Daily Market Outlook, November 22, 2021

Overnight Headlines

- Biden Speak On Economy Tuesday As Fed Decision Looms

- Powell, Brainard To Struggle Align Hikes With Hiring Goals

- Biden’s Landmark Spending Bill Face Next Battle In Senate

- US Intel Show Russian Plan For Potential Ukraine Invasion

- PBoC Signal Easing As Economic Growth Slow, LPR Steady

- China FX Agency Urge Banks Cap Speculation, Yuan Surge

- Japan Considers Release Of Oil Reserves After US Request

- EU's Sefcovic Sees Progress, Hope In N Ireland Brexit Talks

- BoE Governor Warn Inflation Risks To Forecast Two-Sided

- UK Economy Will Grow ‘Slower Than Forecast’, EY Survey

- Germany Debates Compulsory Vaccination As Wave Rage

- KKR Make $12Bln Bid For Telecom Italia At 46% Premium

The Week Ahead

- Biden's Fed chair pick and RBNZ tightening in focus Central banks will be in focus this week. U.S. President Joe Biden is expected to hand down his decision on who will chair the Federal Reserve board, while the Reserve Bank of New Zealand is widely expected to raise interest rates. The front-runners for Fed chair are incumbent Jerome Powell and Fed Governor Lael Brainard. The decision comes as Fed officials, including Vice Chair Richard Clarida, openly debate whether to speed up the tapering of bond purchases given strong growth and hot inflation data. The FOMC minutes, also due this week, should add more colour to the Fed's broad views on inflation pressure. Brainard is considered more dovish than Powell and is a favourite of progressive Democrats. If she is appointed, it may lead to a slight dovish shift in Fed expectations, which could depress short-term U.S. yields and weigh on the rising USD. The RBNZ is expected to raise the overnight cash rate for the second straight meeting. Some analysts believe it will deliver a 50-basis-point hike to 1.0% and the market is pricing in around a 40% chance of this. The bank's OCR projections will also be watched, with nearly 200bps of tightening priced by end-2022.The economic impact of Europe's rising COVID cases and potentially, increased lockdowns will likely keep a lid on hawkish ECB expectations in the short term at least. Markets will pay close attention to government reactions if case numbers continue to increase.

- EZ flash PMIs, U.S. GDP lead quiet data calendar It will be a quiet week for key global economic data, with the U.S. Thanksgiving holiday on Thursday limiting releases out of the United States. U.S. data includes the second estimate of third-quarter GDP, durable goods, Markit flash PMIs, University of Michigan consumer sentiment, the core PCE price index and weekly jobless claims – along with existing and new home sales. Euro zone flash November PMIs, consumer confidence and the German Ifo will be the key events in Europe, with German Q3 GDP also on tap. Flash PMIs will be the only data of note out of the UK. Japan's calendar is limited to flash manufacturing PMI and Tokyo CPI. There is no data due from China and the benchmark Loan Prime Rate was left unchanged at the monthly fixing on Monday, as expected. Australia will be a bit busier with Q3 capex and final October retail sales on tap. New Zealand has retail sales and trade data, and a closely watched central bank decision. No key data is due in Canada.

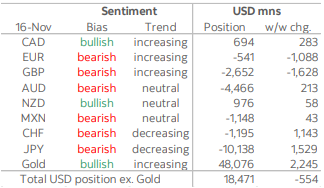

CFTC Data

The aggregate USD long position dropped for the sixth straight week, with a USD554mn move against the dollar taking the overall position to +USD18.5bn or about 20% off its early-October peak of USD23.2bn in the currencies that we cover. The USD nevertheless appreciated against all major currencies over the week to Tuesday, with a relatively large decline in the EUR of 2.4% (the worst performer among the currencies in this report) to below 1.14 and eventually 1.13. Having flipped to a small long the previous week, EUR sentiment again turned bearish with a USD1.1bn move against the shared currency to take its overall position to USD541mn short which is still well off the USD22bn aggregate short six weeks ago.

After turning net short last week, investors added to negative positioning in the GBP with a US1.6bn bet against it to total USD2.6bn. The BoE’s hold in early-November has seemingly prompted a large increase in shorts to their highest in over two years with 82k contracts outstanding—a 16k rise after the previous week’s increase of 24k. With elevated inflation and solid post-furlough employment data, sterling sentiment may improve somewhat in coming weeks in anticipation of BoE hikes after chopping around neutral for the past four months.

The CAD’s net long rose over the week by USD283mn to USD694mn, which represents the largest bullish bet on the CAD since mid-July. Investors likely positioned for a strong Canadian CPI print on Wednesday, but while the data met economists’ expectations the resulting reaction in markets suggests that CAD sentiment has worsened slightly since. Declines in crude oil prices may also have recently hit CAD positioning, while investors’ bets against its crude oil peer, the MXN, were left practically unchanged over the week at over USD1.1bn.

