Dollar Reverses Sharply From Session Highs

DXY Reverses on Monday

Price action in DXY today suggests USD is at risk of a fresh push lower this week following a sharp reversal form earlier session highs. The daily candle is now looking heavily bearish, suggesting plenty of caution and uncertainty ahead of tomorrow’s keenly awaited US CPI release. Following a heavy drop in recent US labour market data, traders’ Fed expectations have turned more heavily dovish. The CME group is now pricing in a more than 80% chance of a Fed cut next month followed by at least one further cut ahead of year end.

CPI & Fed

If tomorrow’s CPI data shows any weakness, this should see dovish pricing rising again, putting fresh pressure on USD near-term. However, even if we see a lift in inflation, this is unlikely to derail September rate cut chances given the heavy downward revisions in jobs data. Indeed, rising inflation will likely be a seen as a further threat to growth amidst a soft jobs market, keeping a cut next month firmly on the table.

Trump/Putin Meeting

Beyond tomorrow’s inflation data traders will be looking to Friday’s meeting between Putin and Trump. The core view is that Russia will only agree a ceasefire if Ukraine surrenders some territory, which Zelensky has vowed not to do. As such, there is plenty of uncertainty ahead of the meeting. However, if progress is made on Friday this should bolster risk sentiment, keeping USD pressured near-term. If talks fail, however, USD could rally as risk assets tumble.

Technical Views

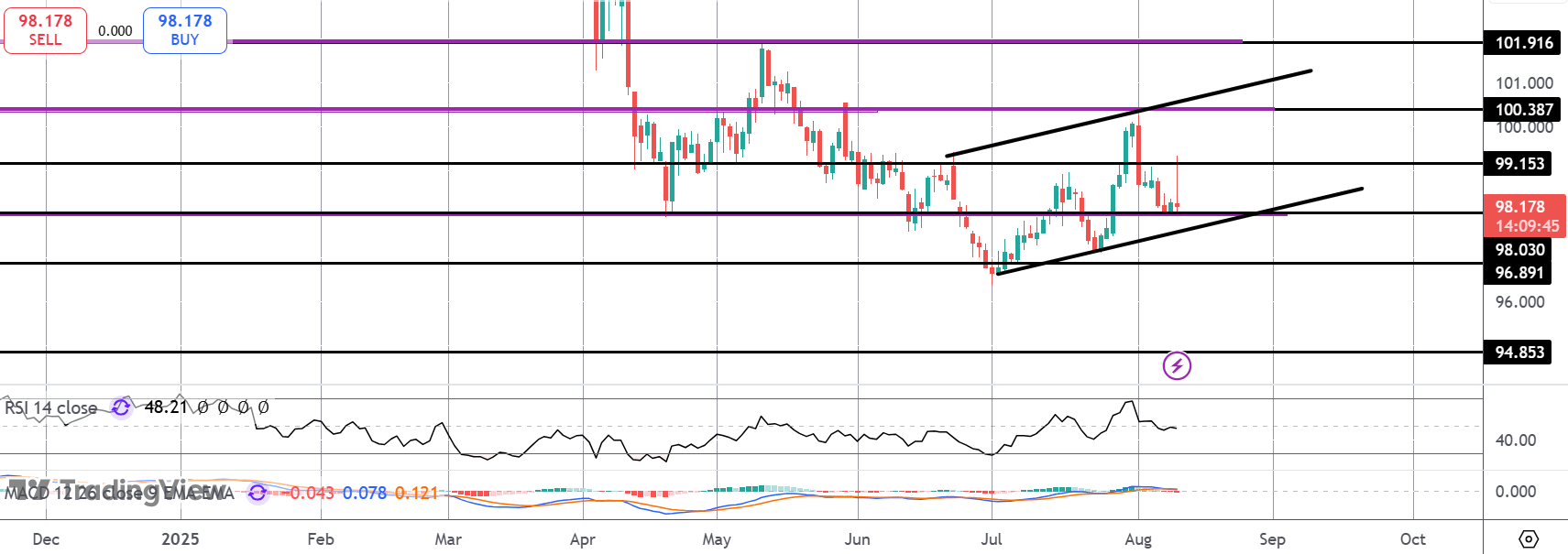

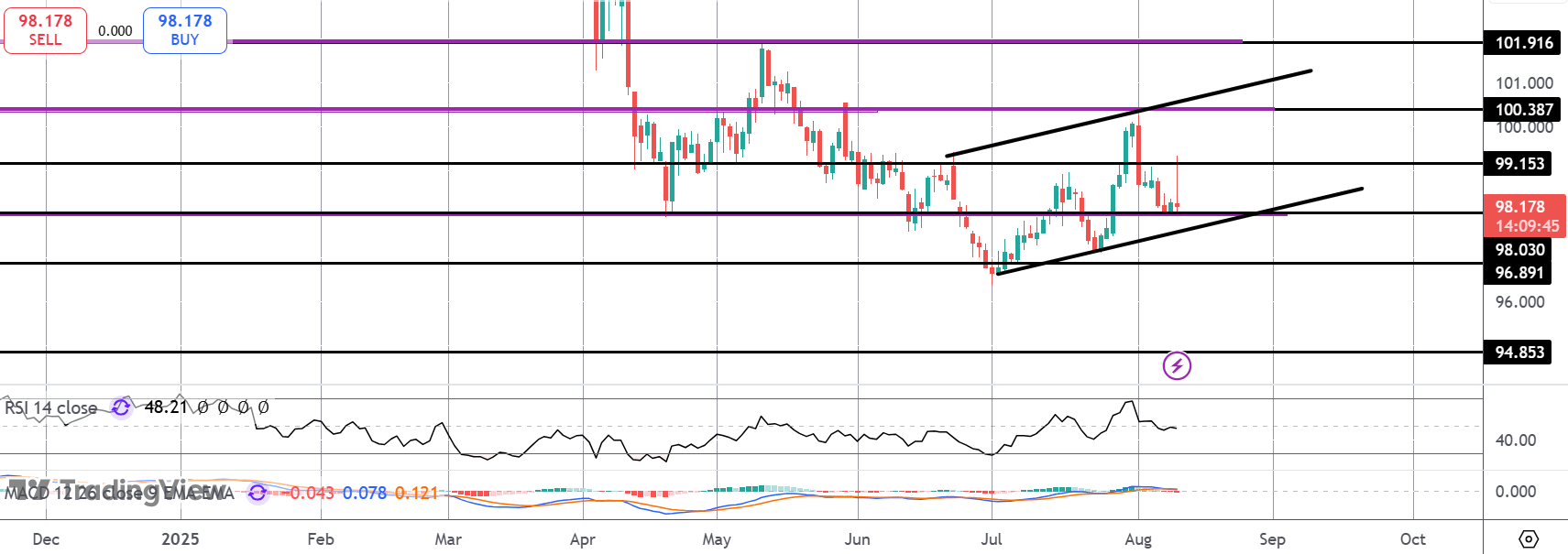

DXY

A firm rejection at the 99.15 level suggests the inverse head and shoulders in DXY is at risk of breaking this week. Price is currently testing the 98.03 support, with the bull channel lows just below. If we break below this level, 96.89 will be the key support to watch, a break of which opens the way for a heavier run down to 95.85 thereafter.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.