Dow Under Pressure Amidst USD Revival

Dow Slips on USD Rally

US stocks have come under heavy selling pressure into the end of the week amidst an uptick in USD. The Dow Jones has shed almost 3% this week as continued hawkish sentiment from Fed members has helped reverse the Dollar losses we saw last week in response to softer US inflation data. Yesterday, US PMIs were seen jumping to their highest combined level in just over two years. Coming amidst a flurry of hawkish Fed commentary, the data helped push USD higher and saw stocks further unwound as traders looked to cover positions ahead of the long weekend.

Hawkish Fed Commentary

The details of the latest FOMC meeting released this week confirmed that the Fed remains highly concerned over the lack of inflation progress this year. Indeed, some members were seen voicing their support for further tightening should inflation continue to hold around current levels.

Inflation is Key

Given this outlook, the implications for stocks are quite clear moving forward: if incoming inflation remains sticky or rises, this will be firmly bearish for stocks as traders scale back their Fed easing expectations. On the other hand, if we see inflation falling more convincingly in coming readings this will see traders rebuilding their near-term easing expectations, weighing on USD and creating fresh support for stocks.

Technical Views

Dow Jones

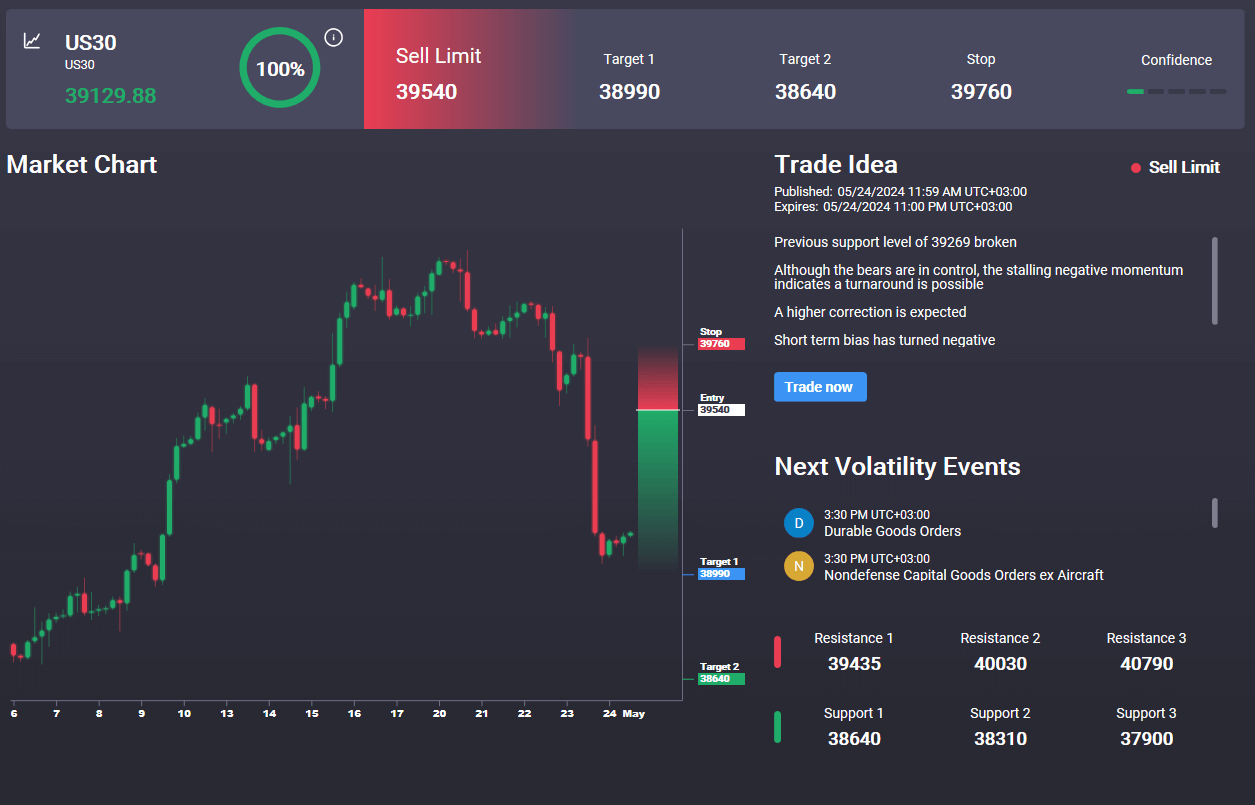

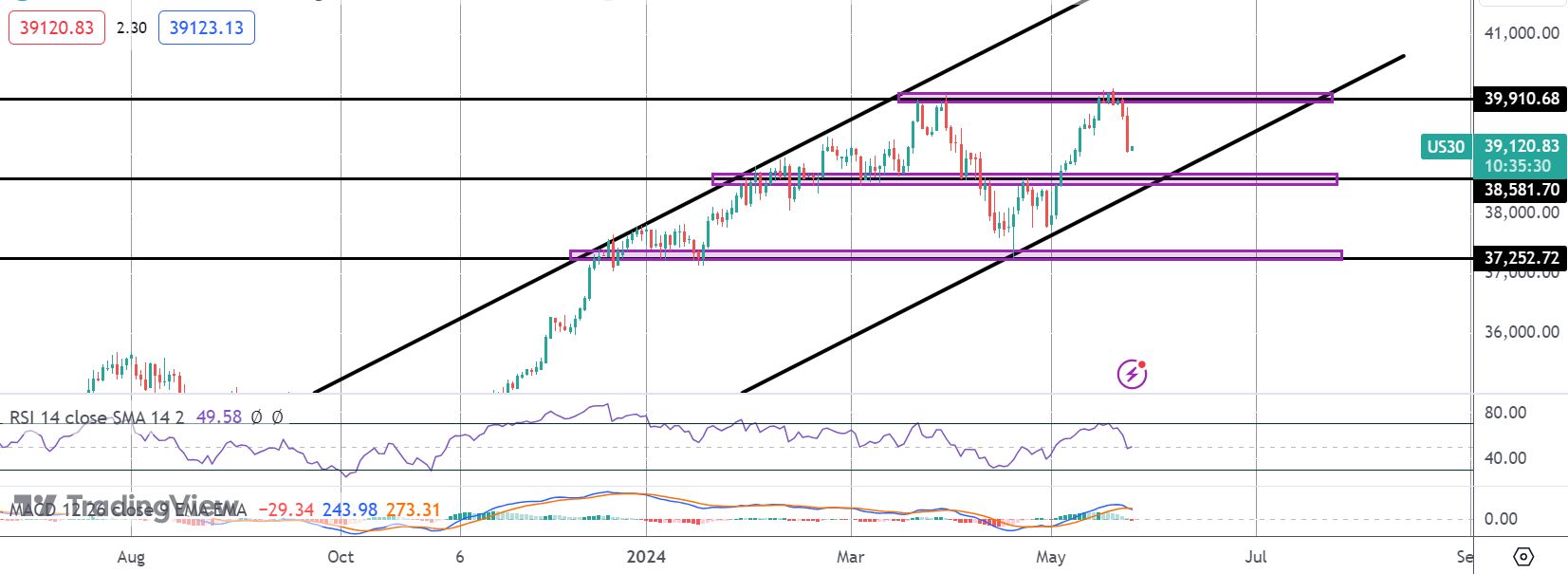

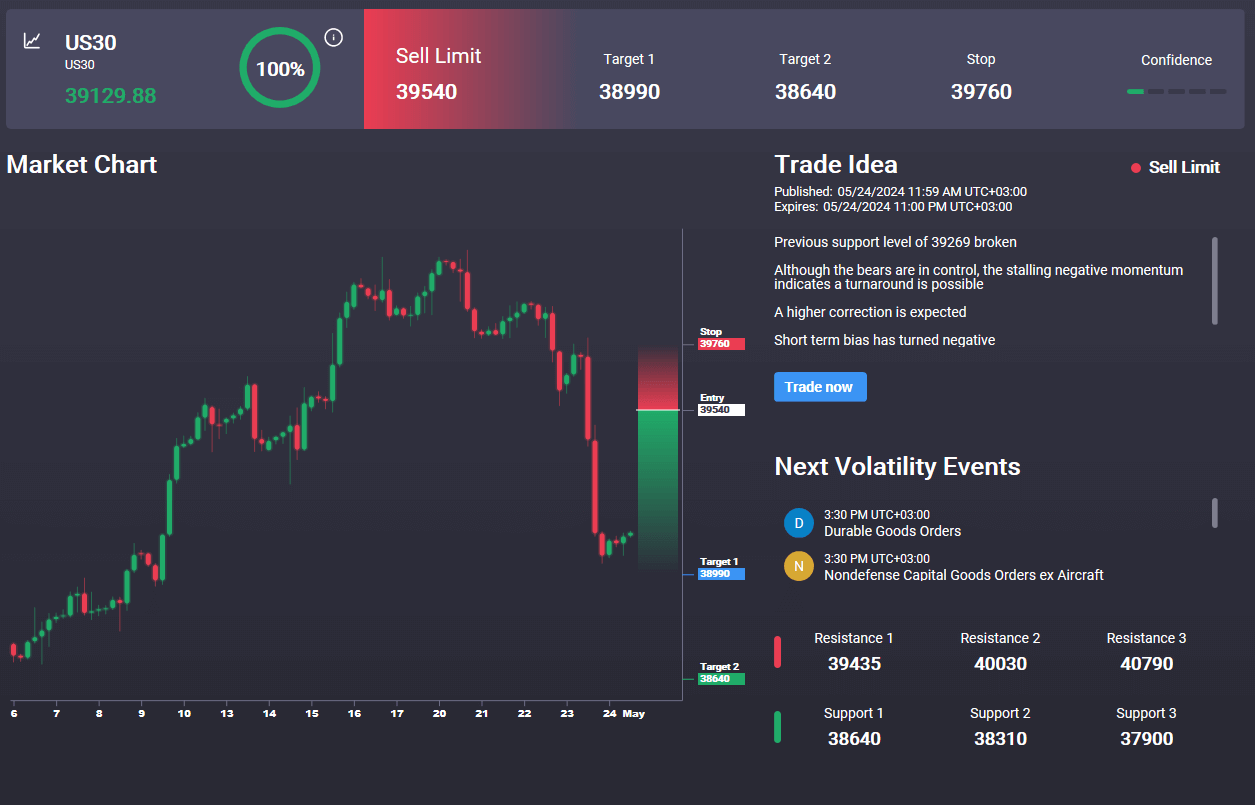

The failure at the 39,910.68 level has seen the market turning sharply lower, now fast approaching a test of the bull channel lows and the 38,581.70 level support. Bulls need to defend this area to maintain the current bullish bias. Below there, 37,252.72 is the next support to watch. This area is potentially the neckline of a large double top formation which, if broken, paves the way for a much deeper reversal lower. In the Signal Centre today we have a sell signal above market at 39540 suggesting a preference to sell any bounce from current levels for a continuation lower.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.