Dollar Rallying Ahead of Powell Speech

Powell in Focus

The US Dollar is rising today ahead of a keenly awaited speech by Fed chair Jerome Powell later today. Speaking at the Jackson Hole symposium for the last time as head of the Fed, traders will be paying close attention to Powell to see if he gives any clear signal as to how the Fed is likely to act next month.

NFP Adjustments

On the back of the heavy downside NFP miss and downward revisions we saw at the start of August, market expectations turned firmly dovish. Market pricing for a September cut hit a peak of 95% after last week’s weaker-than-forecast US CPI print. However, in recent days expectations have weakened with pricing now sitting around the 73% mark. This drift in easing conviction has been well reflected in USD price action with the DXY grinding higher over the week.

Trading Scenarios

Looking ahead today, the lines are clearly drawn for USD: if Powell gives a firm easing signal and acknowledges a weaker outlook on the back of that NFP surprise, USD should come under fresh pressure as easing expectations rise again. However, if Powell refrains from giving a clear signal, perhaps focusing on continues inflation uncertainty, USD stands to rally sharply as traders pull back easing bets.

Trump & Powell

As this will be Powell’s final Jackson Hole symposium speech there should be plenty of summary talk about his term at the Fed. Given the pressure (and public scorn) put on him by Trump traders will be keen to see if the Fed chair uses this as an opportunity to assert the Fed’s independence once again which could lead to further attacks from Trump.

Technical Views

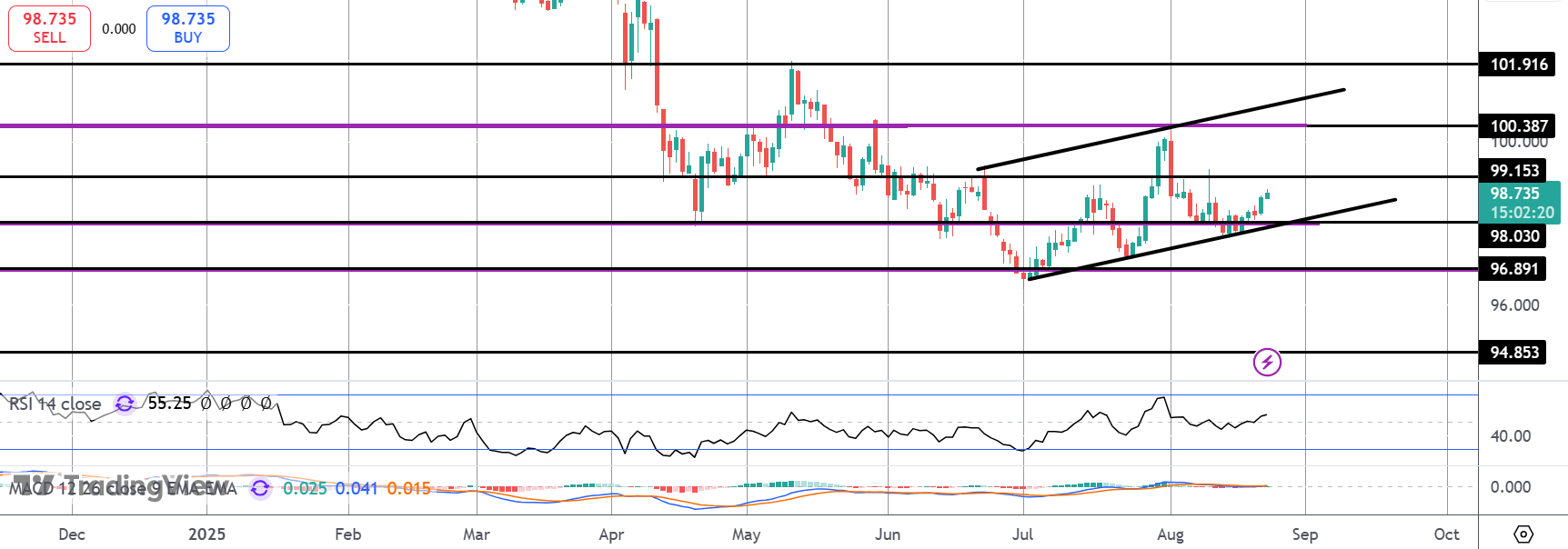

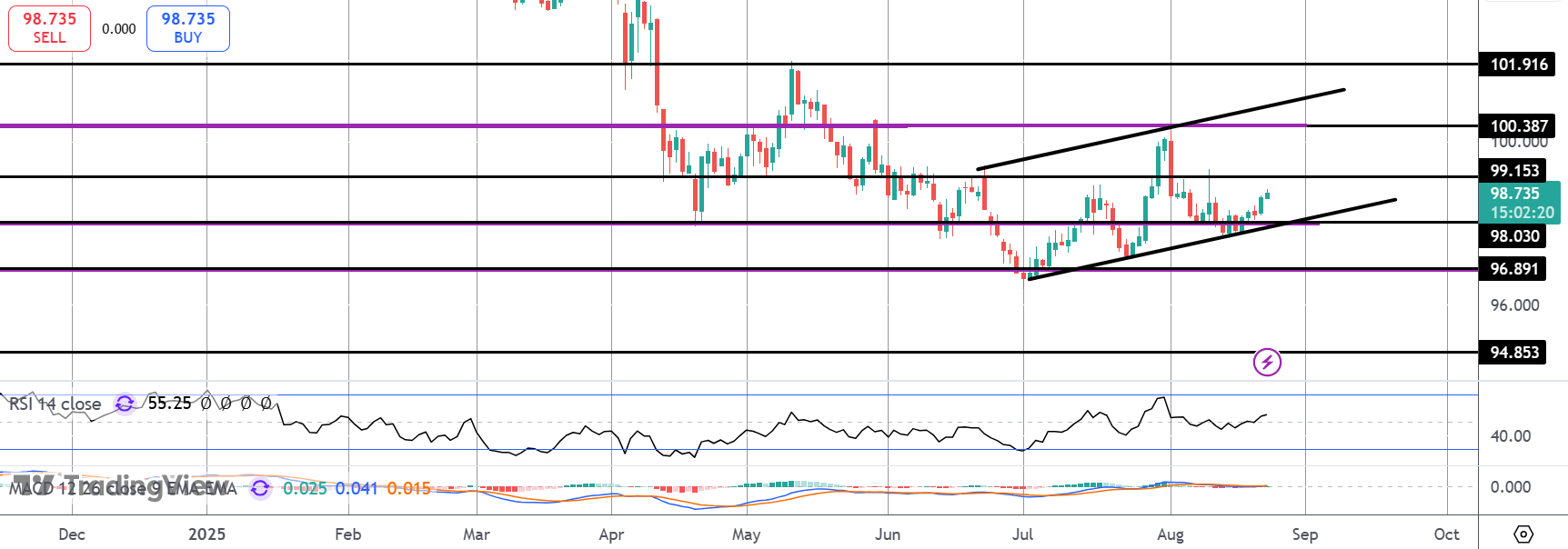

DXY

The index continues to recover off the 98 level and bull channel lows. 99.15 will be the next resistance to watch with the key 100 mark sitting above if we push further higher. If we break channel lows, 96.89 and the YTD lows will be the next support area to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.