Dollar Pullback on Mean-Reversion Trade as Markets Reassess Implications of Trump's Policy Agenda

The US Dollar saw a notable surge of over 1.6% on Wednesday, marking its largest single-day gain in nearly four years. This rally reflects market reactions to President-elect Trump's policy agenda, which includes increasing import tariffs—a move expected to support domestic industries but also risk retaliatory trade measures—and reducing the corporate tax rate, which could boost after-tax corporate profits and elevate stock market valuations through higher discounted future earnings. These policies are also seen as likely to impact Federal Reserve policy, as faster economic growth and rising inflation may prompt the Fed to adjust its pace of monetary easing.

However, on Thursday, the DXY retraced to around 104.80, indicating a correction as investors take profits and reassess the sustainability of the "Trump trade". Technical resistance near the upper bound of the medium-term trend corridor contributed to this pullback. A breach below the 104.50 level could signal a further retracement toward 104 before the USD potentially resumes its upward trajectory:

The EUR/USD pair rebounded to near 1.08 after dipping below 1.0700. While this recovery suggests a short-term correction, several factors weigh on the Euro's prospects:

- Impact of US Protectionism: Trump's proposed tariffs could adversely affect the Eurozone economy, potentially reducing EU GDP by 0.1% by some estimates;

- ECB Vice President Luis de Guindos has cautioned that escalating trade tensions could initiate a global trade war, exacerbating economic uncertainties.

On the data front, slightly better-than-expected PMI figures from HCOB and robust German factory orders (up 4.2% YoY vs. 1.6% expected) have provided temporary support to the Euro. Nonetheless, the overarching sentiment remains cautious due to external risks and potential trade disruptions.

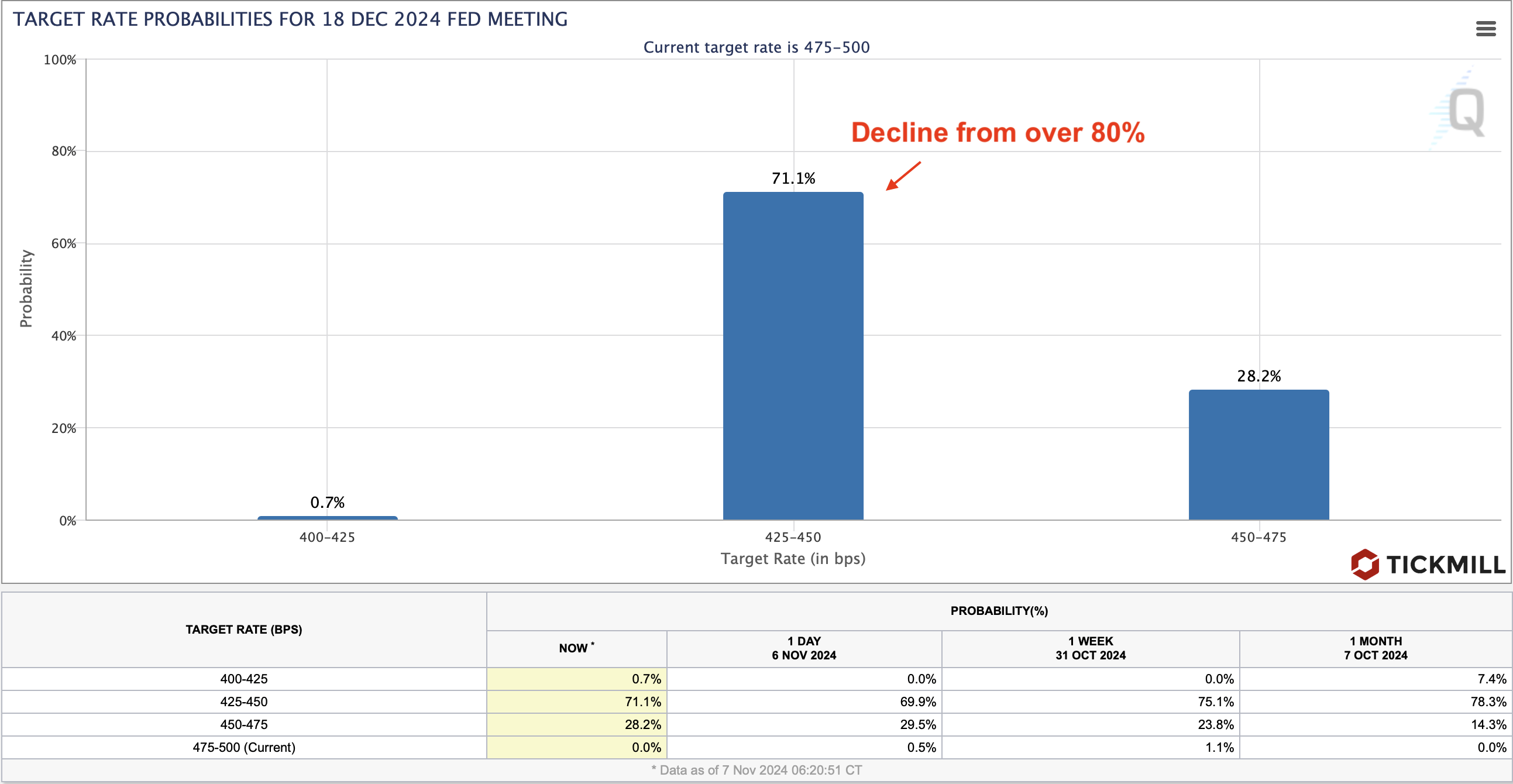

The Fed is widely expected to announce a 25 basis point interest rate cut today. Market participants have nearly fully priced in this move, with attention now turning to December policy decision. Implied odds for a December rate cut have decreased from over 80% to 71.1%, suggesting some uncertainty about the Fed's path amid Trump’s trade and fiscal agenda:

Upcoming data on weekly unemployment claims and consumer credit will offer further insights into the health of US consumption and labor markets.

The British Pound has gained traction following the Bank of England's decision to reduce interest rates by 25 basis points to 4.75%. Key considerations include:

- Monetary Policy Committee (MPC) Vote: The 8-1 vote in favor of the cut indicates a strong consensus toward supporting economic growth;

- Forward Guidance: Governor Andrew Bailey signaled a willingness to continue easing if economic data aligns with expectations but maintained a cautious stance due to persistent inflationary pressures.

From a technical perspective, GBP/USD has tested the ascending trendline multiple times and found support near the 200-day SMA around the 1.28 level:

This suggests upward momentum, with potential breakout above the 1.30 level. A sustained break above this could pave the way for further gains, although medium-term risks associated with global trade policies remain.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.