Daily Market Outlook, September 13, 2023

Munnelly’s Market Commentary…

Asian equity markets faced downward pressure, influenced by the recent tech-related declines on Wall Street, driven by post-Apple event disappointment. Additionally, market participants exhibited caution as they awaited the release of upcoming U.S. Consumer Price Index (CPI) data, which is of significant interest to global financial markets. The Nikkei 225 index in Japan experienced fluctuations, initially swinging between gains and losses. Early gains were observed following mixed Producer Price Index (PPI) data and an improvement in the BSI (Business Survey Index) large industry surveys. However, the index eventually slipped, with money markets now pricing in the Bank of Japan (BoJ) to exit negative interest rates in January, as opposed to the previous expectation of an exit in September of the following year. The Hang Seng index in Hong Kong and the Shanghai Composite index in mainland China initially held their ground, buoyed by strength in energy sector stocks and positive developments as some cities eased restrictions on the real estate sector. However, both indices later succumbed to the prevailing negative sentiment.

UK GDP data for July revealed a monthly decline in economic activity amounting to 0.5%. This drop was larger than what was generally expected. Several sectors, including industrial production, construction, and services, experienced declines during the month. While this decline may be partially attributed to the stronger-than-expected performance in June and the impact of temporary factors like adverse weather and strike actions, it signifies a weak start to the third quarter. Achieving the Bank of England's August forecast of 0.4% quarterly growth in GDP will be challenging given these circumstances. When making the next week's interest rate decision, BoE policymakers will need to weigh this against other signs pointing to a potential slowdown in economic growth.

In anticipation of tomorrow's European Central Bank policy update, July's Eurozone industrial production data is expected to reveal a 0.9% monthly decline. This would mark the first decrease in four months and is another indication that economic activity in the region had a sluggish start to the third quarter. The ECB will need to consider this data when making its latest interest rate decision, while also keeping in mind the persistently elevated inflation levels in the Eurozone.

Stateside the August US Consumer Price Index (CPI) report, set to be released this afternoon, holds significance as it precedes the Federal Reserve's decision on US interest rates next week. Despite the likely increase in headline inflation due to the recent surge in oil prices, the Fed is expected to keep interest rates unchanged, marking the second "pause" this year. Acceleration in gasoline prices will lead to a 0.6% monthly price increase, pushing annual inflation to a three-month high of 3.7%, up from 3.3% in July. A more reassuring aspect for the Fed is that core inflation is expected to decrease further to 4.4% from the previous 4.7%. If core inflation does indeed continue to decline, it should allow Fed policymakers to overlook the rise in the headline rate and maintain their stance on interest rates. Nevertheless, they are likely to continue emphasising potential inflation risks.

FX Positioning & Sentiment

The USD/CNH currency pair experienced a decline as China implemented measures to tighten liquidity in the offshore yuan market. The USD/CNH exchange rate dropped from its opening level of 7.3011 to 7.2903, indicating a weakening of the U.S. dollar against the Chinese yuan. This decline in the exchange rate may lead to a potential test of the level at 7.2777, which marks the entrance point of a downtrend channel in technical analysis. A close below this level on Wednesday could establish a bearish technical bias for the USD/CNH pair, suggesting a possible strengthening of the Chinese yuan against the U.S. dollar. Concurrently, the offshore yuan saw an increase in its value as China implemented measures to tighten liquidity in the market. The People's Bank of China (PBOC) announced its intentions to ramp up the sale of yuan-denominated bills in Hong Kong, contributing to the liquidity tightening measures. Overnight CNH funding rates surged to their highest levels since April 2022, underscoring the heightened demand for yuan liquidity and its impact on currency markets.

