Dissecting the Markets: EURUSD's 1.05 Support Weakens on Fresh Tariff Threats

The US Dollar has reasserted its dominance on Tuesday, propelled by heightened geopolitical anxieties. President-elect Donald Trump's recent declaration to escalate tariffs against Mexico, Canada, and China has injected a fresh wave of uncertainty into the markets. By announcing an additional 25% tariffs on Mexico and Canada, coupled with a further 10% levy on China atop the existing 60% tariffs from his campaign promises, Trump has significantly intensified trade tensions across North America and beyond.

Following a brief dip on Monday triggered by the nomination of hedge fund veteran Scott Bessent as Treasury Secretary, the USD has halted its downward correction, constraining upside in its major peers like EUR and GBP. Initially, Bessent's appointment sparked concerns regarding US fiscal discipline and political stability, leading to a sharp decline in the dollar's value. However, the renewed rhetoric from the President-elect has overshadowed these worries, restoring confidence in the USD.

The EUR/USD chart reveals a notable increase in intraday volatility around the 1.05 level, reflecting heightened market uncertainty regarding the pair's future trajectory. Escalating rhetoric from Trump on tariffs and fair trade has significantly boosted risk-off sentiment toward the Euro. Additionally, the apparent lack of upward momentum to push the pair above the 1.05 mark suggests growing downside potential, indicating the price may be preparing for a further decline in the coming days:

Equity markets worldwide are grappling with widespread downturns. Major indices across Japan, China, and Europe are recording red figures, albeit the losses remain relatively contained, averaging below the 1% mark. In the US, bond prices are experiencing a downward trajectory, driving yields higher on renewed inflation concerns from Trump’s tariff threats.

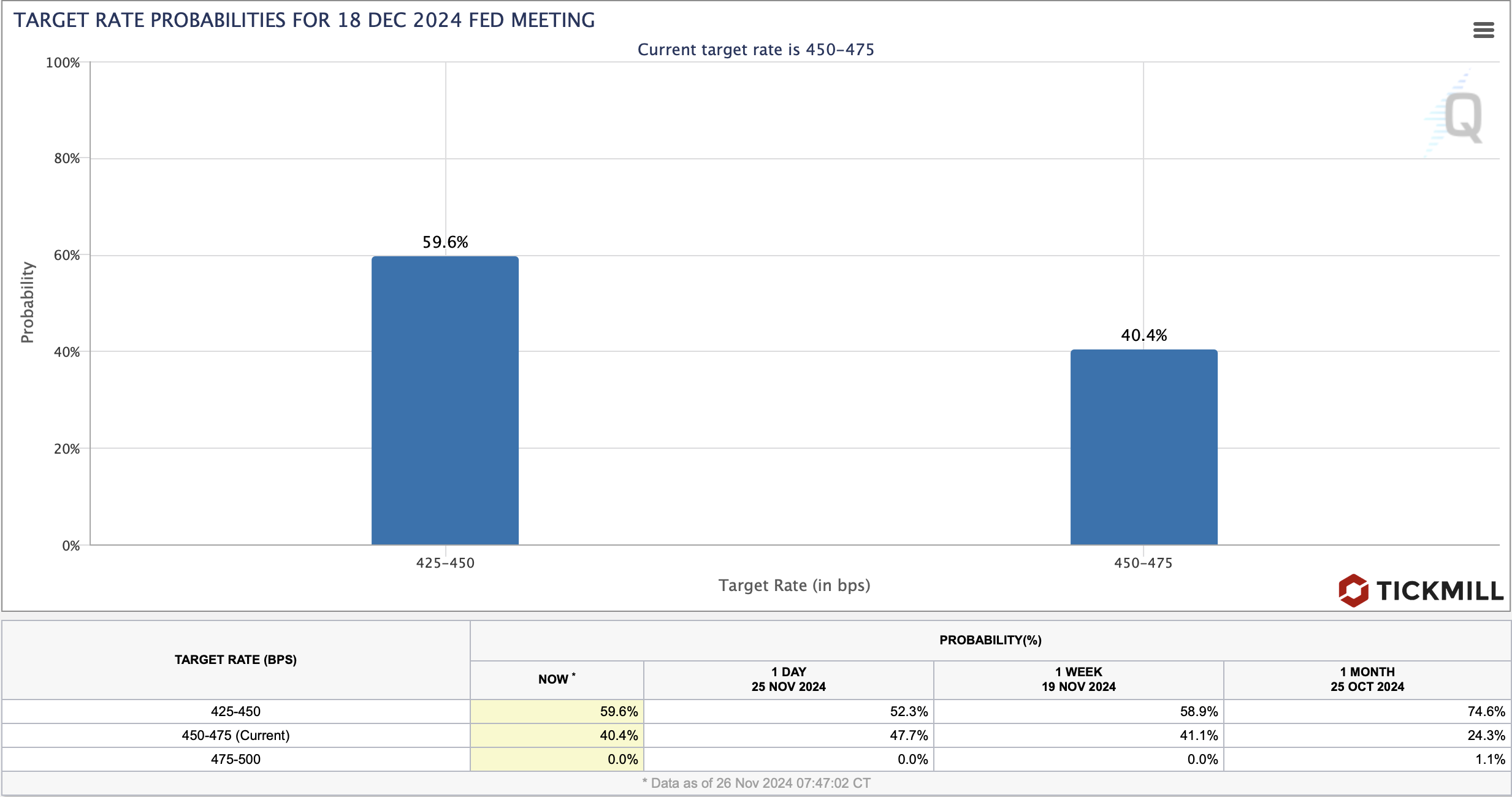

The Federal Reserve's November 7 meeting minutes, set for release today, are expected to provide insightful clues into the central bank's monetary policy outlook, particularly in light of the recent 25 basis point rate cut. Interest rate futures indicate a 60% probability of an additional 25 basis point rate cut in the upcoming December meeting, while a 40% likelihood exists for rates to hold steady:

The British Pound remains largely flat against its major counterparts as the market awaits clearer signals from the Bank of England regarding its interest rate trajectory. Governor Andrew Bailey and most BoE policymakers advocate for a measured approach to policy easing, citing ongoing inflationary concerns. Deputy Governor Clare Lombardelli emphasized the importance of a gradual withdrawal from monetary restrictions, highlighting the persistent risk of inflation exceeding forecasts, with wage growth stabilizing around 3.5%-4% and the Consumer Price Index hovering near 3%.

The daily technical chart of GBP/USD indicates underlying weakness in the pair, as it fails to challenge the medium-term bullish trendline and continues to consolidate just above the critical 1.25 level. The lack of buying interest around this key support, similar to the situation with the Euro, suggests that downside pressure may be building in the near term:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.