on February 3, while the daily change in the number of confirmed cases reached its first peak of 4 February. By mid-February, attention shifted to the dynamics of the epidemic in South Korea, Iran and then in Italy. The increase in the number of confirmed cases also pushed up the gold quotes, since, based on the example of China, this increased chance of lockdown outside China and all the related economic damage. It follows that a pullback in gold is possible as soon as markets get some confidence about a change in the trend of confirmed cases outside of China:

[caption id="attachment_38814" align="alignnone" width="940"] Coronavirus new cases outside China[/caption]

Coronavirus new cases outside China[/caption]

Which won’t certainly happen in an abrupt shift what also speaks in favor of smooth pullback in Gold.

Comparing the current Gold rally with historical cases, it doesn’t look extremely irrational for the following three reasons:

- The global economy is in the last part of expansion phase (widely discussed last year);

- Reasonable concern about the recession – major supply shock (Chinese production) + demand shock (due to quarantine);

- Gold quotes are still at 84% of the historical maximum, and the intensity of a possible recession may exceed 2008, so from this point of view we are far from overbought state;

From the technical point of view, gold momentum has not yet run out of steam. Looking at RSI as a confirmation we have not yet reached the last peak of 84 points, where, by the way, strong resistance is formed:

Among the other short-term factors that may continue to push gold prices up:

- We are still in the phase of rapid growth in the number of infected in Italy and South Korea. China example shows there won’t likely be any sharp changes in trend and decline in new confirmed cases will happen smoothly.

- IMF warning to central banks that the outbreak of coronavirus will cause significant damage to the global economy. A clear signal that it is time to lower rates again. The chances of the Fed rate cut in July rose from 17 to 59%;

- Lack of success in Italy with the search for patient zero, which makes it difficult to track new cases.

Accordingly, the closest goal for gold remains at $1,700 per troy ounce.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.