EUR Bid Despite Fresh Wave of ECB Easing

ECB opts For Range of Options

It was a wild day for the Euro yesterday as traders reacted to the keenly anticipated September ECB meeting. In line with broad market expectations, the central bank announced a range of easing measures including a reduction in the deposit rate, the restarting of QE, the introduction of a two-tiered system for the penalty rate, the strengthening of forward guidance and the extension of TLTRO maturities from 2 to 3 years. Draghi announced that the deposit rate will be lowered by a further .10% from -0.40% to 0.50%, while QE will be restarted from November 1st at 20 billion EUR per month, with no specified time limit. The two-tiered penalty rate is aimed at containing damage to bank balance sheets while easing the terms of the TLTROs should also help alleviate pressure.

Still Room For Rates To Go Lower

While the deposit rate cut and restarting of QE was in line with consensus forecasts, many analysts were looking for a more aggressive move.However, Draghi’s forward guidance noted that there is still room for rates to go lower with the statement saying rates will stay at present or lower levels “until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics”.

Regarding QE, the forward guidance was equally dovish with the statement noting that purchases will continue “as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates”

Inflation Still A Big Concern

The post-decision press conference compounded the dovish skew to this month’s meeting. The ECB’s concern over still subdued inflation was made clear as Draghi told reporters “Today’s decisions were taken in response to the continued shortfall of inflation with respect to our aim. Incoming information since the last Governing Council meeting indicates a more protracted weakness of the euro area economy, the persistence of prominent downside risks, and muted inflationary pressures.”

Draghi's Dovish Outlook

Draghi’s comments on the outlook for monetary policy in the eurozone were equally dovish, saying “The Governing Council reiterated the need for a highly accommodative stance of monetary policy for a prolonged period of time and continues to stand ready to adjust all of its instruments as appropriate to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry.”

Negative interest rates have drawn much criticism in recent times, with many economists voicing their concerns over the diminishing returns from deeper, negative rates in economies such as Japan and the Eurozone. However, at this month’s meeting, Draghi once again stood up for the tool, telling reporters that negative rates are “necessary” to help the ECB meet its mandate.

Market Reaction

The market reaction reflected a split in opinions over the potency of the new measures. Initial buying in reaction to the decision turned to heavy selling as details of the statement and comments in the post-decision press conference filtered through. However, following the end of the press conference, EUR buying kicked back in heavily with price entirely reversing the losses suffered on the day to close with a strong, bullish, daily candle. The ultimate reaction to the meeting suggests some degree of disappointment in the market regarding the scale of the new measures though we could see this change next week as traders continue to digest the announcement.

Trump Sounds Off on Twitter

The reaction to the ECB’s announcement was not just limited to traders either. President Trump was quick to use the event to attack Fed monetary policy, writing on Twitter "European Central Bank, acting quickly, Cuts Rates 10 Basis Points. They are trying, and succeeding, in depreciating the Euro against the VERY strong Dollar, hurting U.S. exports... And the Fed sits, and sits, and sits. They get paid to borrow money, while we are paying interest!”