CFTC Data As Of 08-09-23

USD net USD G10 short -$3.4bn in Aug 30-Sep 5 period, $IDX +1.17% in period

Fed high for longer versus whiff of steady ECB, less austere BoE lifts USD

EUR$ -1.42% in period, specs -10,448 contracts now +136,231

Sellers overwhelm bottom-fishers as king USD reigns, pair flat since Tuesday

$JPY +1.23% in period, specs +1,337 contracts now -97,136

Longs sell USD ahead of expected intervention area near 150

GBP$ -0.68% in period, specs sell 2,017 contracts now long 46,384

Traders sense dovish BoE shift, high BoE rate path tempers GBP weakness

CAD & AUD shorts rise 9k & 13k respectively amid weak China growth view

BTC -6.79% in period, specs buy 532 contracts long grows to 2,039 contracts (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0730 (420M), 1.0755 (697M)

1.0765-75 (471M), 1.0825 (475M), 1.0845-50 (659M)

1.0855-60 (481M)

USD/JPY: 144.05 (389M), 146.69-75 (275M), 147.50 (252M)

USD/CHF: 0.8850 (251M). EUR/CHF: 0.9450 (375M)

0.9500 (225M), 0.9550 (300M)

GBP/USD: 1.2500 (214M). EUR/GBP: 0.8750 (386M)

AUD/USD: 0.6315 (260M), 0.6355 (220M), 0.6400-05 (538M)

0.6500 (445M), 0.6525-35 (1.18BLN)

Overnight Newswire Updates of Note

European Markets Set For Negative Open Ahead Of US Inflation Data

Japan PPI (Y/Y) Aug: 3.2% (est 3.3%; prev R 3.4%)

BoJ Watchers Bring Forward Rate Hike Forecasts On Ueda’s Remarks

China Extends Tariff Exemption On Certain US Goods

RBNZ's Silk: Decisions From Liquidity Policy Review To Come By End-2023

N.Korean Leader: Russia Trip 'Clear Manifestation' Of Prioritising Ties With Russia

