DAX Rallies on ECB Comments & Earnings Boost

DAX Turning Higher

The DAX is attempting to push higher today, bolstered by some positive news in the earnings backdrop and dovish comments yesterday from ECB president Lagarde. On the earnings front, we saw Swiss pharma company Novartis lifting its full year guidance after better-than-forecast Q1 results. French car giant Renault also came in above forecasts with its Q1 results as did DNB, Norway’s largest bank. There were other positive results seen across the board with names such as Italian fashion brand Golden Goose topping earnings along with German software maker SAP, adding to generally bullish sentiment across European asset markets on Tuesday.

ECB Sticks to Rate Cut Forecasts

Speaking yesterday, ECB’s Lagarde doubled down on the bank’s projections for multiple rate cuts this year. Speaking at the IMF’s Spring Meetings, Lagarde told reporters that the bank fully intended to press ahead with rate cuts this year. With regards to timing, Lagarde signalled that the bank was fast approaching the time to begin easing, so long as there are no major shocks seen.

ECB Watching Oil

In terms of risks and threats, Lagarde said the bank was monitoring oil prices very closely, in line with the risks stemming from the crisis in the Middle East. Despite the recent uptick in violence between Iran and Israel, however, Lagarde noted the oil price reaction had so far been moderate. For now, expectations of a June rate cut should keep EUR assets supported with only an uptick in inflation likely to derail this view.

