Dollar Slides On US Inflation Undershoot

US Inflation Data Undershoots

The US Dollar is trading lower today on the back of yesterday’s July US inflation data. Headline annualised CPI was seen holding at 2.7%, undershooting expectations for a lift to 2.8%. On the monthly readings, core rose slightly to 0.3% from 0.2% while headline fell to 0.2% from 0.3%. In all, the data was seen as a dovish result, strengthening expectations for a Fed cut at the September FOMC. CME pricing for a .25% is now more than 95% with pricing for a follow up cut in October now well above 60%. This dovish shift in market pricing is well reflected in the current USD slide we’re seeing and the greenback now looks poised for further downside near-term.

Trump/Putin Meeting

Looking ahead, focus now turns to Friday’s meeting between Trump and Putin with traders keen to gauge the likelihood of a ceasefire agreement between Russia and Ukraine. If talks go well on Friday, this should further bolster risk sentiment, putting fresh pressure on USD via reduced safe-haven demand. The prospect of a ceasefire should also prove a stronger driver for EUR upside given the advantages to the eurozone economy and the expected fall off in energy prices. However, if talks fail on Friday and a ceasefire looks unlikely, risk sentiment could quickly recoil causing a short squeeze in USD via fresh safe-heaven demand.

Technical Views

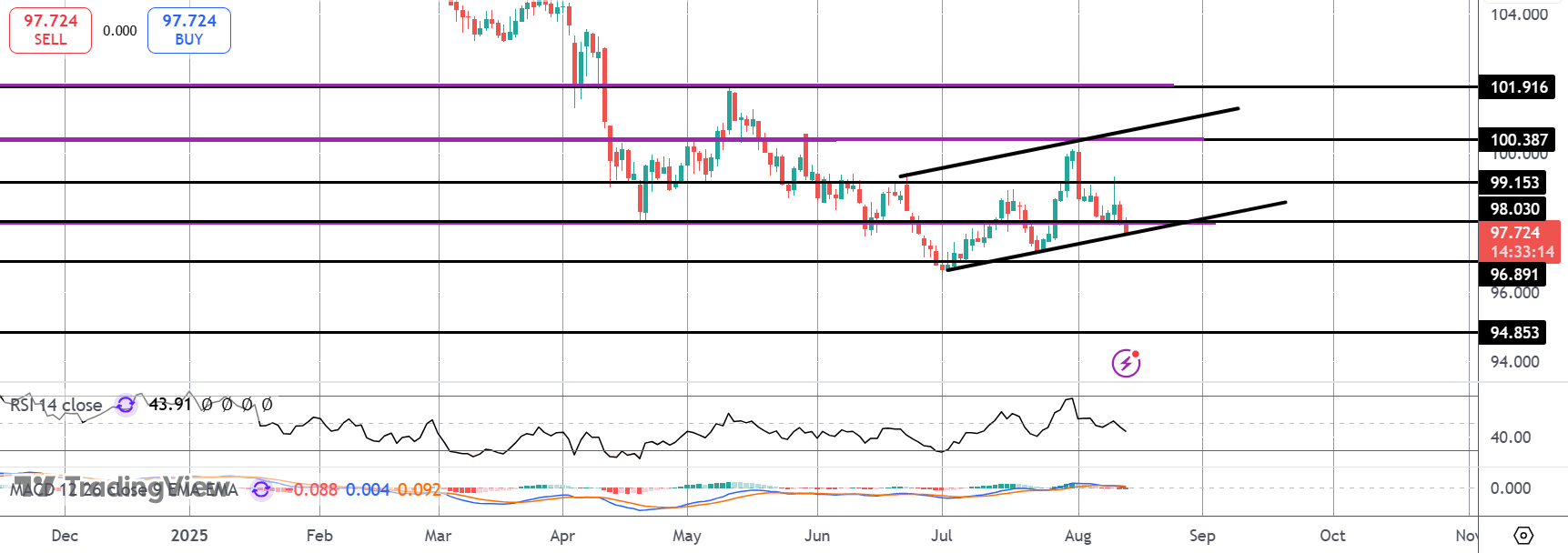

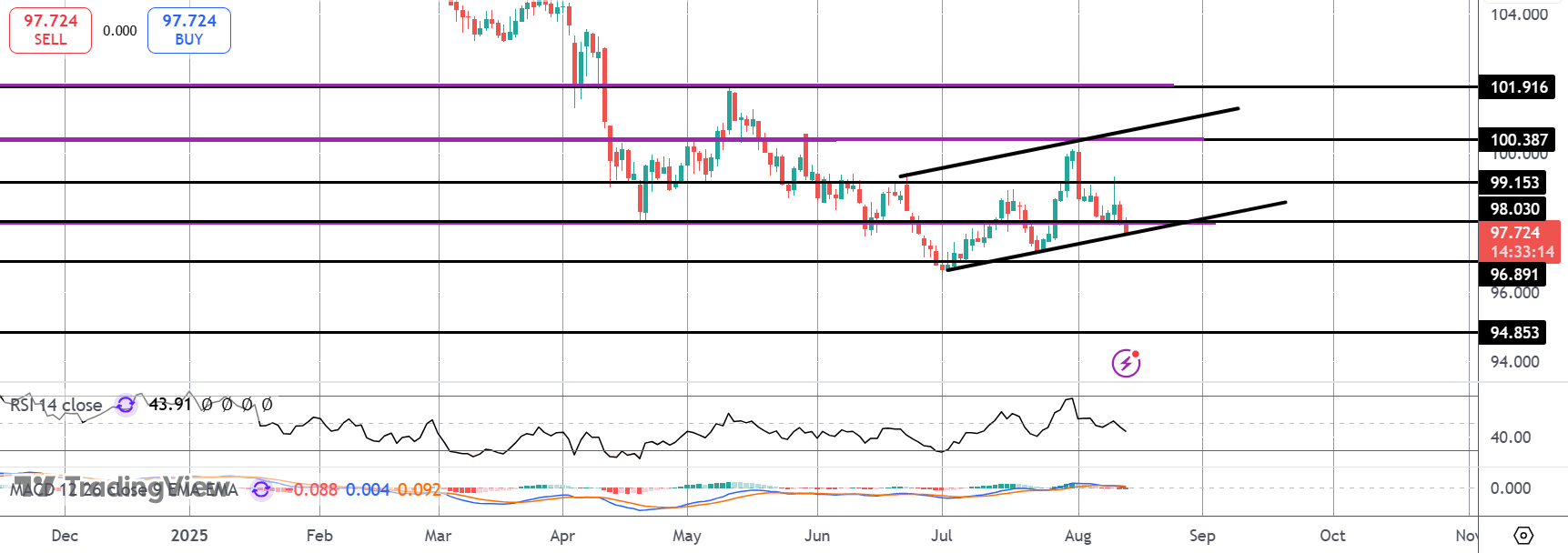

DXY

The failure at the 100 level and bull channel highs has seen the market reversing sharply lower. Price has broken below the 98-level support and is now testing the bull channel lows. With momentum studies weak, risks of a downside break ae growing with 96.89 the next bear target ahead of the deeper 94.85 level if we break down to new YTD lows.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.