N.Korea Fired Ballistic Missile, Likely Landed Outside Japan’s EEZ

ECB's Crucial 2024 Projection To Put Inflation Above 3%, Source Says

Senate Republicans Align With Democrats To Avoid Shutdown

Country Garden Wins Vote To Extend Repayment Of Seven Yuan Bonds

Arm Is Expected To Price IPO At Top End Of Range Or Higher

Honda, BMW And Ford Seek To Optimise EV Grid With New Venture

Apple Raises iPhone 15 Pro Max Price To $1,199

UAW May Strike At Small Number Of Factories If It Can’t Reach Deals

Amazon To Boost Pay For Contracted Delivery Drivers

T-Mobile To Buy Up To $3.3 Bln Of Airwaves From Comcast

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

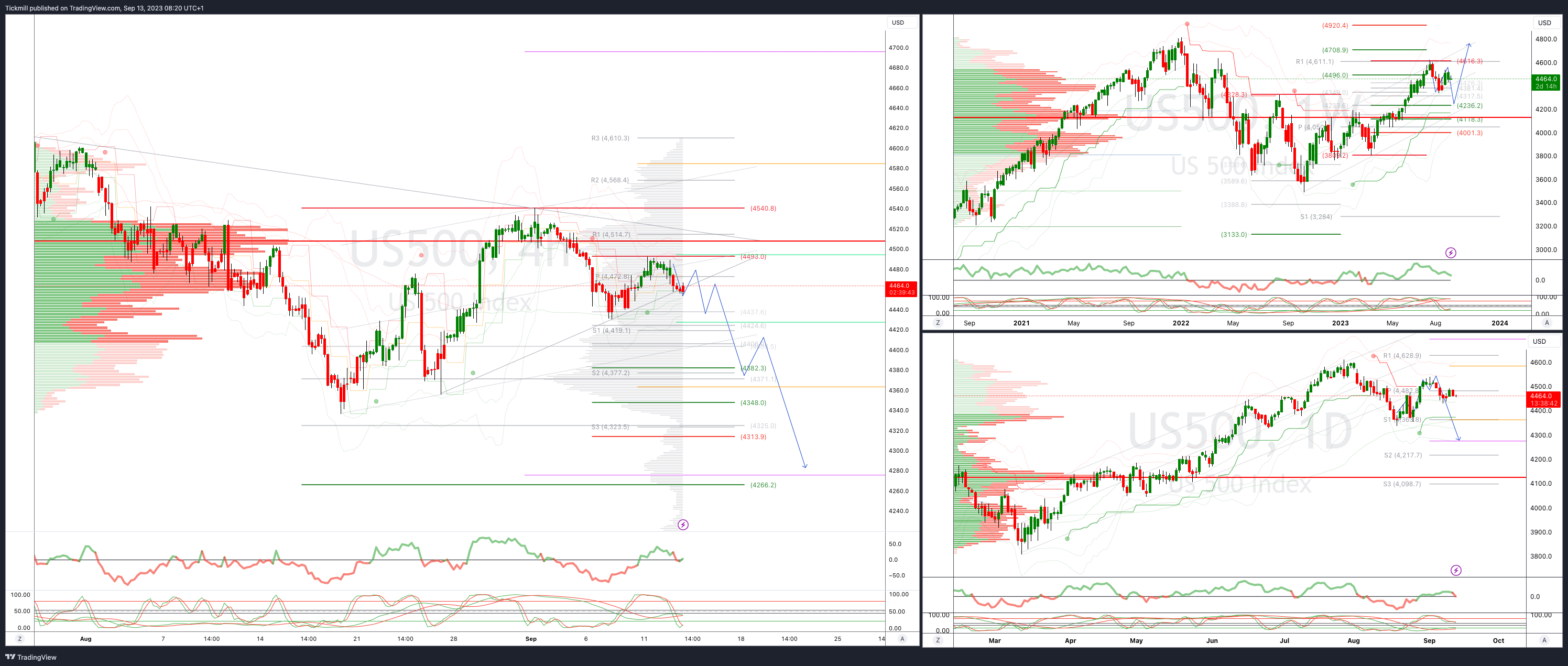

SP500 Bias: Bullish Above Bearish Below 4500

Above 4500 opens 4540