Technical Views

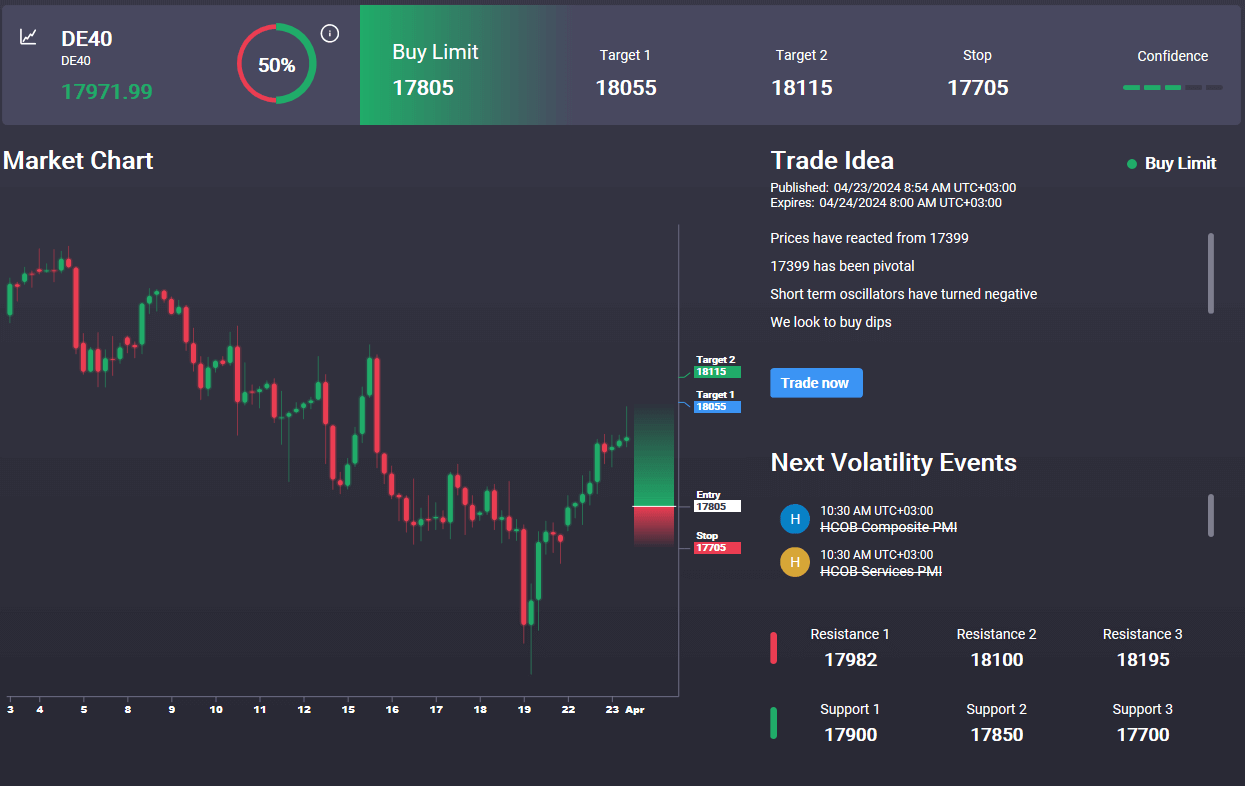

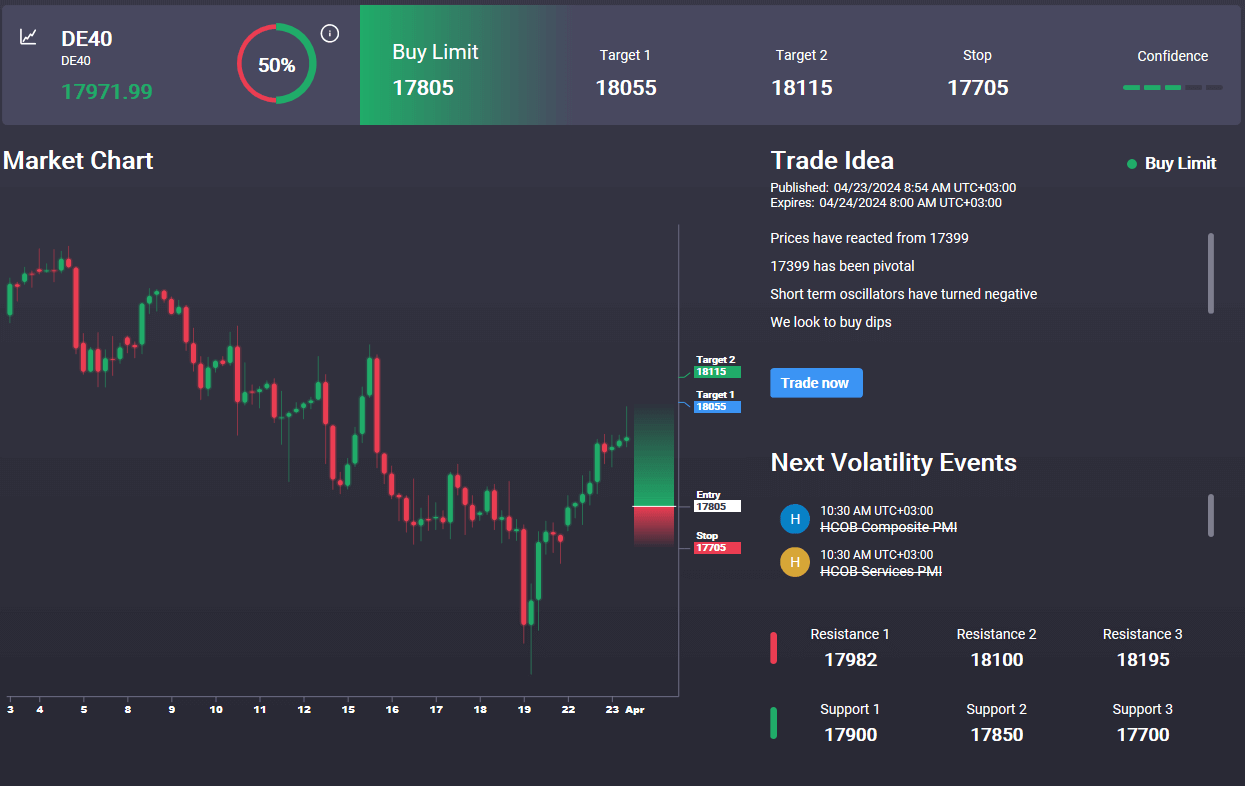

DAX

The rally in the DAX has stalled for now into highs around 18547.75 with price since reversing and breaking below the bull channel. 17609.45 is holding as support for now and, while it does, focus is on a continuation higher. Below there, 16997.55 is the next support to note. In the Signal Centre today, we have a buy signal set below market at 17805 suggesting a preference to buy any weakness for a continuation higher.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.