Dollar and Equities Saw Muted Reaction to Dovish US CPI Surprise. Here is why.

The US inflation report had a moderately favorable outcome for the market. Both overall and core inflation figures came in below expectations, slightly alleviating market tension linked to the risk of another rate hike by the Federal Reserve (Fed). Overall inflation eased from 3.3% to 3.2%, but more importantly, core inflation retreated by 0.1% to 4.7%. Nevertheless, the market viewed the inflation slowdown as unconvincing: not only did the dollar not transition into a sustained decline on the positive surprise, but it also swiftly recovered from the initial dip:

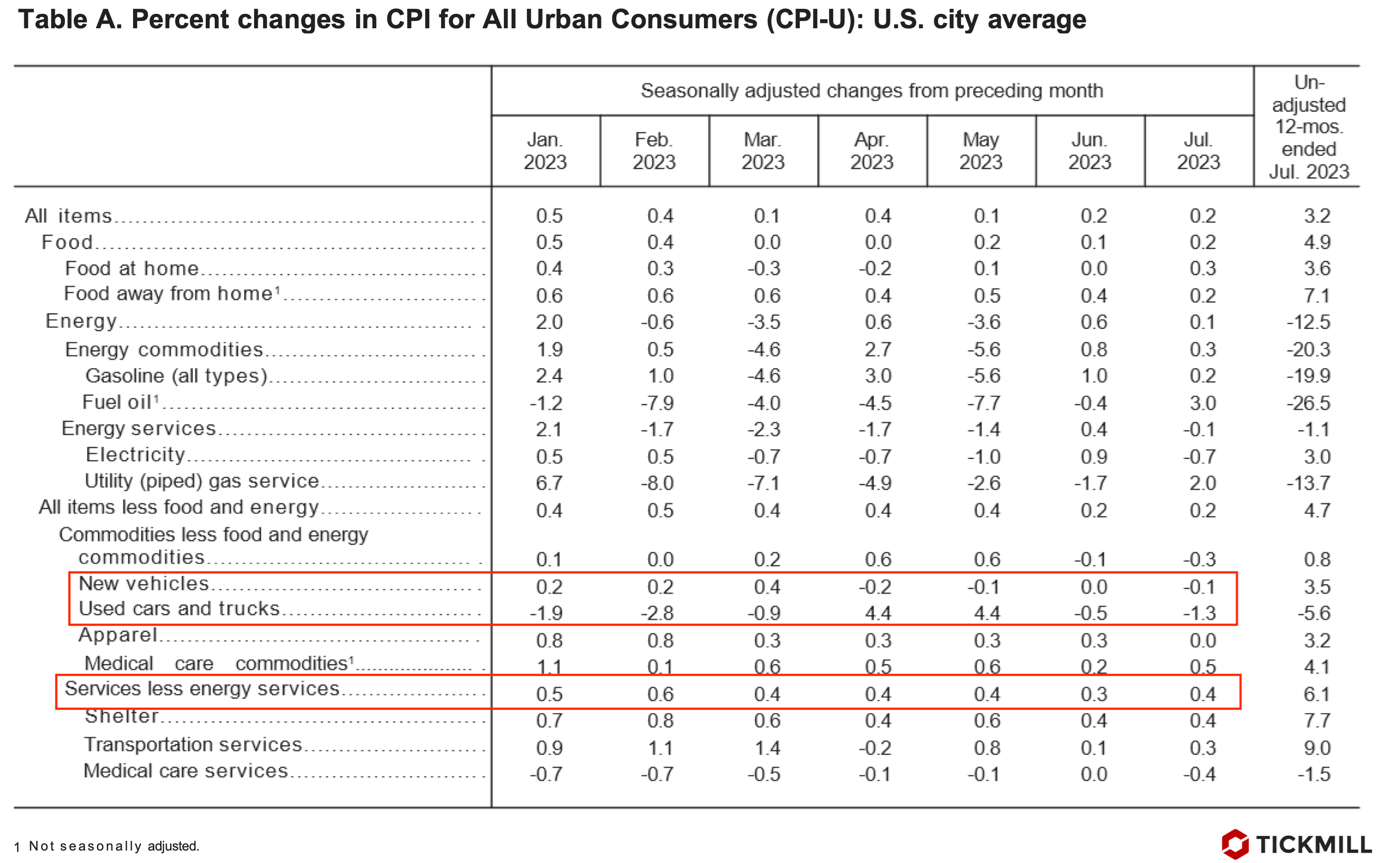

Upon delving into the report's details, it becomes evident why the positive numbers prompted a seemingly disproportionate positive market reaction:

Firstly, what stands out is the acceleration of consumer inflation in core services, rising from 0.3% to 0.4%. Powell has previously drawn the market's attention to inflation within the services sector - until it consistently recedes, the Fed will be hesitant to alter its policy course. Several reasons contribute to this stance:

The services sector generates a substantial portion of the US GDP (approximately 70%);

It's a more labor-intensive sector, implying a higher contribution of human labor as a production factor, thus yielding more significant implications for the labor market;

Consumer prices within the services realm tend to be stickier compared to goods, which are subject to fluctuations, including those stemming from changes in supply and demand for commodities in global markets. Since service prices change less readily, they shape medium-term inflation trends.

Secondly, examining the "Shelter" category, which primarily comprises housing expenses, reveals that inflation remained unchanged at 0.4% compared to the previous month. This category holds a weight of over 30% in the Consumer Price Index (CPI), and prices within it are particularly sticky. The desired changes by the Fed, as evident, did not materialize.

Consequently, the market's response has been somewhat cooled by the price gains in new and used automobiles, energy resources, clothing, and medical services. This outcome does seem unconvincing in terms of the impact on the Fed course. Consequently, the probability increases that the Fed will emphasize that it maintains wait-and-see stance in upcoming comments. If Fed’s remarks indicate that the decrease in July's inflation affected forecasts, a more pronounced upward rebound in risk assets and a more significant decline in the dollar can be anticipated.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.