ETH Rally Stalls for Now

The rally in Ethereum, amidst optimism around expected SEC approval for ETH ETFs, has stalled for now with the market stagnating into a test of the 4003 level. Last Thursday the SEC laid out initial approvals for spot-ETH ETF applications (mirroring the funds launched earlier in the year for BTC). With first round approvals in place, traders are highly expectant that full approval will be granted imminently, allowing ETH ETFs to begin trading as early as July/August. Despite an initial breakout move higher as optimism ratcheted higher, bulls have since lost momentum with price stalling at 4003 for the last six days.

Inflation Creating Issues for Crypto Bulls

The major headwind for ETH here, and all crypto assets, is the drop-off in Fed easing expectations. Fed policymakers have been very vocal in recent weeks, pushing back against near-term easing calls citing concern over inflation. CPI was seen cooling to 3.4% last month, down from 3.5% prior but still well above the bank’s 2% target. Alongside hawkish Fed commentary in recent weeks, the latest FOMC minutes added to hawkish sentiment with some members seen voicing support for further tightening if inflation remains sticky at current levels. Last week, a bumper set of US PMIs added further cause concerns with inflationary elements seen rising in both the services and manufacturing sector readings. Looking ahead, focus will now be on Friday’s core PCE data with risks of a correction lower in ETH if we see a further rise in inflationary data.

Medium-Term View Remains Bullish

While concerns over inflation persist, and near-term Fed easing expectations remain subdued, crypto prices are likely to continue to struggle to gain ground. However, given the bullish developments within the crypto space, if we start to see US inflation cooling and Fed easing expectations being rebuilt, this should fuel a strong wave of buying across ETH, BTC and other digital coins.