Primary resistance is 4550

Primary objective is 4266

20 Day VWAP bullish, 5 Day VWAP bearish

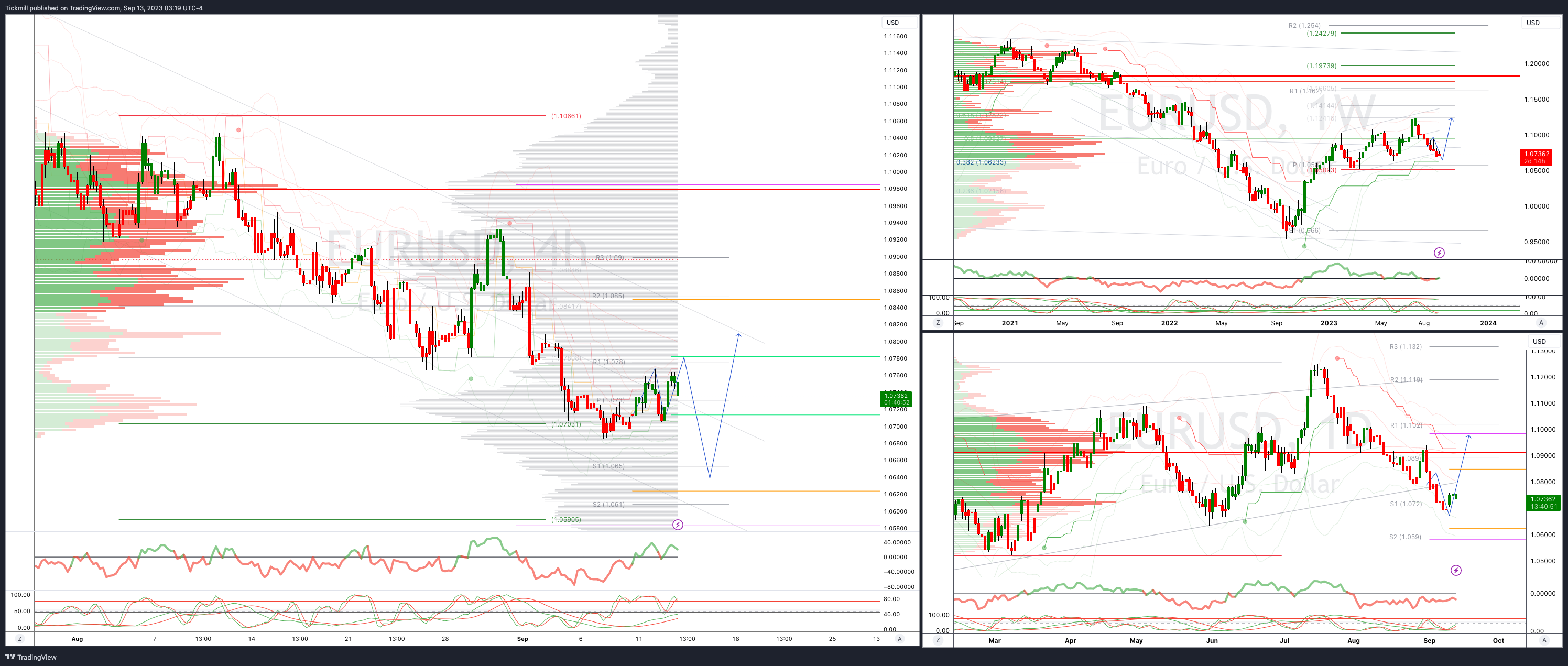

EURUSD Bias: Bullish Above Bearsih Below 1.0810

Above 1.860 opens 1.0945

Primary resistance is 1.1066

Primary objective is 1.0660

20 Day VWAP bearish, 5 Day VWAP bullish

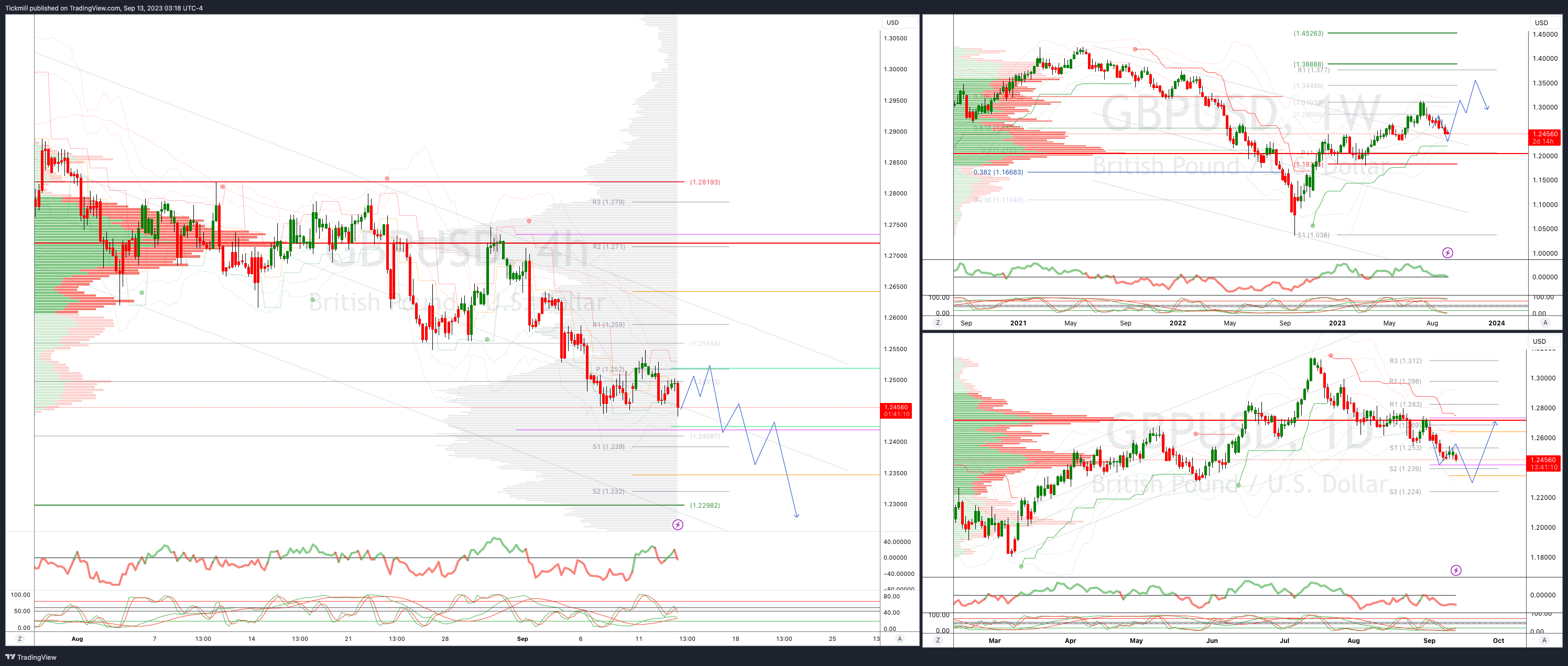

GBPUSD Bias: Bullish Above Bearish Below 1.2560

