Dow Jones Capped by Major Level...For Now

Stocks Soft Following Trump Meetings

US equities are trading tentatively today on the back of multi-lateral meetings between Trump, Putin and Zelensky. The Dow broke out to fresh all-time highs late last week before reversing lower in response to stronger-than-forecast US PPI data. The market has remained down from those highs with traders waiting to assess the outcome of those political meetings. However, with no deal agreed and little in the way of concrete progress, markets have reacted in a muted way so far. While it looks as though talks will continue, and the path to peace is there, it still remains unclear how peace can be achieved without Zelensky surrendering land.

Fed in Focus

Looking ahead, focus will now turn to the Fed with the FOMC minutes due tomorrow and the Jackson Hole symposium on Friday. Given the dovish shift in market expectations on the back of the recent labour market data downward revision, traders will be looking close for any dovish details. If seen, this should keep USD pressured lower, allowing equities room to push higher again. Rate cut pricing softened slightly in the wake of Friday’s upside PPI surprise. As such, there is room for those expectations to strengthen again in response to any dovishness this week. However, if the meeting minutes and Powell’s speech on Friday err on the neutral side, dwelling on inflation uncertainty, this could see easing pricing soften again, capping equities here while USD rebounds.

Technical Views

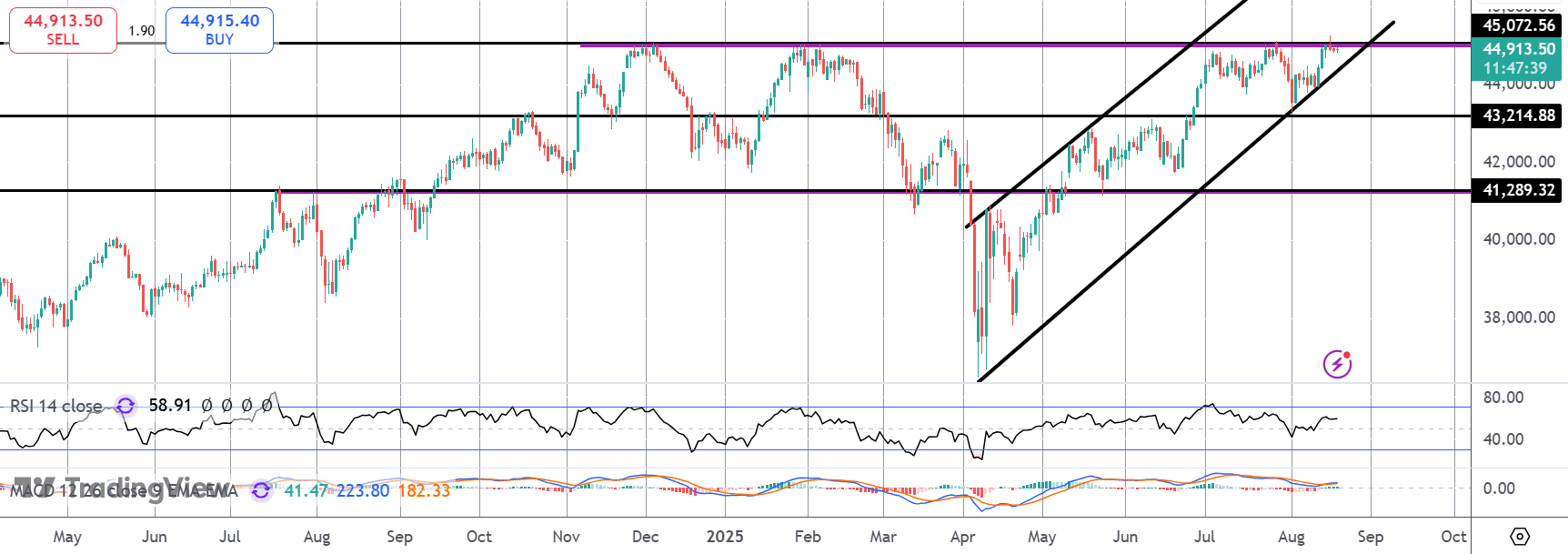

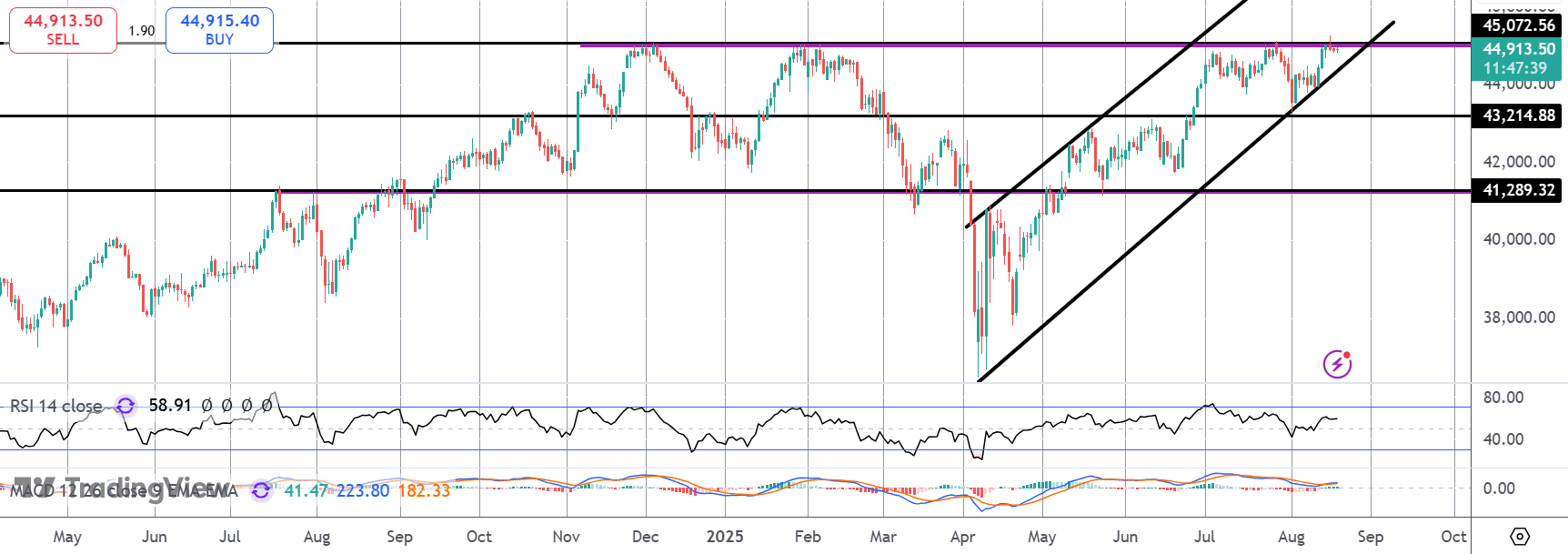

Dow Jones

The rally in the Dow Jones has stalled for now into the latest test of the 45,072.56-level resistance. This has been a formidable ceiling for the market since November last year with price yet to break higher. Given the bull trend, focus remains on an eventual break higher while 43,214.88 holds as support. Below there. Focus turns to a deeper correction towards the 41,289.32 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.