Technical Views

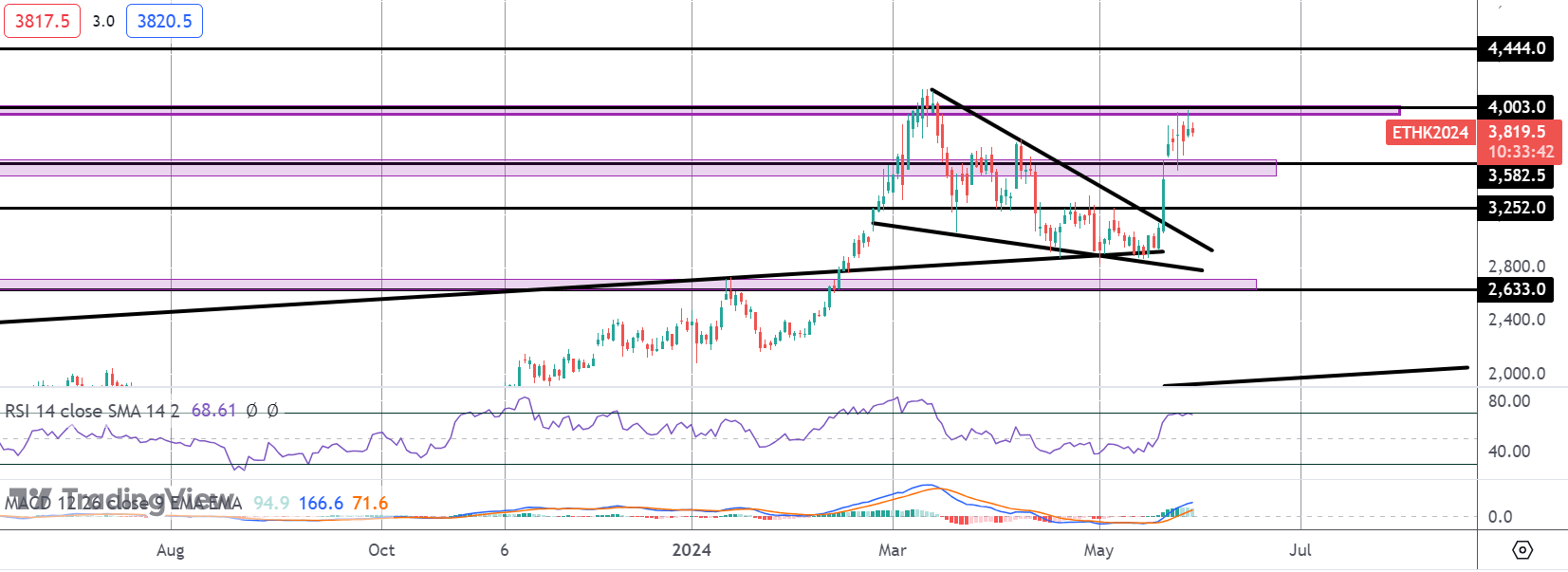

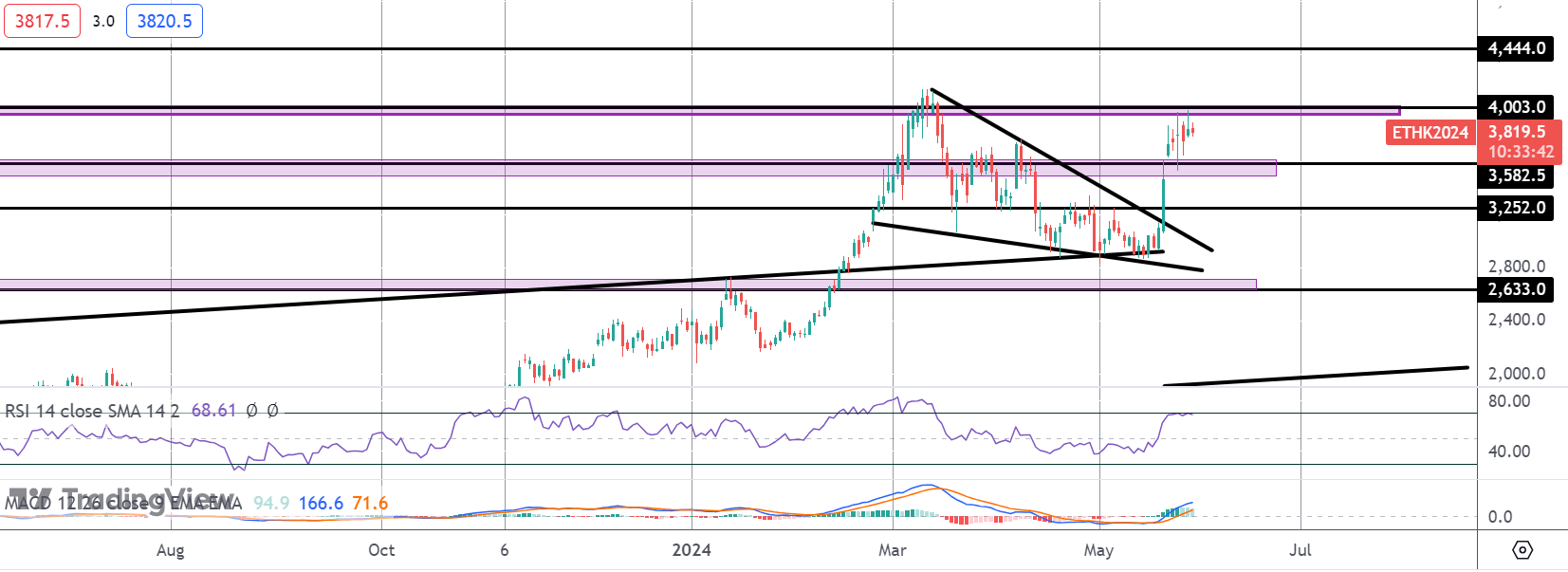

ETH

The rally in ETH has seen the market breaking out above the 3582.5 level, though stalling for now into a test of the 4003 resistance. With momentum studies bullish, focus remains on an eventual breakout higher while 3582.5 hold as support. Below there, 3252 will be next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.