Above 1.2650 opens 1.27

Primary resistance is 1.2750

Primary objective 1.23

20 Day VWAP bearish, 5 Day VWAP bearish

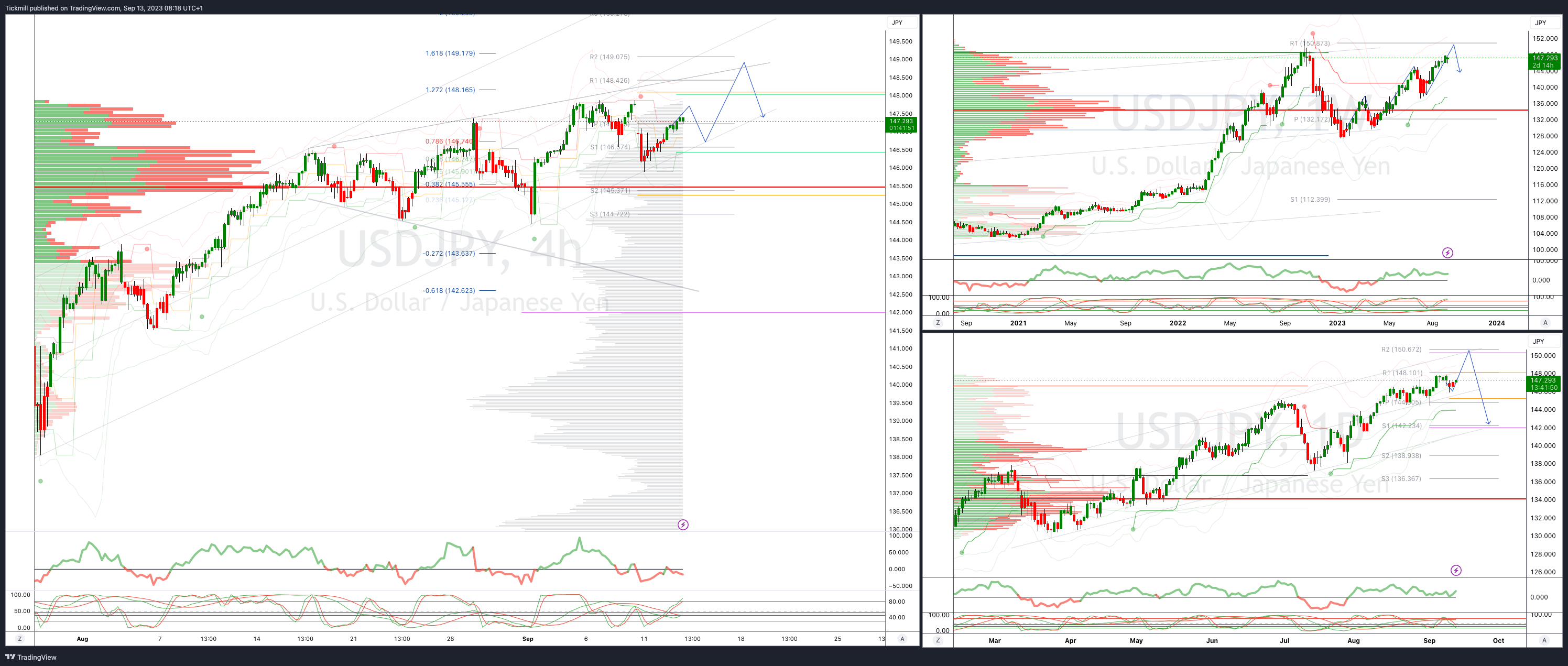

USDJPY Bias: Bullish Above Bearish Below 146.50

Below 146 opens 144.90

Primary support 144.50

Primary objective is 150

20 Day VWAP bullish, 5 Day VWAP bullish

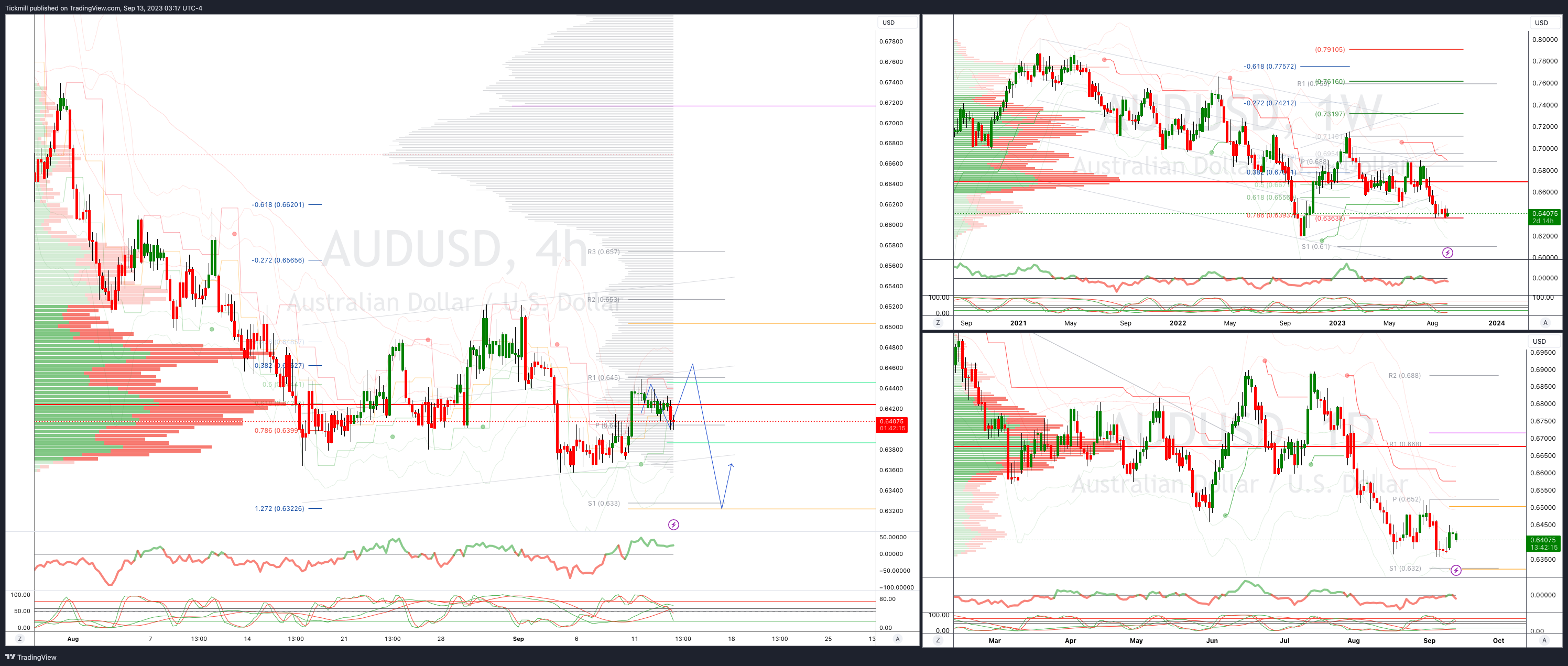

