Dollar Index Dips While EURUSD Climbs Following US Inflation Report

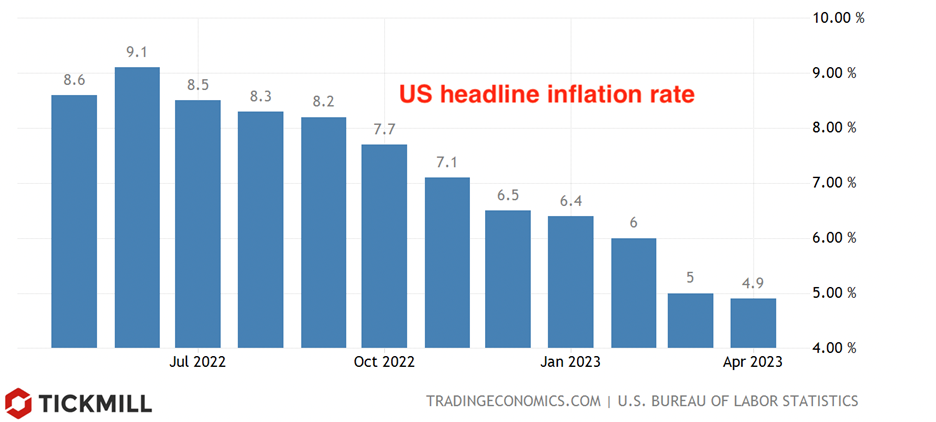

The dollar took a nearly half-percent dip, while EURUSD climbed above 1.10 following the US inflation report. Market expectations were quite pessimistic ahead of the report, as preliminary data, such as the unemployment report, indicated the prospects of escalating price pressures in the economy. However, the negative expectations were not met, as overall inflation dropped to 4.9% against a forecast of 5.0%.

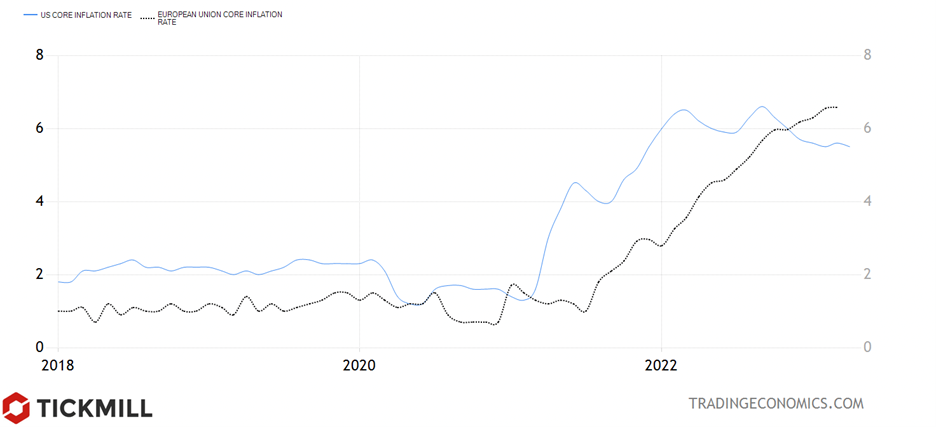

Nevertheless, the more crucial indicator for the Fed, core inflation, only eased by a mere 0.1% to 5.5%, in line with forecasts. Similar to the EU, core inflation in the US declines at a rather slow pace, despite the most aggressive monetary policies by central banks in decades:

When calculating core inflation, fuel and food prices, which can fluctuate significantly due to cyclical and seasonal supply changes (especially in global markets), are not taken into account. Therefore, core inflation is less volatile, not jumping up and down from month to month, and seems to better reflect consumer demand trends.

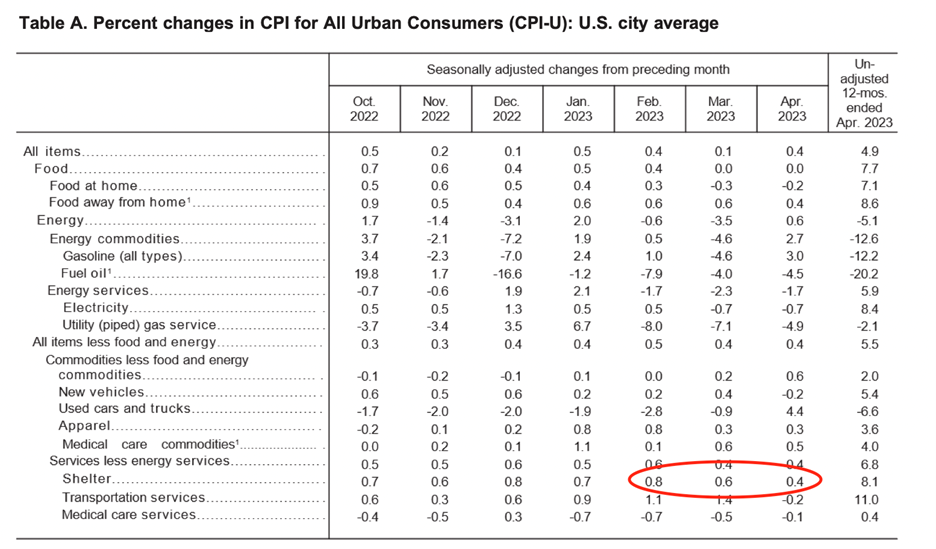

Examining price growth across categories separately, one notable positive aspect is the inflation rate for rental costs (Shelter), which holds a weight of over 30% in CPI and tends to move in trends. It has been declining for the third consecutive month and stood at 0.4% on a monthly basis:

Another interesting development was the surge in prices for used cars (+4.4%) after more than 6 months of deflation.

US Treasury yields declined after the release of the inflation report, albeit minimally, as there were no surprises in core inflation. The yield on the 10-year Treasury bond decreased by approximately 5 basis points, while the yield on the 2-year Treasury bond dropped by 10 basis points. In the interest rate derivatives market, swaps on the Fed's interest rate lowered the probability of a rate hike in June.

Rate futures market currently assigns an almost 90% probability to the Fed's pause in June, which somewhat limits potential downside for the dollar as the room for dovish surprise is obviously small. However, the US currency could significantly strengthen if data on accelerated inflation in June emerges.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.