Daily Market Outlook, November 25, 2021

Overnight Headlines

- Fed Officials Stress Flexibility On Taper Pace At Last Meeting

- US Put Chinese Companies Aiding Military On Trade Blacklist

- Israel Warn White House On Striking Nuclear Deal With Iran

- Russia Move Forces To Crimea In Ukraine Build-Up, Analysts

- China Urge Local Governments Spend More To Offset Slump

- Japan To Show Budget In $312Bln Spending To Tackle Covid

- Bank Of Korea Raises Rates Again, See Faster 2022 Inflation

- RBNZ Orr Signal Cautious Policy Approach With Small Steps

- EU To Delay Contentious Rules On $59Tln Securities Market

- UK Dial Down Brexit Threat While Progress Made In EU Talk

- German Covid Deaths Pass 100,000 As Infection Still Spiking

- OPEC Forecasts Releases May Greatly Swell Global Surplus

The Day Ahead

- Asian equity markets are mixed this morning. Minutes of the November US Federal Reserve monetary policy meeting showed that there was a discussion of the possibility of speeding up the pace of ‘tapering’ of asset purchases if it appeared that inflationary pressures are building. Comments by Fed policymaker Daly indicated that she was open to this possibility but wants to see upcoming data.

- In Germany the centre-left SPD appear to have agreed terms with smaller parties to form a coalition government. The latest reading for German consumer confidence slipped by more than expected, possibly due to concerns about the recent rise in Covid cases.

- Today is Thanksgiving in the US, while there are also no data releases of note elsewhere to interest markets. However, several speeches from central bankers are scheduled, which will be watched for further clues on the interest rate outlook. In the UK, Bank of England Governor Bailey will speak at an event which is described as a “conversation” with high profile economic pundit Mohammad El Erian. As the latter has criticised central banks for being slow to react to the current rise in inflation, Bailey’s response will be interesting.

- BoE policymaker Haskel will also speak today but his remarks are part of a seminar on productivity and structural change and so he seems unlikely to say anything about the immediate outlook for interest rates. In remarks earlier this week, he confirmed that while he still thinks the current inflation rise is largely ‘transitory’, but he nevertheless does expect a modest interest rate increase will probably be appropriate. However, it was less clear whether he would vote for one in December.

- The European Central Bank continues to push back harder than most other central banks on prospects for an interest rate rise next year. That was clearly a key message from the ECB’s last policy update in October and today’s minutes of the meeting are expected to confirm that. However, there will still be interest in whether they show any sign of that consensus cracking. There are also several ECB speakers today including ECB President Lagarde.

- The Swedish Riksbank is another central bank that has played down the likelihood of an early tightening in monetary policy and today’s update is expected to continue to take that line. The Riksbank seems more concerned that any hint of a shift in policy push up the krona rather than with near-term inflationary pressures. Consequently, its message is likely to still be that interest rates are unlikely to rise until very late in 2024 at the earliest.

- After a volatile day’s trading yesterday ended with longer-dated government yields slightly down in both the UK and the US as markets continue to weigh up the potential impact of a tightening in monetary policy

Credit Agricole Month End Model

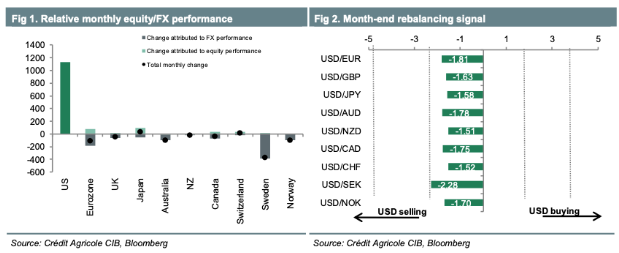

Global equity markets were somewhat mixed during November. In FX, the USD has outperformed across the board on the month. Overall, the moves in equity markets, when adjusted for market capitalisation and FX performance this month, suggest month-end portfolio-rebalancing flows are likely to be mild USD selling across the board with the strongest sell signal in the case of the USD vs SEK.

Our corporate FX flows model is further pointing to EUR buying at the end of the month. In our combined strategy, we therefore use the signals of our corporate flows model and buy the EUR vs an equally-weighted basket of USD and GBP.

As detailed in our report Month-end rebalancing model upgrade, the month-end rebalancing model generates FX trades on the basis of two signals. The first is based on the performance of US stock markets relative to the rest of G10 adjusted for changes in exchange rates and market capitalisation (Figure 1). In particular, we allocate weights to create a portfolio of the nine G10 USD-crosses. In that, we use the signals’ relative strength to determine the portfolio weights (Figure 2).

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

EUR/USD: 1.1220 (295M), 1.1300 (438M), 1.1325-30 (250M), 1.1350 (545M)

GBP/USD: 1.3395 (223M), 1.3700 (663M)

AUD/USD: 0.7240-45 (378M). NZD/USD: 0.7005-15 (259M)

USD/JPY: 114.25 (935M), 115.00-10 (1.2BLN), 115.50 (795M)

EUR/JPY: 128.00 (520M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- Light short covering to relieve over – sold conditions