AUDUSD Bias: Bullish Above Bearish Below .6450

Above .6475 opens .6525

Primary resistance is .6620

Primary objective is .6320

20 Day VWAP bearish, 5 Day VWAP bullish

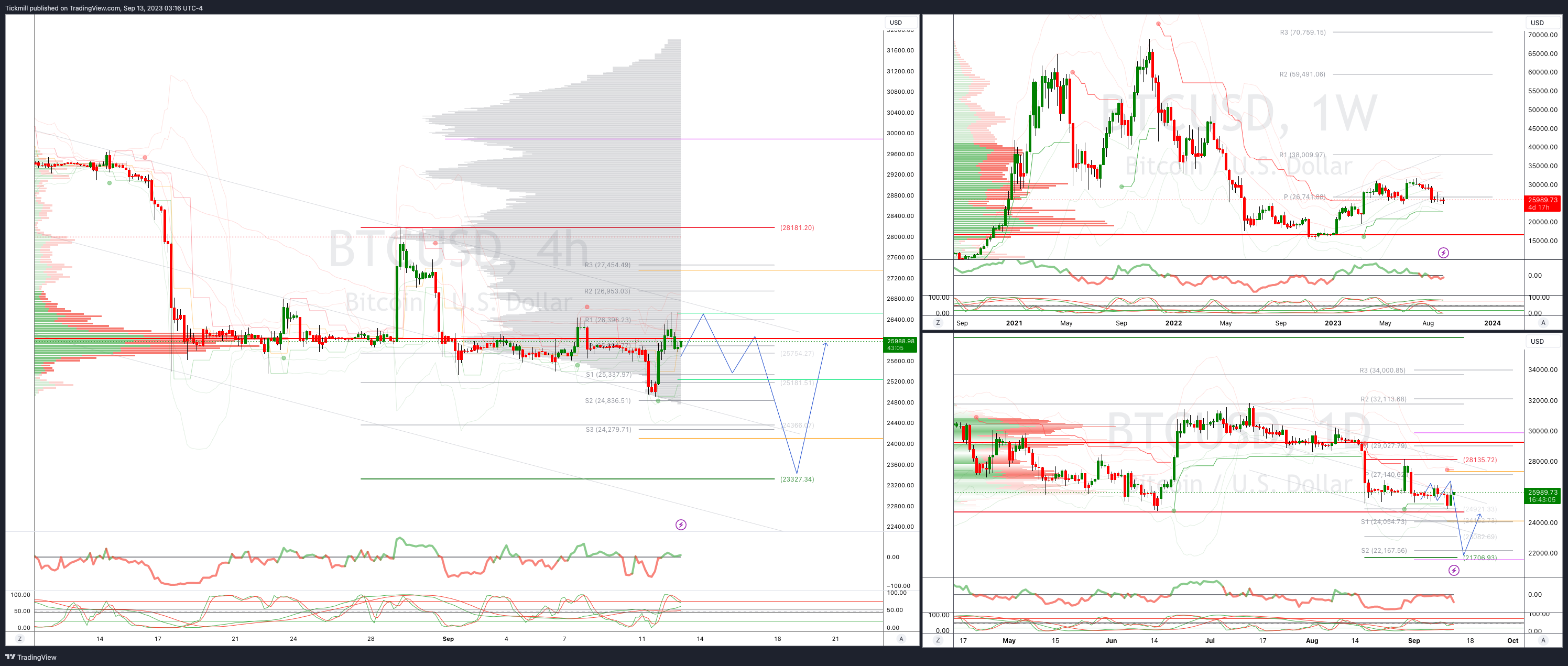

BTCUSD Bias: Bullish Above Bearish below 26175

Above 28200 opens 30000

Primary resistance is 28175

Primary objective is 23300

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!