Daily Market Outlook, October 19, 2020

Most equity markets have made a positive start to the week across the Asia Pacific, buoyed by optimism around the prospect of further US stimulus. This follows lengthy discussions over the weekend between House Speaker Pelosi and Treasury Secretary Mnuchin, which have increased expectations that a stimulus package will be forthcoming in one form or another, irrespective of who wins the Presidential election. Meanwhile, equities in China have slipped following the weaker-than-expected Q3 GDP report. The economy expanded by 2.7%q/q, disappointing market expectations for a 3.3% rise. However, monthly outturns for September industrial production and retail sales beat expectations pointing to the economy ending the quarter with much firmer-than-expected momentum.

Outside of China, the growth outlook remains highly uncertain, with the past week seeing sharp increases in the number of Covid-19 cases. Record numbers have been posted in some European countries and the numbers seem to be on the rise again in the US, with some Midwest states reporting surges. In response, a number of European countries have introduced further restrictions including a nine-city curfew in France. In the UK, Northern Ireland has entered a 2-week ‘circuit break’ from last Friday, which includes closure of schools and hospitality venues. In England, a 3-tier regional system of controls has been introduced with London, Essex and York, among others, being added to Tier 2 and Lancashire to Tier 3. However, Greater Manchester has resisted being raised to the highest Covid-19 alert level, Tier 3.

The media is reporting the likelihood of further measures in the coming week. UK PM Johnson is under pressure to impose a ‘circuit break’ lockdown in England, or at least to move more regions to Tier 3. Ministers will be mulling over the potential economic repercussions of such a decision, balanced against the impact of a further significant rise in cases. This comes at a particularly difficult time, as there are signs that the post-lockdown economic rebound is fading.

For today, aside from the US NAHB housebuilders survey, there are no major data releases due. Therefore, the market focus will remain squarely on Covid-19 and the prospect of further policy measures being announced. The day is peppered with a number of central bank speakers, of which the most notable are ECB President Christine Lagarde and US Fed Chairman Jerome Powell. Closer to home, Bank of England rate setters, Sir Jon Cunliffe and Ben Broadbent are due to speak. However, neither are likely to focus too heavily on the economic outlook, given that one is talking about cross border payments and the other about the production and distribution of cash.

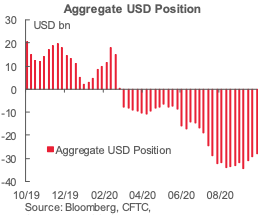

The latest snapshot of FX market sentiment and positioning extends the pattern of developments seen in the CFTC data over the past few weeks—a little more USD short covering activity across the aggregate of major currency positions. But the drive to buy back the USD is still essentially being driven by liquidating EUR positions. The overall net USD short dropped by a little less than USD1bn this week to USD28.2bn. Net EUR longs were cut by USD806mn, accounting for the essential part of the USD short-covering. Gross EUR longs are declining while gross EUR shorts are nudging higher. The net position remains a fairly significant USD24.76bn, however, suggesting there is ample room for more EUR net short-covering to come.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1600 (767M), 1.1615-20 (710M), 1.1650 (1BLN), 1.1700 (550M) 1.1715 (363M), 1.1730-35 (606M), 1.1770-80 (1BLN), 1.1800 (1BLN)

- USDJPY: 105.00 (557M), 105.35-40 (475M)

- GBPUSD: 1.2800 (215M)