- EUR/USD opened 0.44% lower at 1.1200 after USD firmed on strong US data

- It never traded below 1.12000 and drifted up to 1.1213

- Heading into the afternoon it is at the highs for the session

- EUR/USD trending lower with the 5, 10 and 21-day MAs in a bearish alignment

- RSI reading is at deeply oversold reading and may have to correct

- Resistance is at the 10-day MA at 1.1301 and break eases pressure

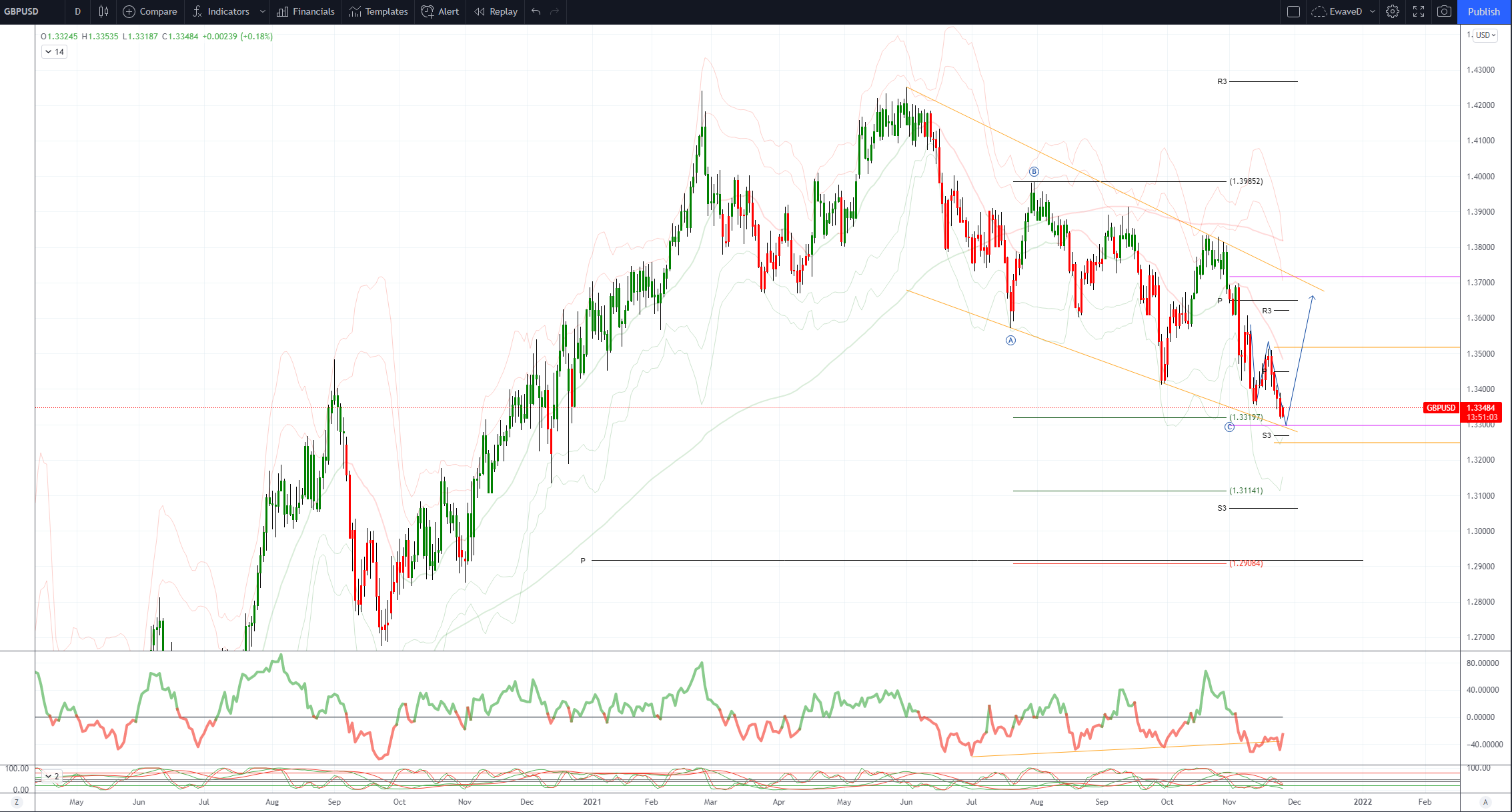

GBPUSD Bias: Bearish below 1.36 Bullish above.

- Bargain hunting, but downtrend remains strong

- +0.1% towards the top of an active 1.3327-1.3344 range with the USD softer

- UK to expand global development finance investment to boost offshore growth

- Part of the plan to diversify UK income in the post Brexit era

- Charts - 5, 10 & 21 daily and weekly moving averages all head lower

- 21 day Bollinger bands slide - strong bearish trending setup back in play

- Close above 1.3498 21 day moving average would end the downside bias

- Initial significant support comes in at 1.3166, 38.2% 2020-21 rise

USDJPY Bias: Bullish above 112.50 Bearish below

- JPY crosses do little pre – US Thanksgiving holiday

- USD/JPY in tight 115.31-45 EBS range into the US Thanksgiving holiday

- Trading light, flows few and far between, maybe so till next week

- Bids eyed on dips towards 115.00, offers eyed 115.50+

- US yields supportive, front-middle of Tsy curve to pre-pandemic levels

- Option expiries bracket - today 114.95-115.00 $1.1 bln, 115.50 $795 mln

- JPY crosses see little action, most in stasis

- EUR/JPY 129.28-38, GBP/JPY 153.70-154.03, AUD/JPY 82.95-83.19

- Only Japan data today CSPI, Oct +0.4% m/m, +1.0% y/y, prev unch, +0.9%

AUDUSD Bias: Bearish below 0.75 Bullish above

- Gently bid in quiet session ahead of US holiday

- AUD/USD opened -0.44% at 0.7195 after USD firmed on solid US data

- After trading at 0.7590 the AUD/USD struck a firm tone

- It traded to 0.7208 when Aus Q3 Capex spending intention were strong

- Sellers ahead of 0.7210 capped and it settled around 0.7200/05

- Resistance is at the 10-day MA at 0.7261 and break would ease the pressure

- Support is at the Sep 29 low at 0.7170 and break targets 2021 low at 0.7106

- AUD/USD trending lower with 5, 10 and 21-day MAs in bearish formation

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!