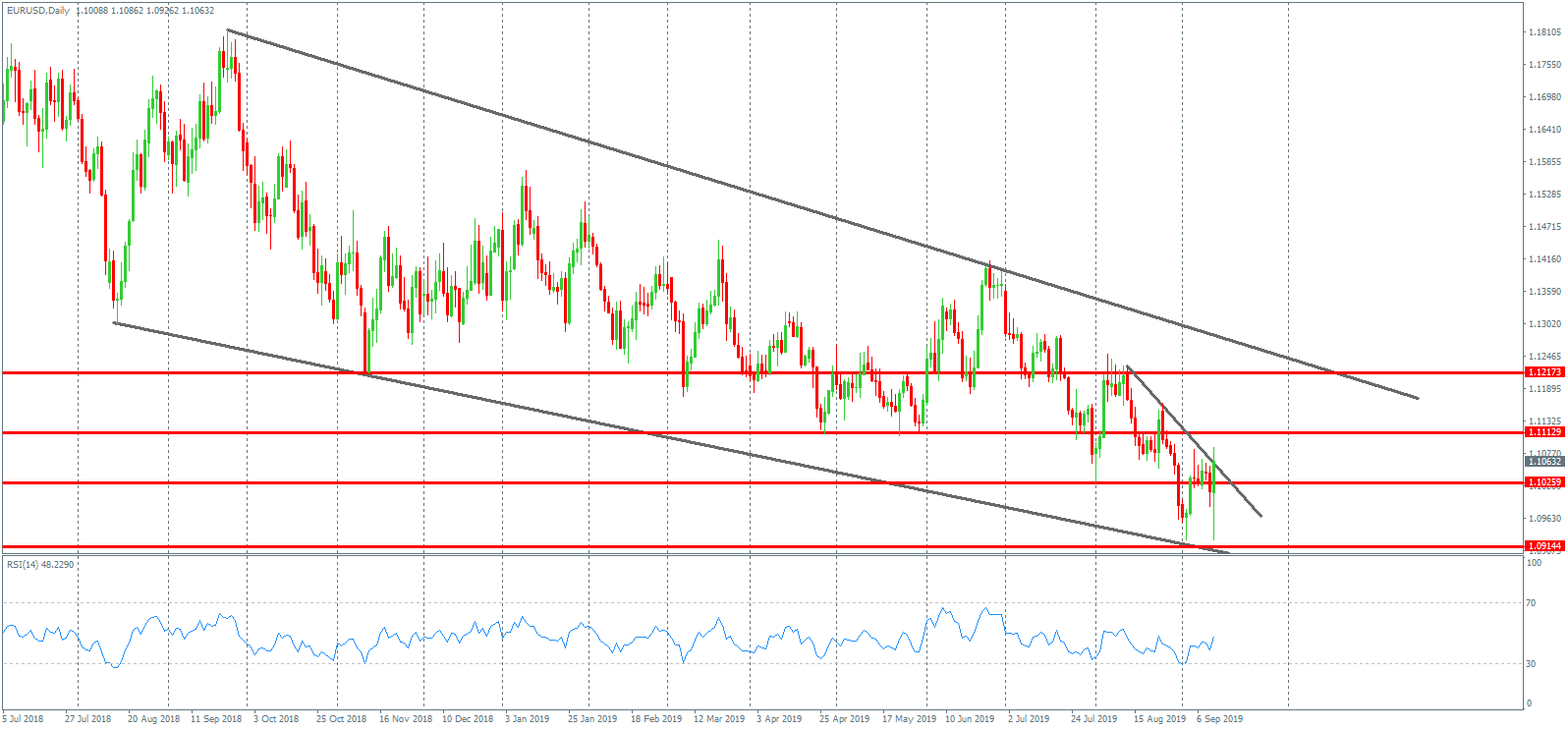

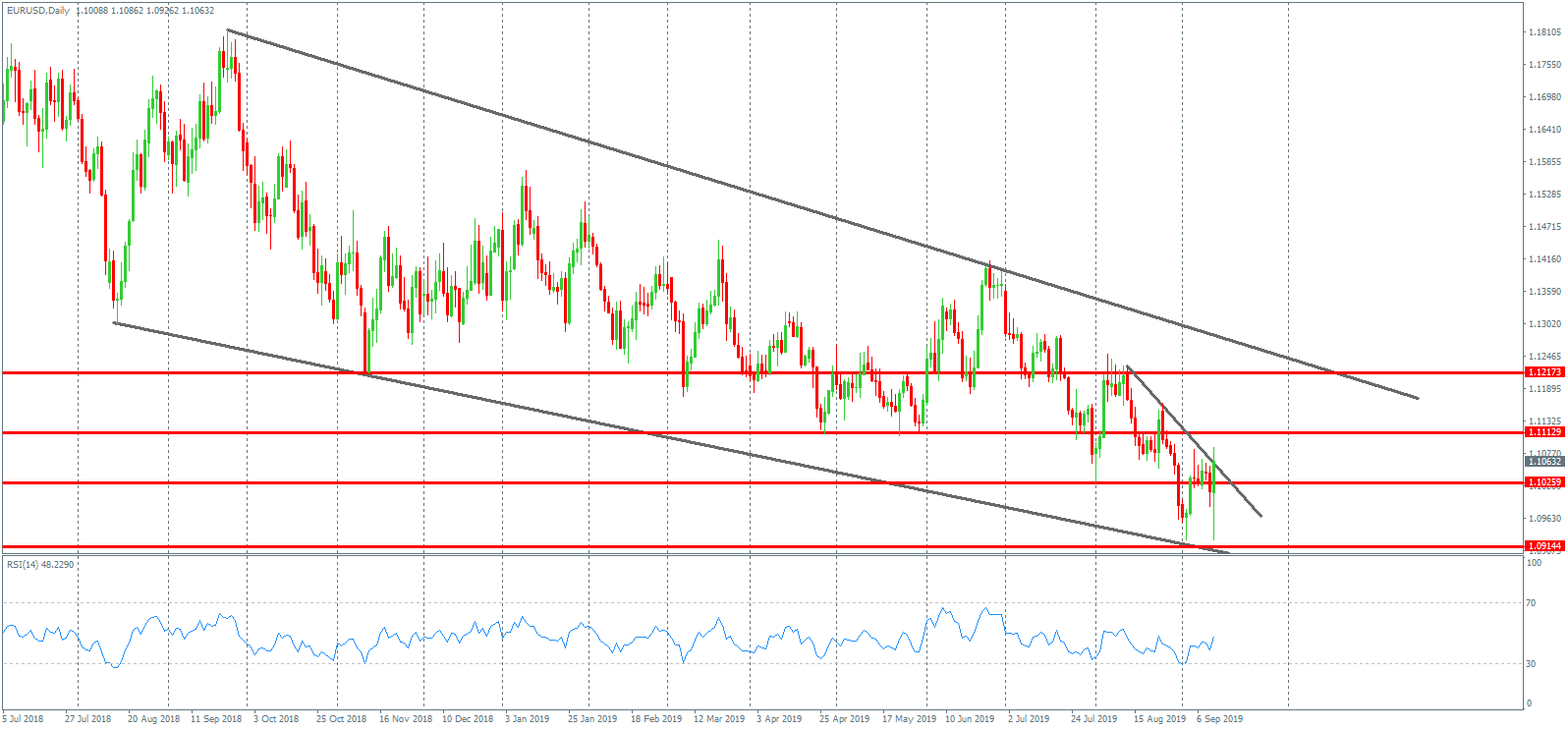

Technical Perspective

The bullish reversal in EURUSD off the day’s lows yesterday has created some interesting price action with a large bullish outside bar at a double bottom, just ahead of 1.0914, backed up by bullish RSI divergence. The setup suggests the risk of a reversal higher. Price is currently testing the local bearish trend line of a falling wedge structure within the broader bearish channel. A break higher here could see a move up to the 1.1217 level where we also have the bearish channel top. 1.1111 will be the first topside level to watch, a break of which should signal the push up to the channel top next.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.