Technical & Trade Views

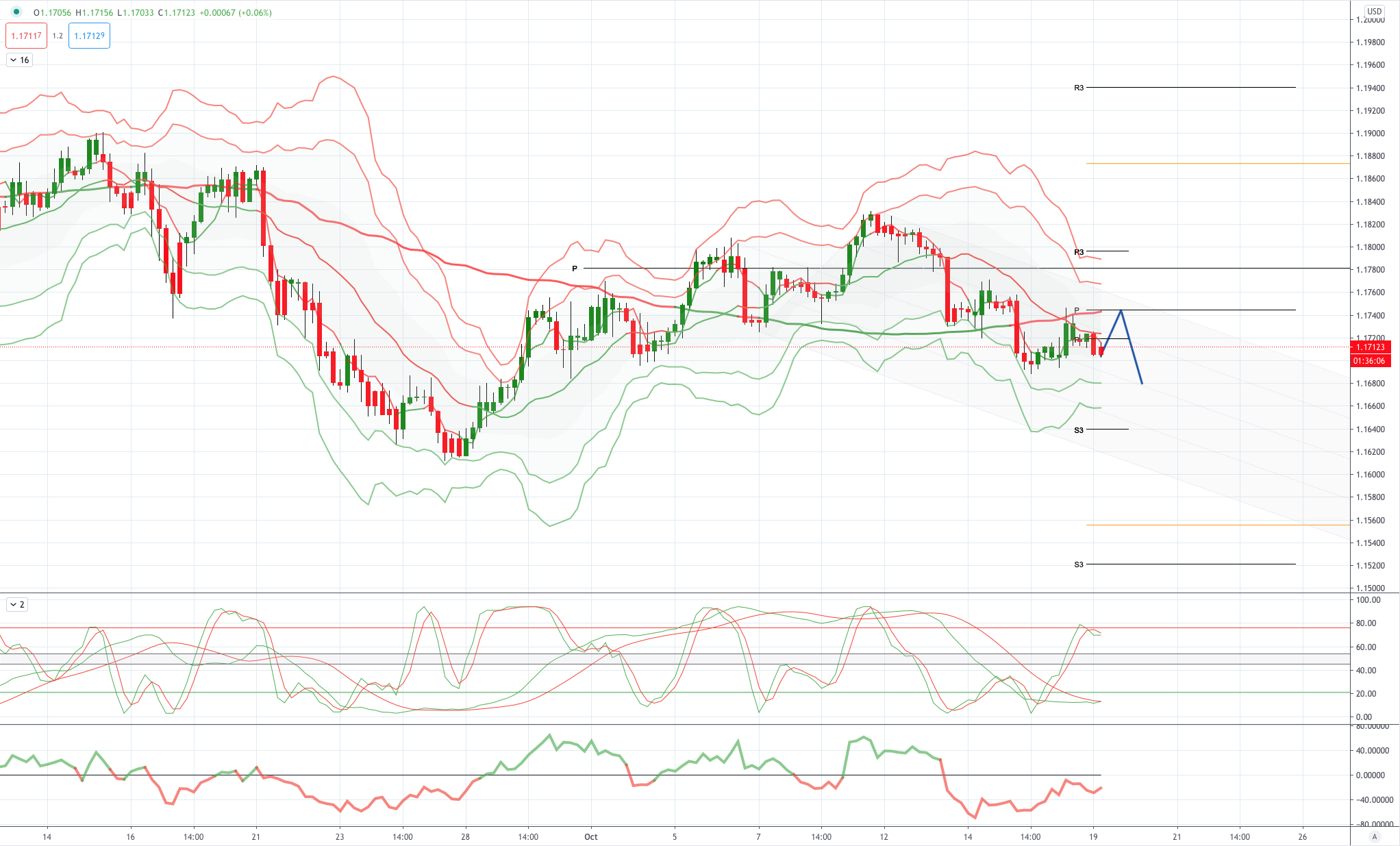

EURUSD Bias: Bullish above 1.1750 bearish below

EURUSD From a technical and trading perspective, as 1.1750/60 now acts as resistance look for a test of 1.1650 next

Flow reports suggest topside offers through the 1.1800 levels with weak stops on a push through the 1.1820 level with offers around the 1.1850 area with increasing offers through to the 1.1900 level, downside bids into the 1.1700 level with weak stops on a break through the 1.1680 level and limited bids through to the 1.1620 area where stronger bids seem to appear however, a break here opens a deeper move through to the 1.1500 area.