As for the JPY and the CHF, bearish positioning declined as accounts turned more constructive on these currencies and took USD1.5bn and USD1.1bn off their respective shorts of (now) USD1.2bn and USD10.3bn, respectively. The JPY and CHF have outperformed since the cutoff date of the CFTC data as US yields turned lower and risk-off trading took over market sentiment, which suggests that next week’s figures may show an additional reduction in their respective net shorts. Investors also added USD2.2bn to the Gold long. The large AUD short was trimmed by USD21mn to USD4.5bn while accounts made minor adjustments to the NZD long this week (the largest of those in this report) to just shy of the USD1bn mark on a USD58mn bet in its favour

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

USDJPY - 115.20 460m

EURUSD - 1.1450 1.30bn (867m C). 1.1410/20 703m. 1.1390/1.1400 505m. 1.1380 546m. 1.1350 954m. 1.1300 992m.

GBPUSD - 1.3390 426m. 1.3360/70 811m

AUDUSD - 0.7400/10 605m.

NZDUSD - 0.7100 701m.

USDCAD - 1.2680 1.05bn (P). 1.26350 500m. 1.2530/50 541m. 1.2480/1.2500 1.38bn (987m P). 1.2360 810m.

EURGBP - 0.8360 507m.

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- Ender pressure in Asia as COVID concerns weigh

- EUR/USD opened 1.1290 after closing down 0.66% at 1.1299 on Friday

- After trading at 1.1296 it came under pressure due to concerns over COVID-related lockdowns

- Selling was seen through the morning and it traded down to 1.1265

- Heading into the afternoon it is hovering above the session low

- Support and buyers are found at 1.1250 while sellers are tipped at 1.1300

- A break below 1.1250 targets the 76.4 of 2020/2021 move at 1.1040

- EUR/USD trending lower with the 5, 10 & 21-day MAs in a bearish formation

- Resistance is at the 10-day MA at 1.1391 and a break would ease pressure

- Price action in EUR/USD suggests more downside in immediate-term

GBPUSD Bias: Bearish below 1.36 Bullish above.

- Weak euro and stronger USD weigh – 1.3166 beckons

- -0.05%, dragged lower by the soft Euro and subsequent firmer USD

- Traded a 1.3430-1.3448 range with decent volume once Asia fully opened

- BoE's Bailey torn between long term and temporary inflation

- Charts - 5, 10 & 21 daily moving averages conflict, 21 day Bolli bands fall

- Neutral setup - primary downtrend valid while 1.3557 21 DMA holds

- Targets a break of 1.3354 Nov low and test of 1.3166, 38.2% 2020-21 rise

- London 1.3410 low, and NY 1.3475 high are initial support and resistance

- Chance sterling resilience may prove fleeting this week

- IMM speculators upped gross GBP shorts by 15,945 contracts in week to Nov 16

- They also cut gross GBP long positions by 3,561 contracts to 50,443

- Combination raised net GBP short to 31,599

- 31,599 contracts is largest net GBP short position since June 2020

- IMM specs were net GBP long in week to Nov 2 -- before BoE rate hold shock

- Funds dump sterling at fastest pace since 2007

USDJPY Bias: Bullish above 112.50 Bearish below

- USD/JPY better bid in Asia, crosses hold above Friday lows

- USD/JPY better bid in Asia, 113.91 to 114.21 EBS before steadying

- Decent bids from low, Japanese importers, specs paring shorts tipped

- Upside limited though with specs still in sell-rally mode, Japan exporters

- Hourly Ichi cloud 114.24-41 above, 100-HMA in cloud at 114.31

- Ascending 200-HMA below at 114.08

- US yields showing small bounce in Asia, Treasury 10s @1.561%

- Options not a factor today, no major nearby expiries, tom 114.20 $780 mln

- Nikkei off after TSE open but closer to par later, -0.2% @29,691

- JPY cross in holding pattern above lows Friday, risk mood still iffy

- EUR/JPY 128.60-85, GBP/JPY 153.11-53, AUD/JPY 82.31-68

- Implied volatility premium for JPY calls over puts has increased Monday

- Benchmark 1-month 25 delta risk reversals paid 0.35 JPY calls over puts

- That's the highest downside vs upside strike premium since September

- A relatively big increase from the neutral premium seen last Thursday

- Means dealers are shifting more volatility risk premium to USD/JPY downside

AUDUSD Bias: Bearish below 0.75 Bullish above

- Steady in Asia as rise in Dalian iron ore underpins

- AUD/USD fell 0.55% Friday and closed at 0.7237

- It traded at 0.7250 early Asia, but gain was short-lived

- Pair spent most of the session between 0.7227/0.7237

- Heading into the afternoon it is trading around 0.7235

- A 3.3% gain in Dalian iron ore helped underpin AUD/USD

- AUD/USD trending lower with the 5, 10 and 21-day MAs in a bearish alignment

- Only a break above the 10-day MA at 0.7300 would ease the pressure

- Support is at the 200-week MA at 0.7195 and trend low at 0.7170

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!