Dollar Rally Continues Despite Mixed Fed Speak

Dollar Pushes On

The US Dollar continued to push higher yesterday with the trade-weighted index hitting fresh highs for the year. Momentum was capped later into the session however by dovish comments from Fed’s Daly. The San Franscisco Fed president was heard voicing her support for further rate cuts noting that there was no information to suggest the Fed shouldn’t continue reducing its headline rate. Daly went on to say that rates were still very restrictive given the trajectory of inflation and urged the need to prevent a further decline in the labour market.

Data-Driven Fed

Commenting on the bank’s recent half-point reduction, Daly noted that it was a close-call to go with a deeper cut though she personally was strongly in favour of the move. Looking ahead, Daly refrained from offering comments regarding the expected pace and scale of cuts, saying that the Fed would adjust rates in line with developments in the economy. As such, traders will be closely monitoring incoming inflation and labour market data to gauge likely Fed action.

Shifting Fed Outlook

Daly’s comments come on the back of other policymakers who spoke on Monday, displaying a preference for a slower pace of cuts going forward. Both Fed’s Logan and Kashkari cited the need for a gradual lowering of policy. This outlook feels more in line with the view the market has taken recently, pairing back expectations of further .5% cuts, seeing USD recover higher accordingly. While this narrative holds, USD likely has room to recover further ahead of the November FOMC.

Technical Views

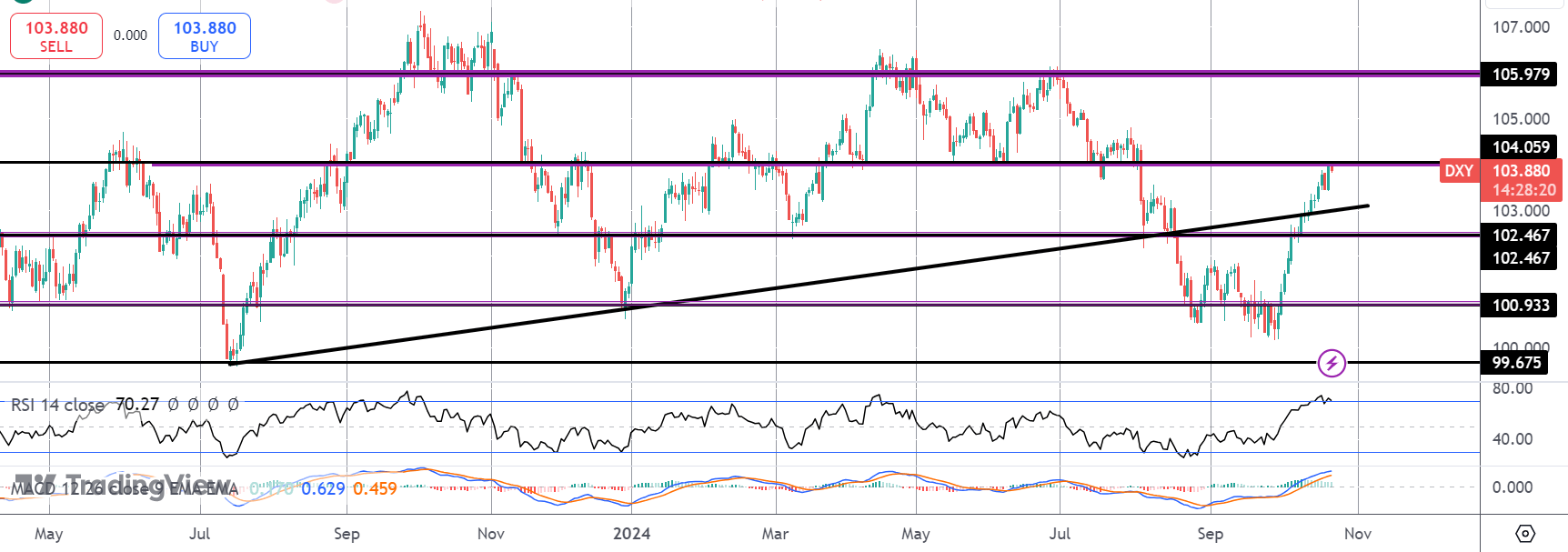

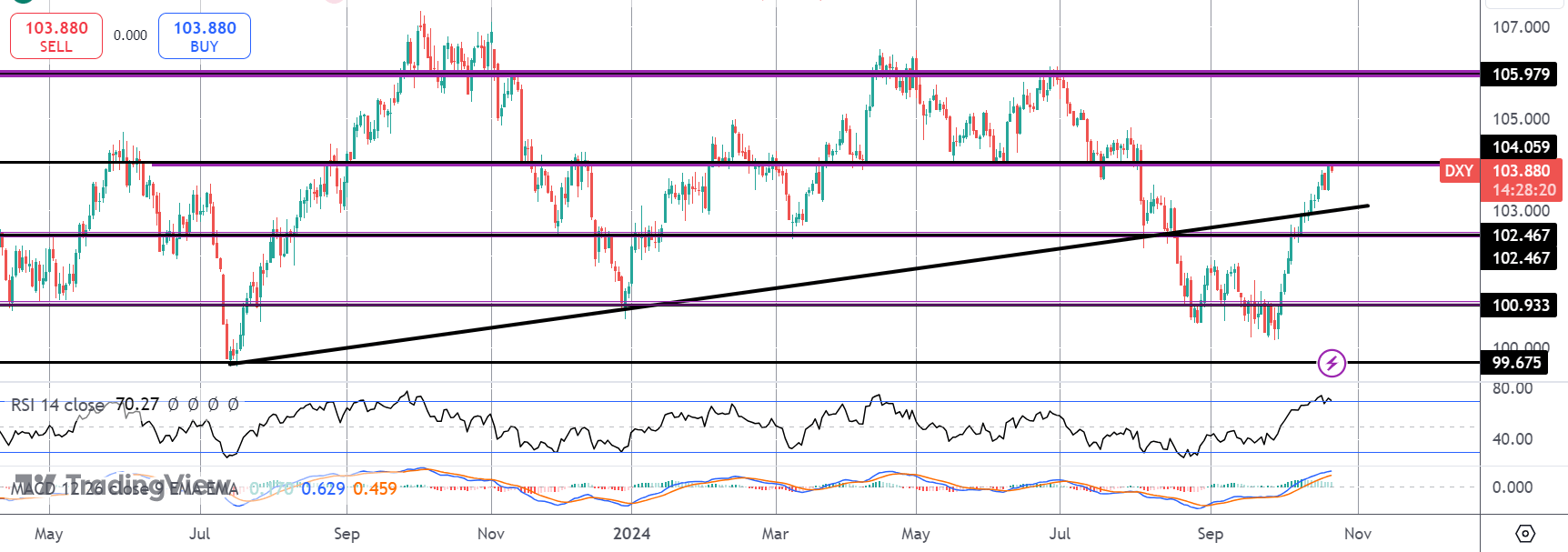

DXY

The rally in the DXY has seen price breaking back above the 102.46 level and the bull trend line. Price is currently stalled into a test of the 104.05 level. However, with momentum studies bullish, focus is on a continued push higher with 105.97 the higher bull target to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.