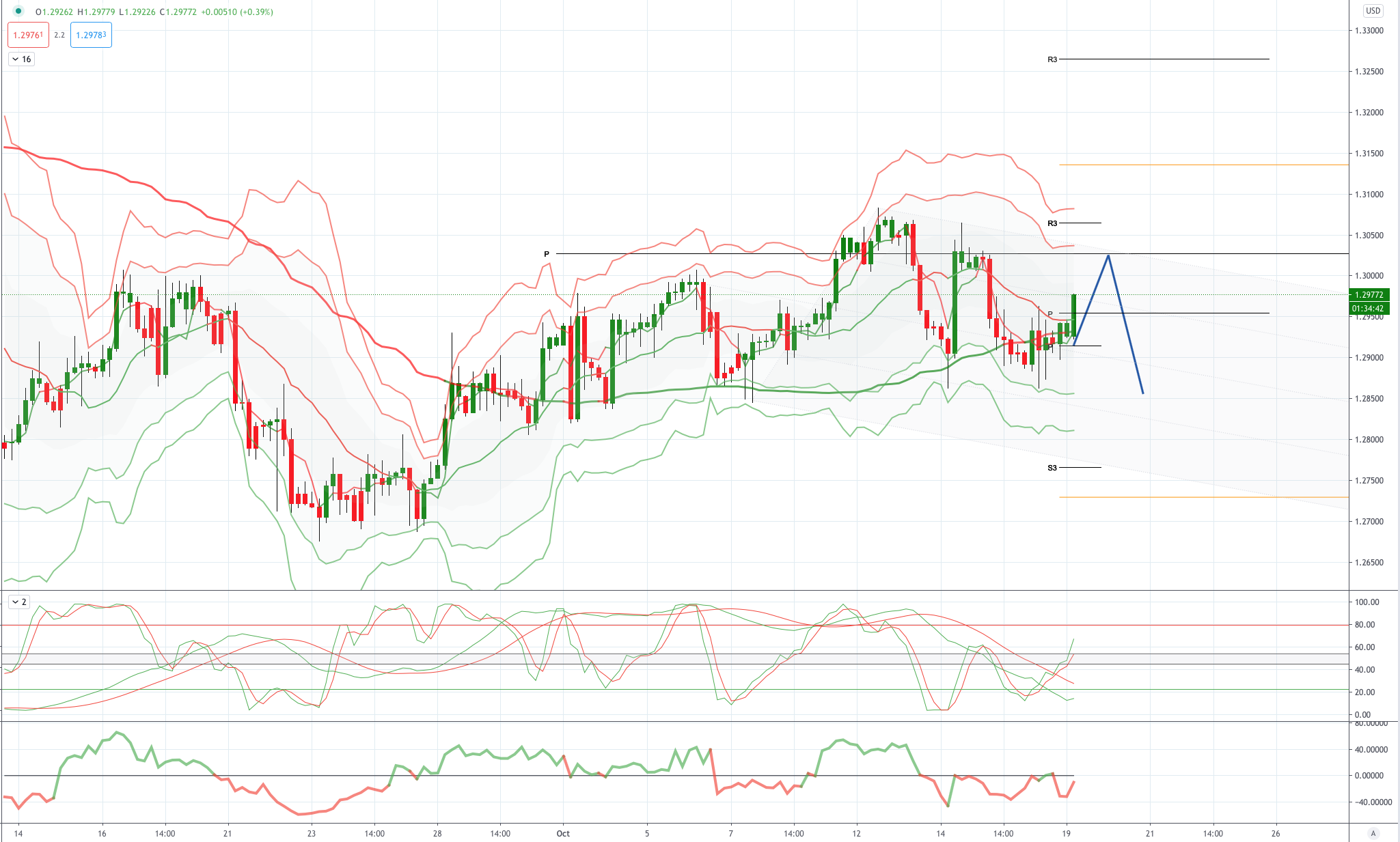

GBPUSD Bias: Bullish above 1.29 bearish below

GBPUSD From a technical and trading perspective, broad range trade persists 1.3050/1.29, play range or wait for breach and retest

Flow reports suggest topside offers light through to stronger offers around the 1.3000 area with strong stops through the level and the market then opening for further gains. Downside bids light through the 1.2800 area with weak stops on a move through likely to be light and quickly absorbed on any dip through to the congested 1.2750 areas with stronger bids into the 1.2700 level.

USDJPY Bias: Bullish above 105.20 bearish below

USDJPY From a technical and trading perspective, breach of ascending trend channel concerns bullish thesis as 105.50 caps upside look for a test of 104.90

Flow reports suggest offers strong into 106.00 area with stops on a break through the 106.20-30 area, offers remain into the 107.00-20 area with congestion likely to be mixed with weak stops on a break of the level and that congestion likely to continue on any move into the 107.60 area where stronger offers are likely to appear, maybe another round of stops before stronger offers then appearing through to the 108.00 level. Downside bids into the 104.20 light and then increasing on any dips to the 104.00 level and stronger stops through the 103.80 level, any break here opens the chance of a deeper move through to the 103.00 level before stronger bids start to appear with possible option related buyers.

