Dollar Major Recovery Becomes a Real Risk After a Surprisingly Strong US Payrolls Report

US equities posted a good performance on Thursday, with the SPX almost testing 4200 points and NASDAQ jumping 3.56%, very close to 13000 points, the highest level since the end of August. The FOMC meeting was a nothingburger with the FOMC statement and Powell comments indicating a strong bias towards a much less hawkish stance, which could open the way to new local highs this year, but Friday Payrolls report thwarted the bullish outlook for risk assets. Also, the market rebound on Thursday was not reflected in a corresponding decline in Treasury yields: despite the rise in equities, the 10-year bond yield hovered very subduedly around 3.35%, the level that formed after the Fed meeting on Wednesday. Thus, speculative momentum could join the rise in the stock market, which should make it more vulnerable to a pullback in the event of bearish catalysts.

Gold price, despite an initial rise after the FOMC, plunged on Thursday, leaving many questions about the investors’ take on the FOMC meeting. Since gold returns are a function of the real interest rate (the lower the expected rate, the higher the value of gold, all other things being equal), gold collapse suggests that the Fed meeting did not provide a convincing argument that real US rates will go down in 2023, including through the transition of the Fed to a soft policy.

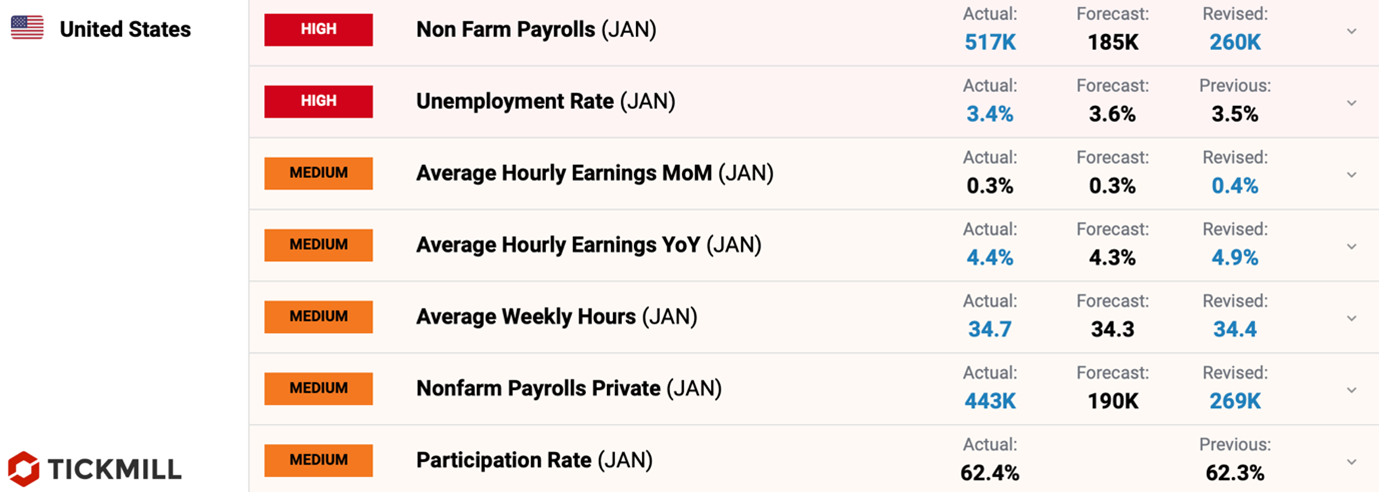

The shocking Non-Farm Payrolls report today brought back a 50 bp Fed rate hike to the list of possible scenarios at the next meeting! Job growth more than doubled the forecast - 517K (expected 185K). The previous Payrolls figure was also significantly revised upwards to 260K. Wages in annual terms accelerated to 4.4%:

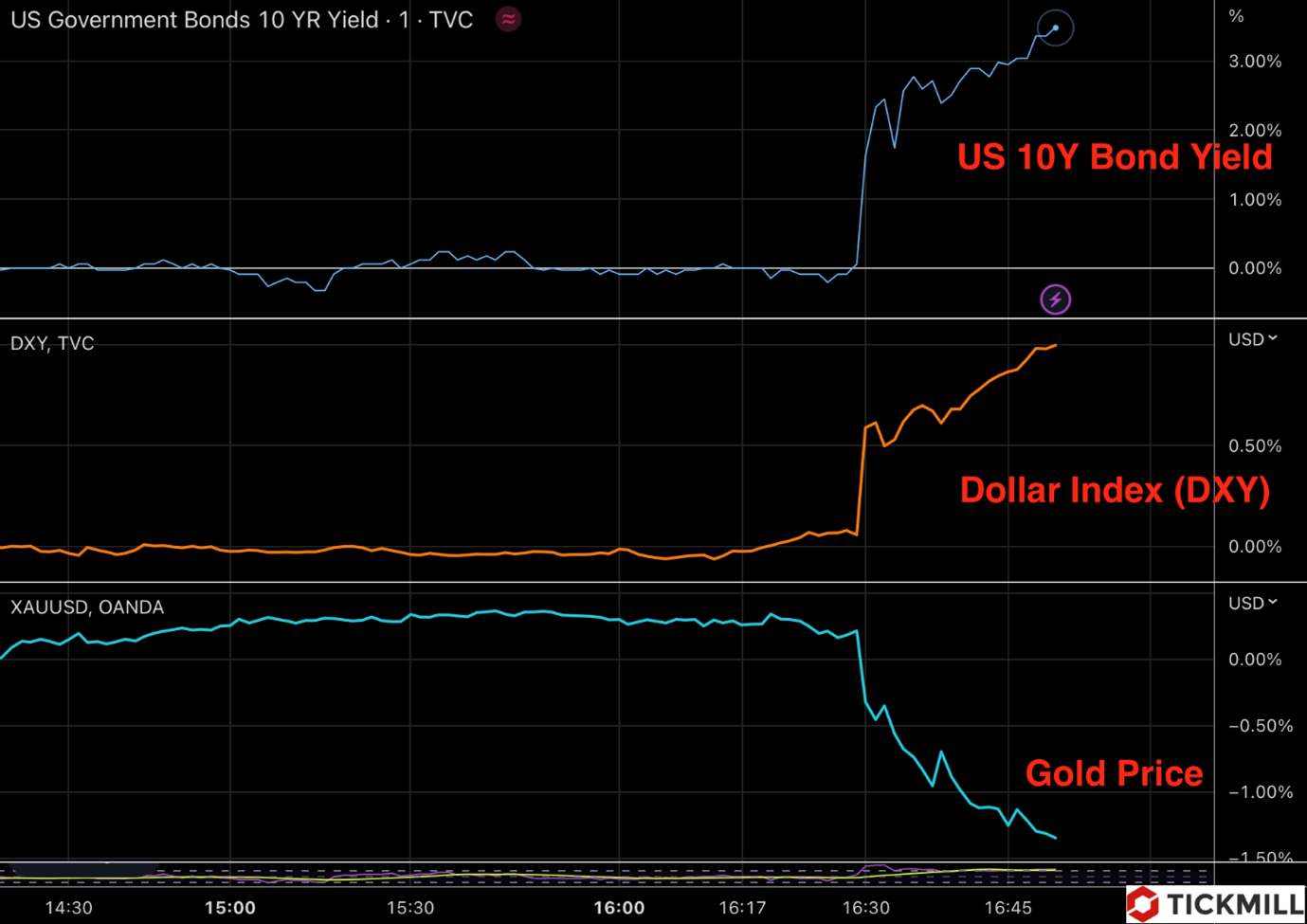

The release of the report caused a sharp strengthening of the dollar, the index of the US currency jumped by more than 0.5%, and the yield of the 10-year bond returned to the level of 3.5%. Gold collapsed:

Strong Payrolls report, in my opinion, will significantly complicate further rally in the risk assets market, since the outlook for lower Fed rates in the second half of 2023 was the driver of bull run. Now, market participants may seriously consider that instead of a single rate hike, the central bank will deliver more or move to “large-caliber shells” (a 50 bp increase) as a strong labor market can generate inflation longer, which may require a longer central bank intervention. On the other hand, the report showed that the US economy is in excellent shape and maintains the momentum of expansion, which allows investors to revise growth outlook for US firms, and hence their expected yield. As one can see, the risk assets market will now be affected by two factors: one positive, in the form of a strong economy, and one negative, the Fed's later transition to a neutral policy setting.

The most likely market scenario next week is a moderate downward correction of risk assets and extension of the dollar rebound, these trends may sharply intensify in the event of a re-acceleration of inflation in January. The January CPI will help to clarify this risk.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.