ECB Meeting: How will Lagarde cope with the Crisis of Goal Setting?

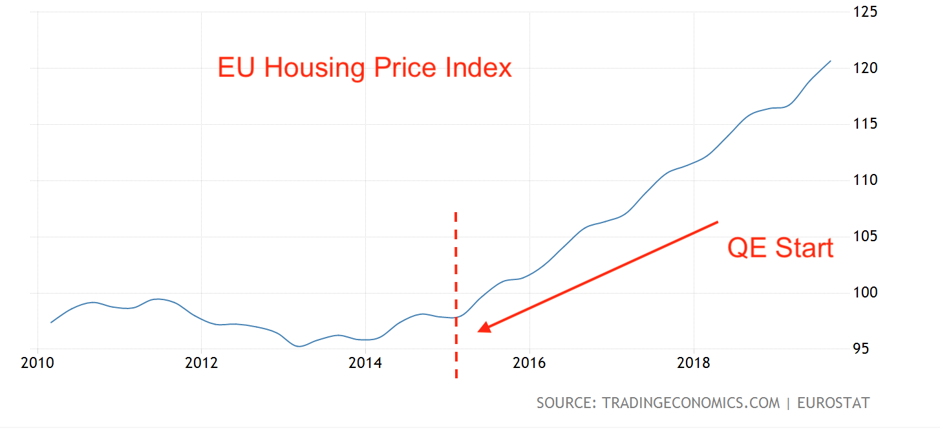

The European Central Bank is now probably at the peak of the crisis of goal setting and achieving goals. What is a comfortable inflation band for the economy? What weight should be given to housing costs, medical services, food products in the formula for calculating inflation if spending profile of the nation is not only heterogeneous, but also varies depending on the stage of the economic cycle? How to include perception of inflation by households (which is usually always higher) into inflation equation? How to achieve inflation goal? By launching a massive overhaul of the ECB working framework shortly after assuming the office, Lagarde basically acknowledged that there can be major disconnection between the goals and methods of achieving them with local price bubbles as the biggest achievement:

The revision of the ECB strategy, for the first time since 2003, is expected to be large-scale and will affect not only the problem areas of inflation policy, but also digital currencies, as well as climate change. Earlier it became known that large central banks (for some reason without the Fed) are going to create a joint working group that will evaluate the cases of using digital currencies in practice.

From a practical point of view, today's meeting will be interesting in Lagarde’s bias in revising the inflation target - whether she will join Draghi and say that the “price” of achieving 2% is justifiably rising or focus on flaws in definition of inflation and its calculation. Would she find the side effects of the policy unacceptable? All of this will have specific policy implications for the future, but markets will respond immediately.

There are rumors which are being widely discussed (backed by some comments of ECB officials) that the wording of the goal as “inflation close to 2% or slightly below” will be replaced by “2%”, with an additional remark that “undershooting” will be equally worrying as “overshooting” The ECB official Villeroy previously stated that the inflation target should be symmetrical and, if the central point is seen as a ceiling, the ECB may constantly “underreact”. Another option for revising the target is inflation “tolerance band”. This means that the goal is no longer 2%, but getting into the interval, which in theory should make the policy a little less predictable (and potentially more effective).

While the ECB will address all these issues, any major policy change is unlikely, since it is unknown what will the result of policy overhaul. The index of economic surprises in the Eurozone rose to a two-year high, which is why there is no need for monetary adjustment so far. The euro is expected to continue to trade in a narrow range of 1.1050 - 1.1150.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.