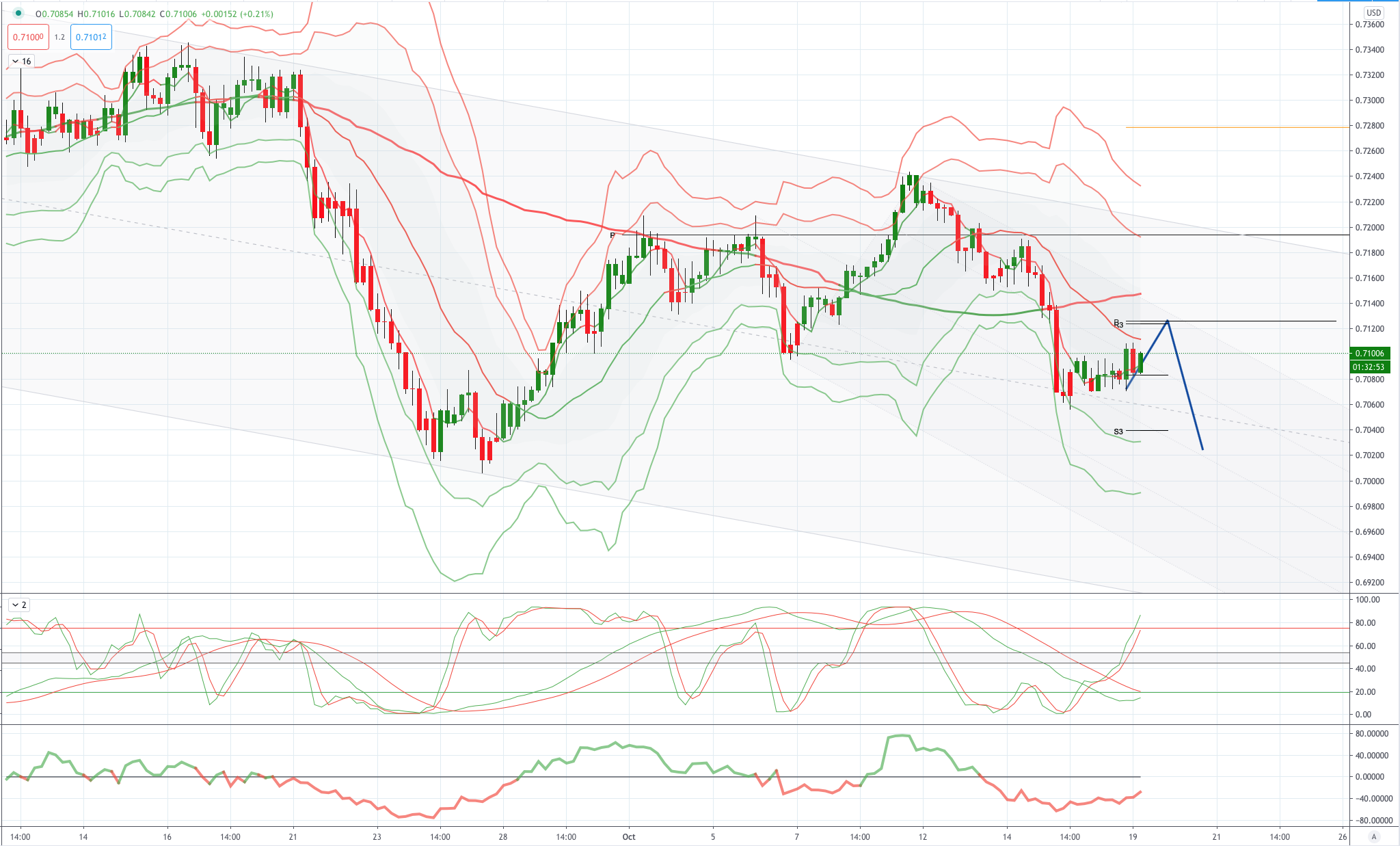

AUDUSD Bias: Bullish above .7150 bearish below

AUDUSD From a technical and trading perspective, .7050 test should see another move to retest .7120/30 as resistance, setting up another leg lower to test .7000

Flow reports suggest topside offers light through the 71 cent area with limited stops through the 0.7120 area, stronger offers likely on a move through to the 0.7150 area and likely to increase on a move through the 0.7180 area and into the 72 cents level before stronger stops appear above the 0.7220 area. Downside bids into the 0.7020-00 level with weak stops likely through the 0.6980 level with stronger support into the 0.6950 area and congestion thereafter.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!